CK Hutchison’s Victor Li and Canning Fok step aside as managing directors, retain key leadership positions

- Li and Fok will stay on as co-executive directors, while Fok will serve as deputy chairman and chairman of its telecoms arm

- The group’s finance director and deputy managing director will take over for the executives after the conglomerate saw profit decline 9 per cent in 2023

The new arrangement is a prelude to Fok’s withdrawal from the front line, and may also mean that there could be some business reshuffling among the entire Cheung Kong Group, according to analysts.

Li will stay on as chairman and co-executive director with Fok, who has now also been appointed deputy chairman. The arrangement will allow Fok, 72, “to spend more time with his family”, Li said.

Fok decided to retire as co-managing director after decades in at the company, with 30 years as group managing director of Hutchison Whampoa, now known as CK Hutchison, and over 44 years with the Cheung Kong Group, the company said in a filing to the Hong Kong exchange on Friday night.

Fok will also be appointed executive chairman of CK Hutchison Group Telecom to lead the conglomerate’s operations in the telecommunications sector.

The incoming co-managing directors are 72-year-old Frank Sixt, who is currently the group’s finance director, and Dominic Lai Kai-ming, who is currently deputy managing director. Lai, 70, is also group managing director at AS Watson Group, CK Hutchison’s retailing.

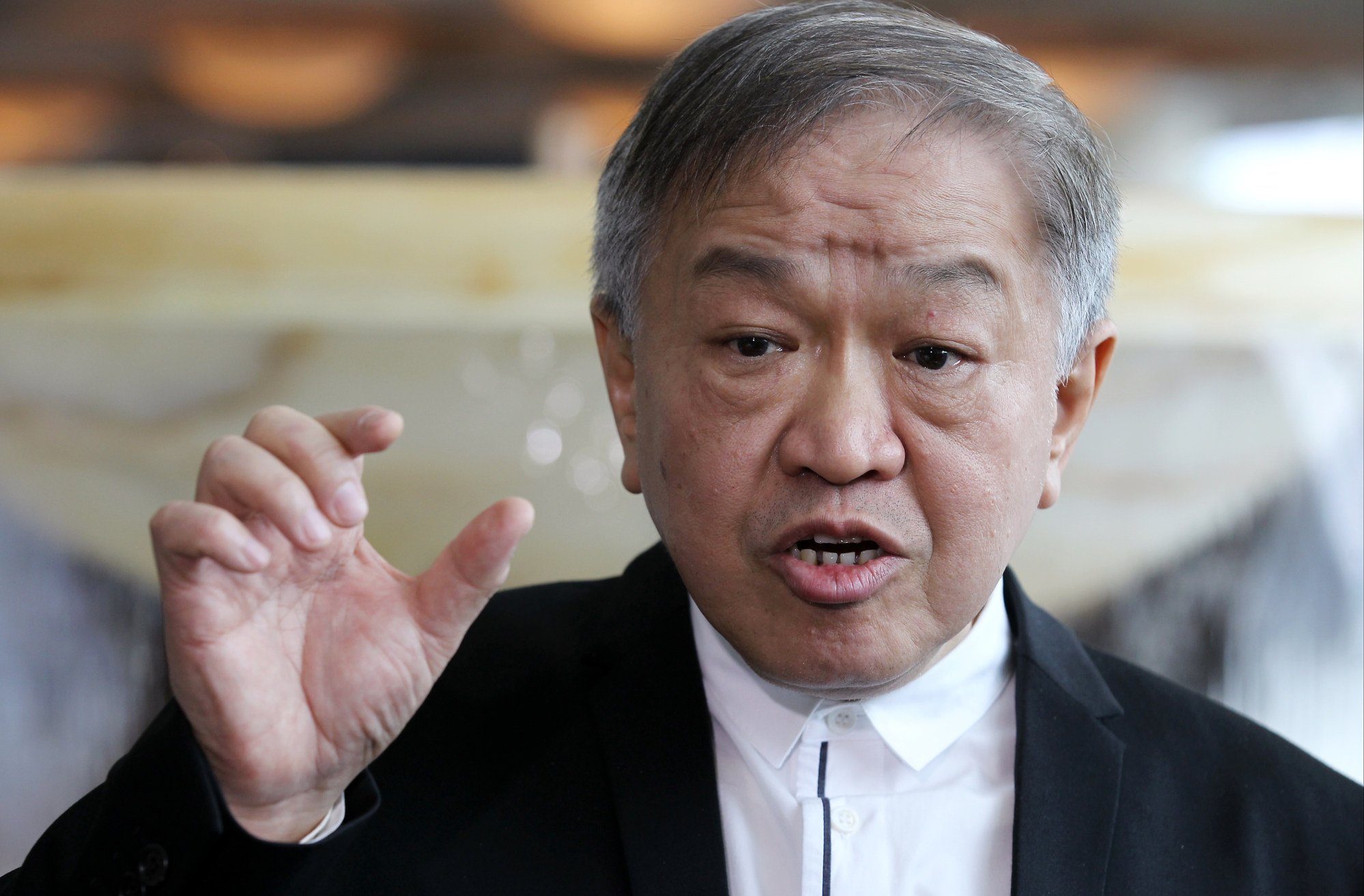

“Fok’s retirement had been anticipated for some time, and the market should be prepared for this news,” said Kenny Tang Sing-hing, chairman of the Hong Kong Institute of Financial Analysts and Professional Commentators.

Tang suggested that overlapping businesses within the Cheung Kong group could be a catalyst for future reorganisation. CK Hutchison’s telecoms business has historically relied on mergers and acquisitions for growth, but it has been challenging in the current political environment to pursue such deals, he added.

Tom Chan, permanent honourable president of the Institute of Securities Dealers, said he believes the changes will not have any negative impact on the stock when it starts trading on Monday.

CK Hutchison declared a final dividend of HK$1.775 per share. Together with the interim dividend of HK$0.756 per share, the full-year dividend totalled HK$2.531, a decline of 13.49 per cent from HK$2.926 in 2022.

The company’s retail division outperformed other sectors, posting year-on-year earnings growth of 13 per cent to reach HK$16.23 billion before interest, taxes, depreciation, and amortisation. It was primarily driven by favourable performance in Europe and Asia.