Hong Kong’s first SPAC merger: Chinese steel website ZG Group set to combine with blank-cheque firm Aquila Acquisition

- Chinese steel trading website ZG Group, formerly known as Zhaogang.com, will combine with Hong Kong-listed Aquila Acquisition, exchange filing shows

- Aquila, Hong Kong’s first SPAC, raised about HK$1 billion in an initial public offering in March 2022

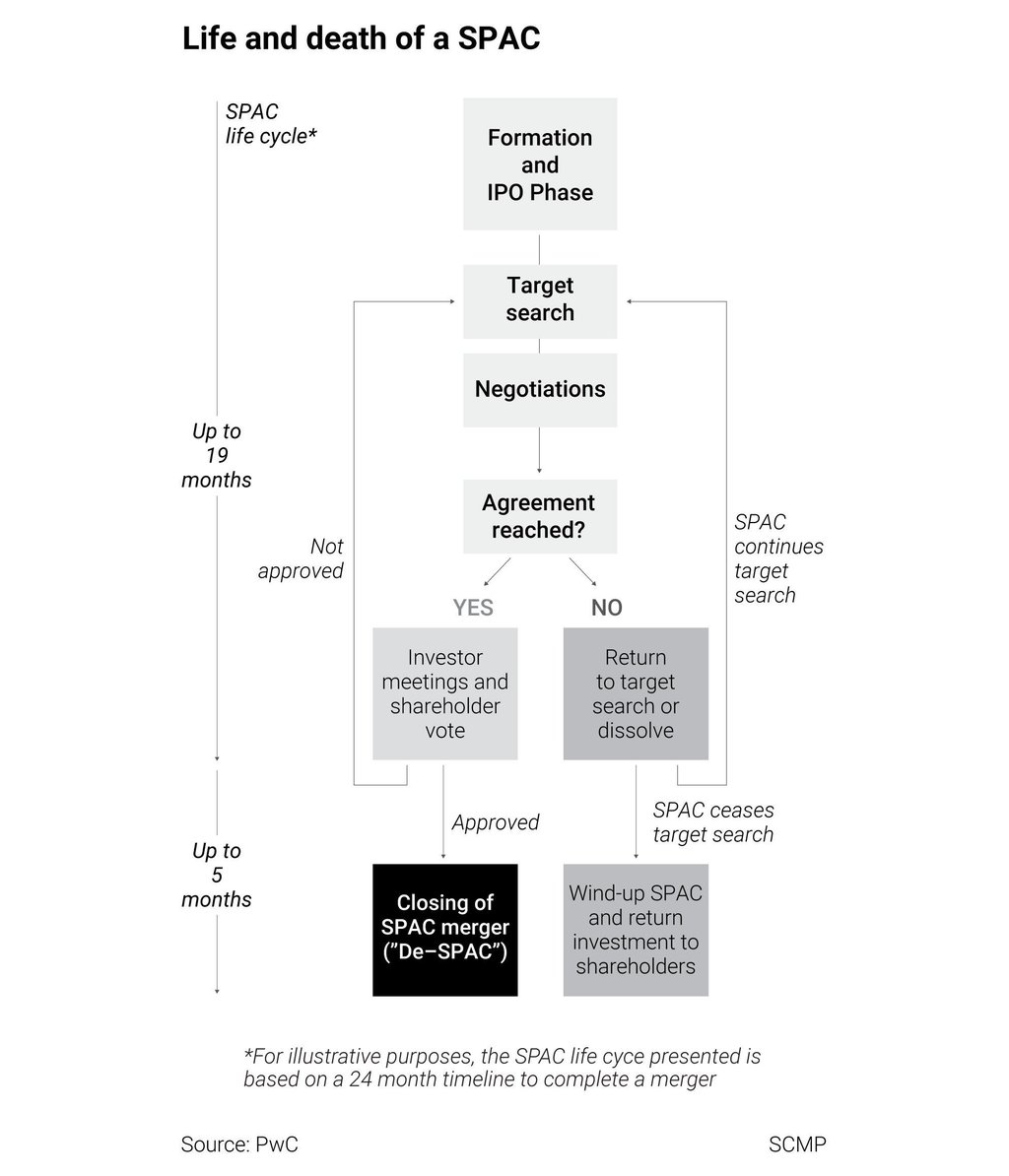

Chinese steel trading website ZG Group has agreed a deal to go public in Hong Kong via a merger with a special purpose acquisition company (SPAC) backed by China Merchants Bank’s overseas asset management arm.

The agreement comes with a private investment in public equity, or PIPE, with 10 investors including a subsidiary of commodities trading giant Trafigura Group, according to the filing. The proceeds from the PIPE will be HK$605 million.

A successful merger would see the first so-called de-SPAC by a Hong Kong-listed blank-cheque company, since the city’s stock exchange announced SPAC rules in 2021 in a bid to chase the US$245 billion US fad that flared and fizzled in less than two years.

Aquila, the Asian financial hub’s first SPAC, raised about HK$1 billion in an initial public offering in March 2022. The blank-cheque company planned to search for a target in Asia, with a focus on China, within “new economy” sectors, according to its prospectus. The SPAC’s shares debuted at HK$10 each and closed at HK$8.93 per share on Wednesday.