Shanghai-based CellX a step closer to bringing cultivated meat to market with launch of China’s first pilot plant

- The CellX plant in Shanghai has a 2,000 litre bioreactor with a capacity to produce ‘single-digit tonnes’ of cultivated meat per year, CEO Ziliang Yang says

- The start-up plans to approach food regulators in the US and Singapore to approve their for products sale later this year

Shanghai-based cell-grown meat start-up CellX launched China’s first cultivated meat pilot factory on Wednesday, a significant breakthrough in the nation’s quest for a sustainable source of animal protein to feed its population.

The pilot plant represents a step closer to bringing cultivated meat to dining tables before large-scale production, co-founder and CEO Ziliang Yang said in an interview.

The plant in Shanghai has a 2,000 litre bioreactor with a capacity to produce “single-digit tonnes” of cultivated meat per year, Yang said, with more bioreactors to be added soon.

“The insights from this pilot facility will be used for our commercial production facility that we’re planning to complete by 2025 [which] will be able to produce hundreds of tonnes of products per year,” said Yang.

Ensuring food security for its 1.4 billion people, around a fifth of the world’s population, has become one of China’s top priorities as part of its strategy to cut reliance on imports.

Yang said the pilot facility will help to reduce CellX’s production cost to below US$100 per pound, making it competitive against premium meats, he said, adding that the launch of CellX’s commercial production facility in 2025 will further reduce costs.

In comparison, one pound of A5 grade Japanese Wagyu Kobe beef sells for around US$189 on Amazon.

“The fact that we’re able to do pilots and reduce costs below US$100 per pound is really a major milestone that signifies the transition from R&D to production,” said Yang. “Industrialisation and commercialisation is something that we will focus on next.”

Later this year, CellX plans to approach food regulators in the US and Singapore to approve its products for sale followed by other international markets in 2025.

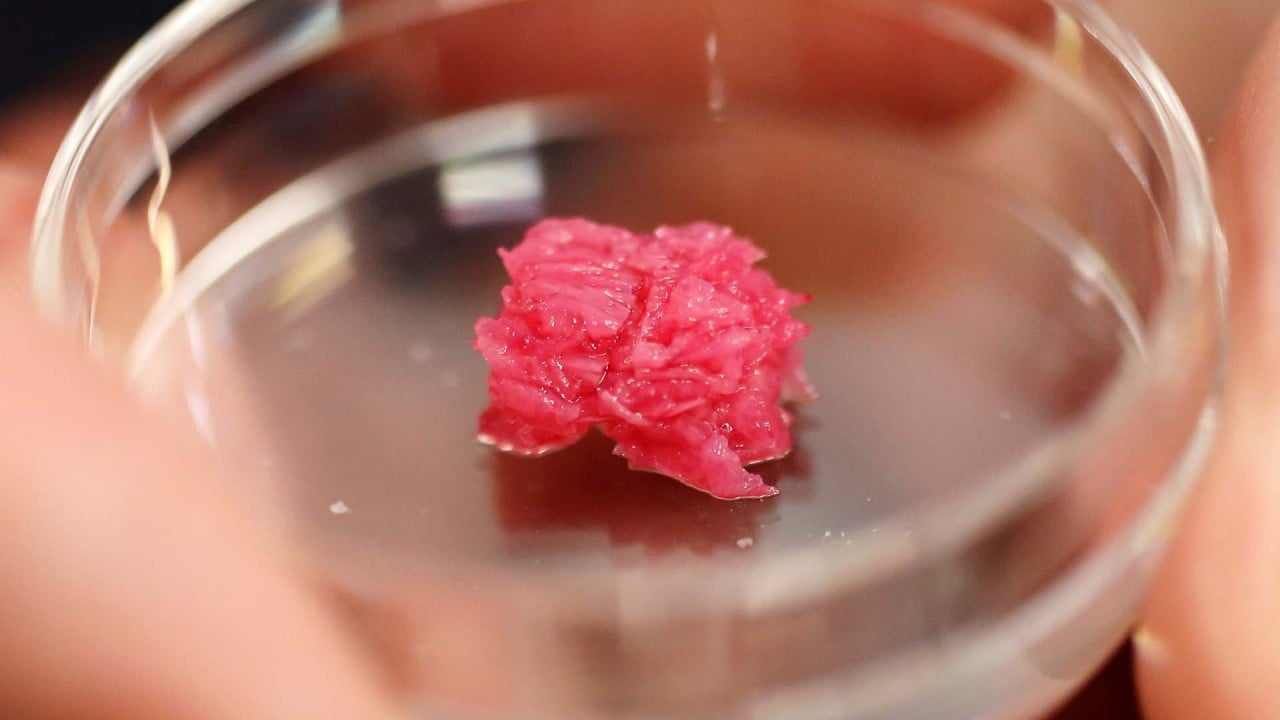

Cultivated meat is produced by cultivating animal cells directly, eliminating the need to raise animals for food.

CellX, which debuted samples of its cell-based pork products in September 2021, adopts a multi-species approach for its cultivated meat products.