As Goldman trims forecasts, all eyes on HSBC, Alibaba, HKEX to rebuff market sceptics in big week for earnings season

- HSBC, Alibaba, NetEase and Hong Kong Exchanges are due to issue their 2021 report cards and outlook for 2022 amid signs of earnings deceleration

- Stocks have wavered despite policy easing signs as regulatory headwinds remain elevated with latest hit on Meituan and peers

In Hong Kong, analysts have also dialled back blue-chip earnings by as much as 15 per cent over the past eight months, according to Bloomberg data. The 19 per cent average growth from seven Hang Seng Index members so far has trailed consensus by 2.7 per cent.

“Most Chinese companies will announce FY21 earnings in late March, and profit alerts suggest likely moderation of earnings growth momentum” in the fourth quarter of 2021, Goldman said in a February 19 report to clients.

The Hang Seng Index’s 64 members are projected to report a 14 per cent average growth in 2022 earnings, after a 15 per cent drop in 2021, according to Bloomberg data. Mainland enterprises dominate listing, market capitalisation and turnover in Hong Kong.

“For Hong Kong companies, it’s possible to see more near-term negative earnings revisions going forward, given the unpredictable course of the pandemic and possibly further social distancing restrictions,” David Chao, global market strategist at Invesco, said by email. Still, downgrades could be bottoming out soon, he added.

BCA Research, a Montreal-based research firm, said China needs to step up credit expansion to the tune of 35 trillion yuan (US$5.5 trillion) on a six-month annualised basis to rejuvenate the economy. That level of stimulus could reduce the odds of an earnings recession below 50 per cent.

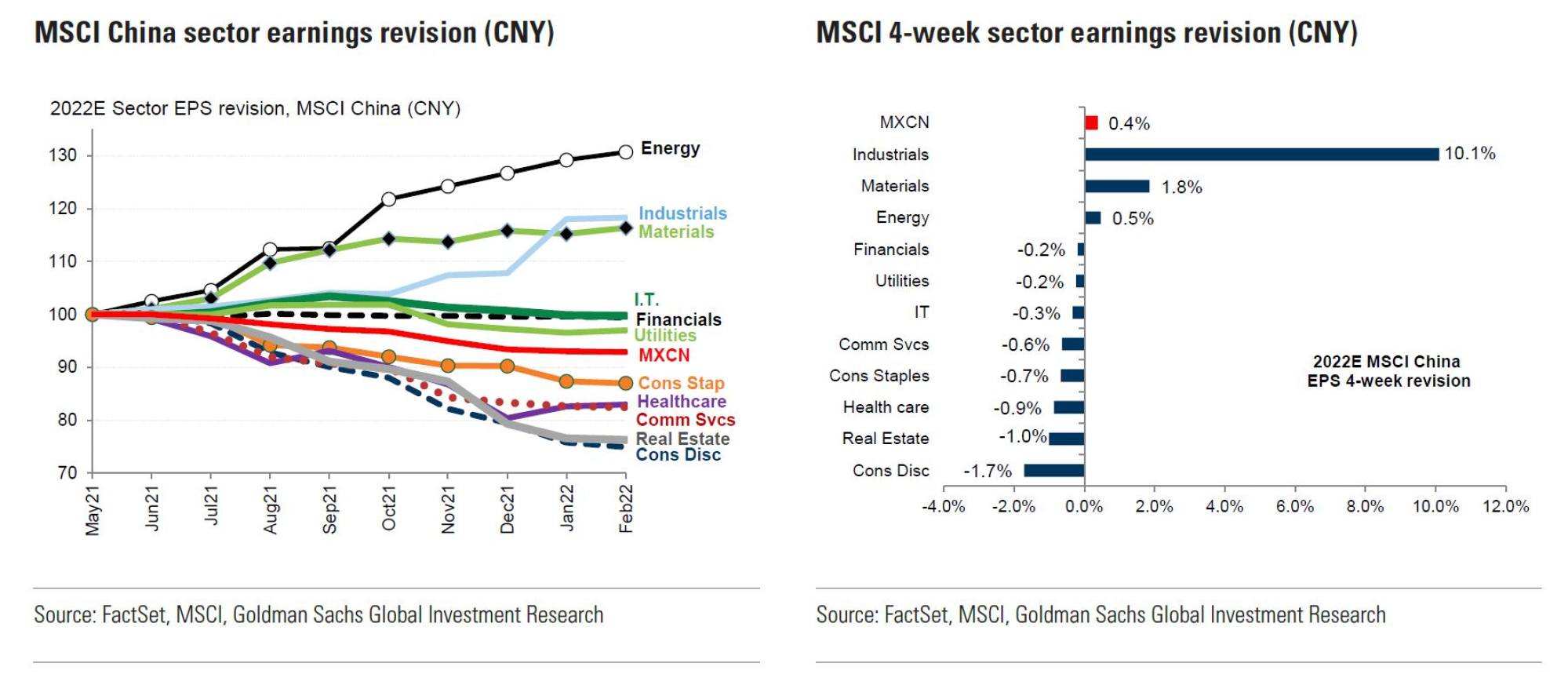

While Goldman strategists remain upbeat on the outlook for Chinese onshore and offshore stocks, they have reined in some of their forecasts for various reasons, including a slowdown in the property market and the broader economy.

They expect MSCI China, which tracks 740 stocks worth US$2.47 trillion at home and abroad, to climb 19.4 per cent in 2022 instead of 25.4 per cent. Growth in per-share earnings was cut to 4 per cent from 7 per cent, compared with consensus for 13 per cent. China’s economy is growing at a record-low pace, excluding crisis years, according to a February 11 report.

Still, Chao at Invesco said recent bias in supporting measures from China could turn sentiment around. Policymakers have pivoted towards stability and growth, which should buffer the downward trend of the economy, he added.

Markets continue to hope for more aggressive signs of monetary or fiscal stimulus in China, which would be key to an improvement in sentiment for Chinese equities,” according to Schroders. More relaxed industry regulatory scrutiny could lead to a sharp improvement in sentiment towards the market, it said.