China EV war: how BYD grew from Elon Musk’s ridicule to Berkshire Hathaway’s ‘ridiculous’ US$98 billion success in 12 years

- BYD delivered 1.86 million fully electric and plug-in hybrid vehicles in 2022, outselling Tesla’s 1.3 million by 42 per cent

- BYD’s shares have soared 40-fold since Berkshire Hathaway’s Charlie Munger first decided to back the carmaker in 2008

Elon Musk laughed out loud when he was asked about potential competition with BYD, which had brought a battery-powered car to market in southern China three years before Tesla.

The object of Musk’s ridicule was the e6, a compact car tested to run 370 kilometres (230 miles) on a single charge, which took more than eight seconds to go from standstill to 97 kilometres per hour (60 miles per hour).

That was in November 2011, just half a year after Tesla’s US$226 million Nasdaq listing put Musk on the road to becoming one of the world’s wealthiest men.

Tesla would launch its upmarket, high-performance Model S electric car the next year, an event that would add glamour, tech-savviness and bragging rights to owning battery-powered vehicles, ushering in the demise of the internal combustion engine.

Buffett’s Berkshire cuts stake in Chinese EV maker BYD for 10th time

BYD is now worth HK$766.68 billion (US$98 billion), almost the value of General Motors and Ford Motor combined, a return that Munger said was “almost ridiculous” compared with Tesla, Fortune reported in February.

What did Munger, the right-hand man of Berkshire’s chairman Warren Buffett, see in the Chinese company that Musk so derisively wrote off?

“The advantages of BYD are very obvious; the first is its high-performance batteries that has the edge over its competitors,” said JD Power China’s chief consultant Jeff Cai, whose 2022 consumer ranking put several Chinese electric car makers ahead of Tesla in terms of technological intelligence.

Secondly, BYD has the product range and trendy designs that better resonated with China’s customers, Cai said.

BYD produces a dozen models in two classes. The Dynasty series – the models named after China’s imperial reigns from Han to Yuan – are fully decked models in 17 variants aimed at middle-class households. The Ocean series – a simpler range with names like Destroyer, Frigate, Seal and Dolphin – features sporty looks to appeal to younger motorists.

For BYD, founded 28 years ago in the test bed of China’s experiment in market capitalism, its secret to success was its dogged belief that batteries would one day be the dominant power source of everything, even replacing fossil fuel for cars.

The company began as a producer of rechargeable dry cells and batteries for mobile phones. BYD was a newcomer to automobiles, expanding into car-making only in 2003 after buying the licence of Xi’an Tsinchuan Auto from the Shaanxi provincial government and the defence contractor China Ordnance Industries Group (Norinco Group).

Its first vehicle was the F3, a bare-bones minicar with a 1.6-litre petrol engine that sold for as little as 40,000 yuan (US$5,850). By keeping prices well below the 100,000-yuan psychological barrier, BYD was the go-to brand for budding motorists, giving it the edge over larger rivals like Toyota and Honda.

From there, BYD grew quickly. When Musk was laughing at BYD, the Shenzhen company was in its eighth year of carmaking and was already China’s sixth-largest volume assembler. China by then had overtaken the United States as the largest vehicle market on the planet.

But BYD’s electric journey was not without its bumps. Before the e6 entered the market, BYD was developing the F3e, an all-electric version of its popular F3, which aimed to charge up to 70 per cent capacity in a mere 10 minutes, going as far as 300 kilometres at a price tag of 150,000 yuan.

Still, BYD’s founder Wang Chuanfu persevered. He was consistently firm with his drive to invest in innovations, develop new models and expand the carmaker’s capacity until his bet paid off, said two executives who asked not to be named.

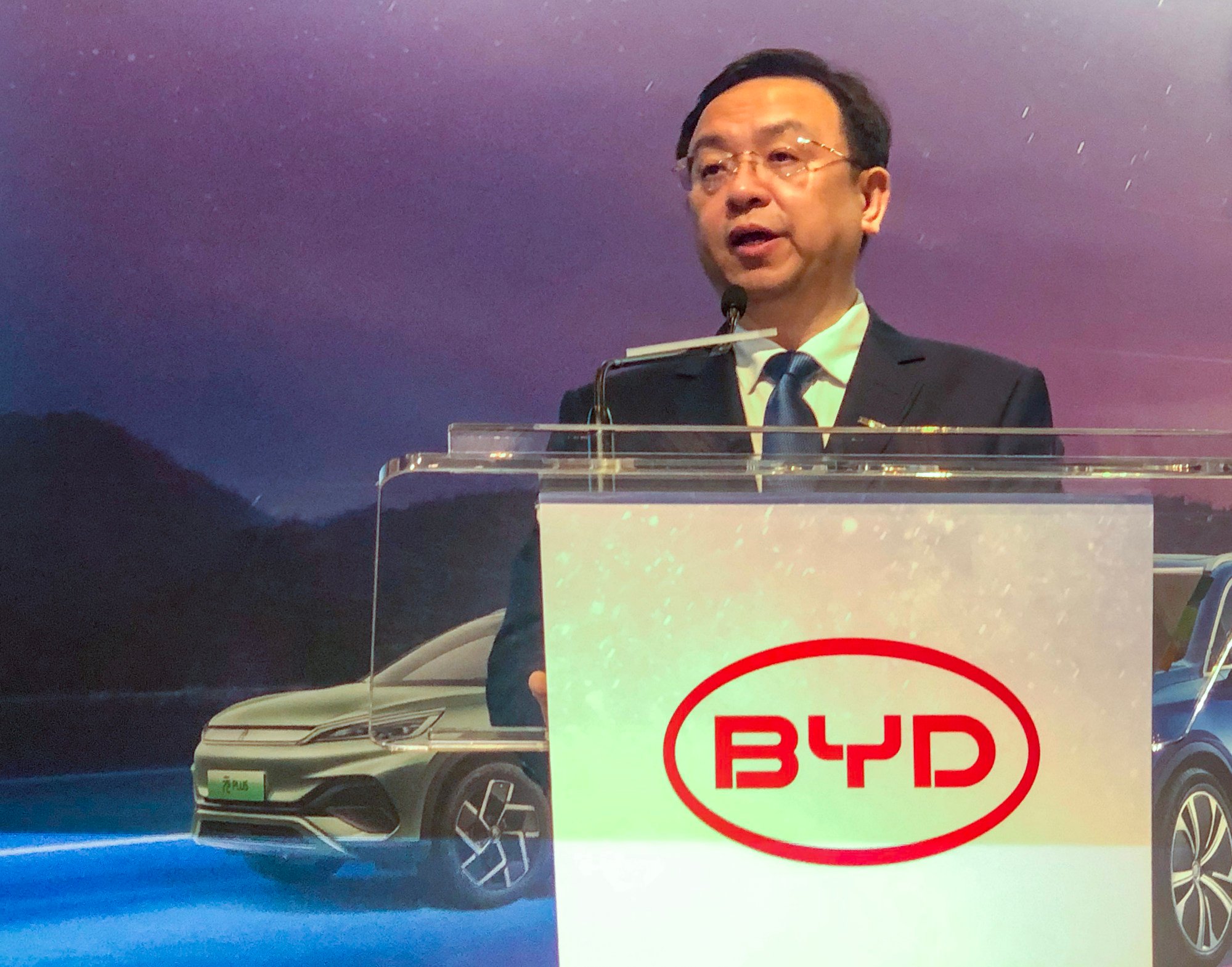

“If there is one thing that we have done right, I would say we are superior to our competitors in terms of technology,” Wang said in response to the Post during an earnings press conference last month.

Innovation was the key to BYD’s growth. In its early days, BYD found a way to make phone batteries at room temperature, giving it the edge over competitors that needed to install costly dry rooms for their assemblies.

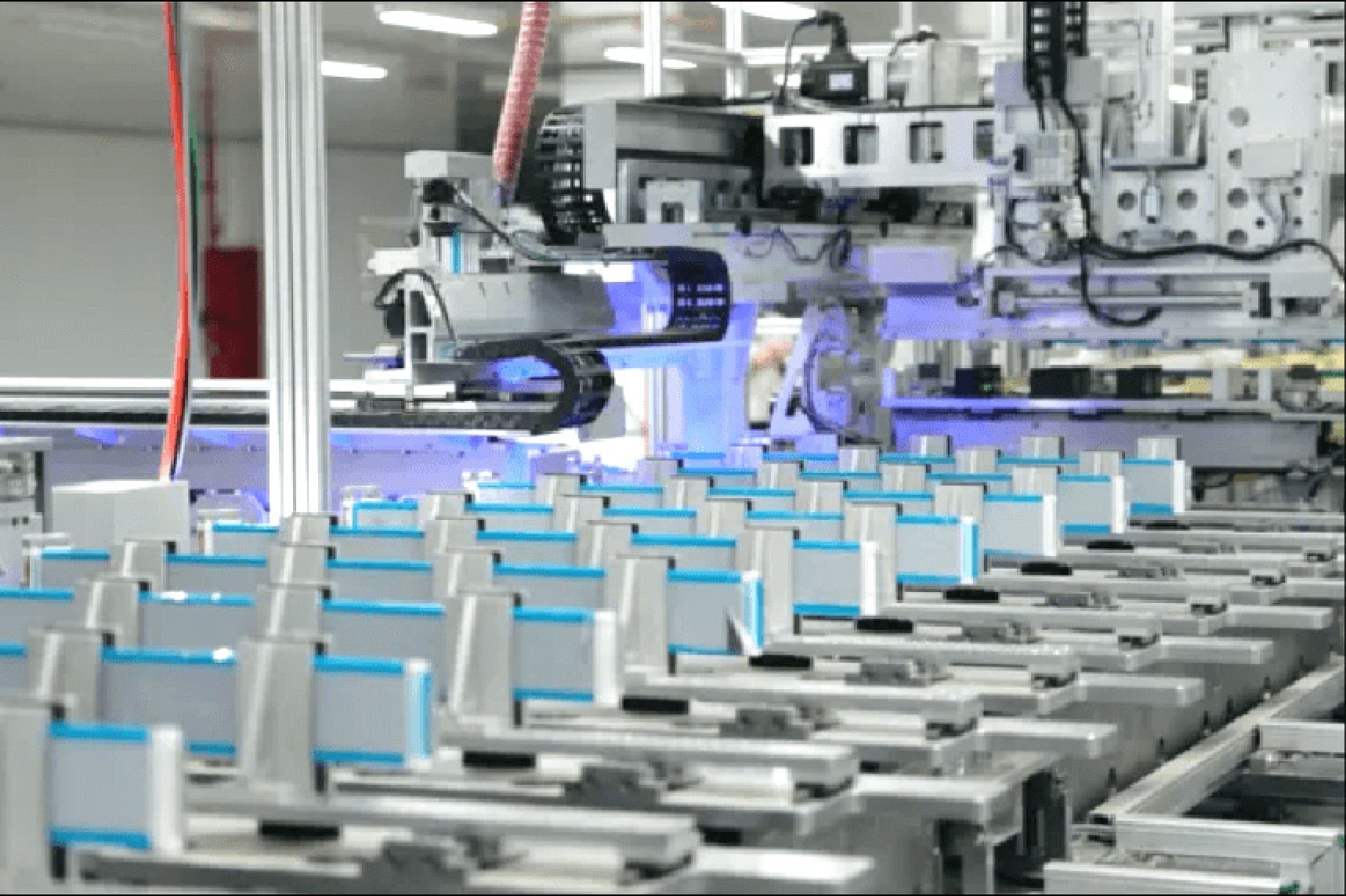

Two decades later, the company moved up the scale to innovate for electric cars. BYD’s Blade batteries arrange their lithium-iron-phosphate (LiFePo) power cells in vertical arrays like blades, giving the packs a higher energy density and heat resistance than conventional cylindrical arrangements.

In 2022, BYD produced 70.4 Gigawatt-hours (GWh) of batteries, or 13.6 per cent of the global market, making it the world’s third-biggest EV battery producer behind Contemporary Amperex Technology Limited (CATL) and South Korea’s LG Energy Solution.

More importantly, BYD owns the entire supply chain of EV batteries, from the minerals and raw materials to the finished battery packs, giving it greater control over its cost, profit margin and deliveries.

BYD also runs its own energy storage division and designs the semiconductor chips it uses in-house. The advantage not only helped BYD control costs, but also ensured speedy production and stable delivery.

“The competition over costs among EV makers is fierce, if you cannot lower the costs, you do not have the edge,” said Yale Zhang, managing director at the consultancy Automotive Foresight in Shanghai.

“BYD’s control over its own supply chain is unrivalled.”

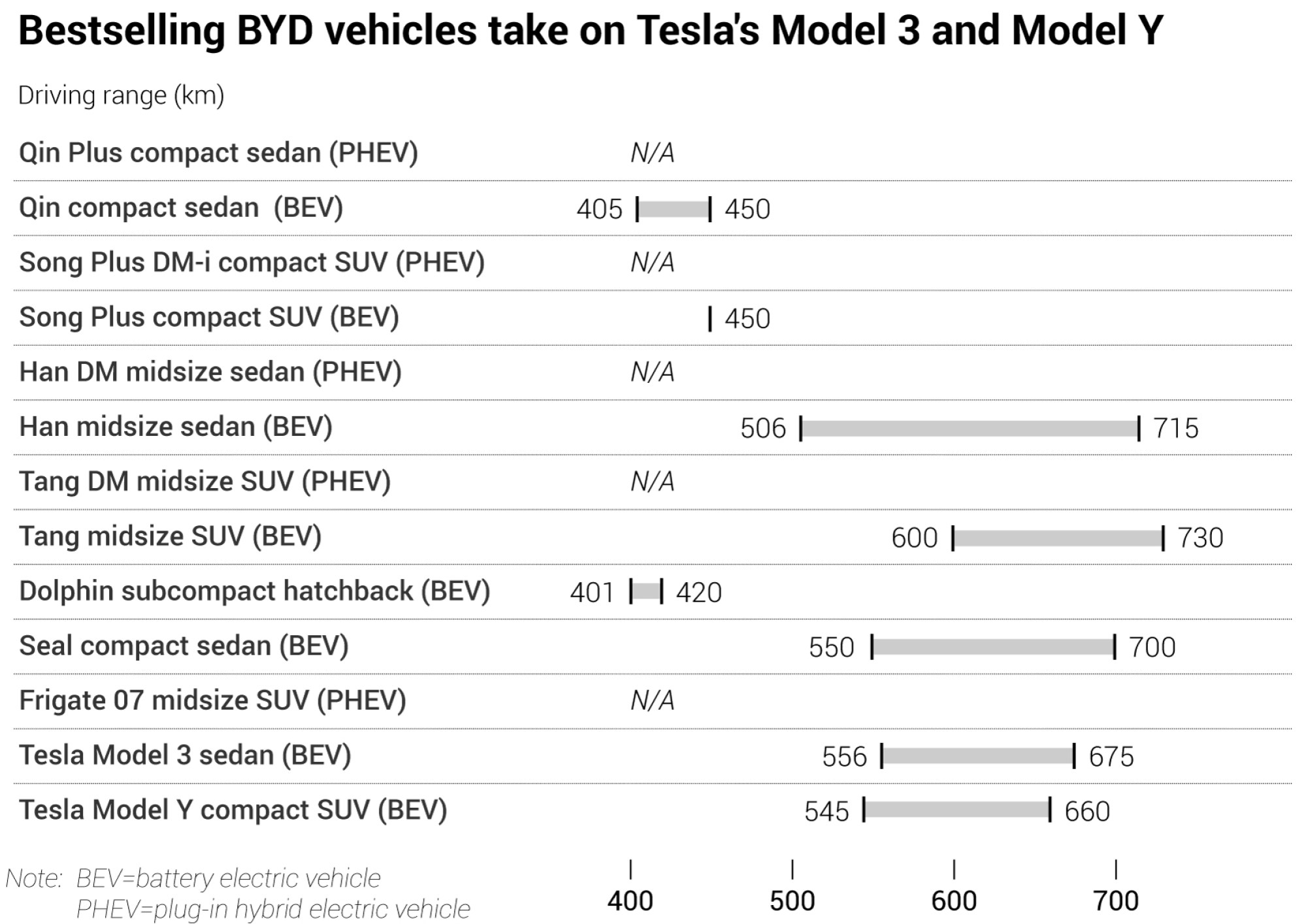

BYD’s flagship Han EV has come a long way from the humble e6. A sleek, low-slung four-door sedan, the Han has a range of 715 kilometres on a charge, and can go from standstill to 100 kilometres/hour in 3.9 seconds.

With a cockpit wrapped in Nappa leather and wood trims, the all-electric model sells for about 300,000 yuan.

This week, BYD released its DiSus body control system to keep passengers in place during high-speed cornering and prevent the vehicle from rolling over.

It is the first Chinese carmaker to own and develop such technology in-house, a “breakthrough from zero to one [that] filled in the gap between domestic and foreign technologies, because we used to rely on foreign technologies”, Wang said.

Still, BYD has a lot of catching up to do, said Chen Jinzhu, CEO of consultancy Shanghai Mingliang Auto Service. The carmaker did not even make the top 10 in JD Power’s intelligence ranking of Chinese EV cars.

“It lacks the technological clout to develop autonomous driving systems and digital cockpits,” features that are now standard, as electric cars are increasingly sold as smart cars, Chen said. “Forming partnerships with technology companies to fine-tune its cars appears to be the best strategy.”

BYD is going all out to make its electric cars smarter – like “super mobile phones on wheels”, as Wang described them – to compete with upmarket rivals.

Wang, who turned 57 last weekend, caught on years ago that the electric car would revolutionise motoring, the same way smartphones upended telephony and made low-cost computing easily available.

“As the industry makes new cars smarter, great changes will take place in people’s daily lives,” the former chemist said during a September 2018 conference in Shenzhen. “The new era of intelligent vehicles has arrived, and by 2035, they will dominate the streets.”

He drew a line over autonomous driving however, dismissing the claims of self-driving by many competitors as “nonsense,” saying that they are at most “assisted driving,” according to Chinese media reports of his speech on March 29.

BYD leaned on partners to help it become smarter. It joined Baidu’s Apollo project in 2017 to use the open platform to develop its self-driving capability. The Han EV uses the HiCar system based on Huawei Technologies’ Harmony operating system.

“We have a lot of respect for the car companies in China,” Musk said. “They are the most competitive in the world … they work the hardest and they work the smartest, so lots of respect for the China car companies that we’re competing against.”

BYD’s executives are more circumspect, noting that only a quarter of the 26.86 million new cars sold last year in China was electric.

“We still have much room to expand, although we’ve developed fast, judging from the current EV penetration,” said Brian Luo, BYD’s assistant general manager of branding and public relations.

“I’ve heard people comparing us with Tesla, calling us the Volkswagen of China, or General Motors of China. We are not against such comparisons, but we have never benchmarked ourselves against any company,” said Luo.

“It is because we are never just a carmaker.”