Hong Kong export credit insurer to cover trade loans made to e-commerce SMEs

- This is the first credit trade insurance based on alternative data to help Hong Kong-based e-commerce merchants, ECIC commissioner Terence Chiu says

As part of the deal with FundPark, ECIC and French reinsurer Scor will provide insurance cover for the trade loan portfolio underwritten by FundPark for Hong Kong-based e-commerce businesses.

Scor will share the ECIC’s risks, which will compensate FundPark in case of defaults. The cover will help reduce the credit risks faced by FundPark and consequently encourage more loans to be extended to online merchants in Hong Kong.

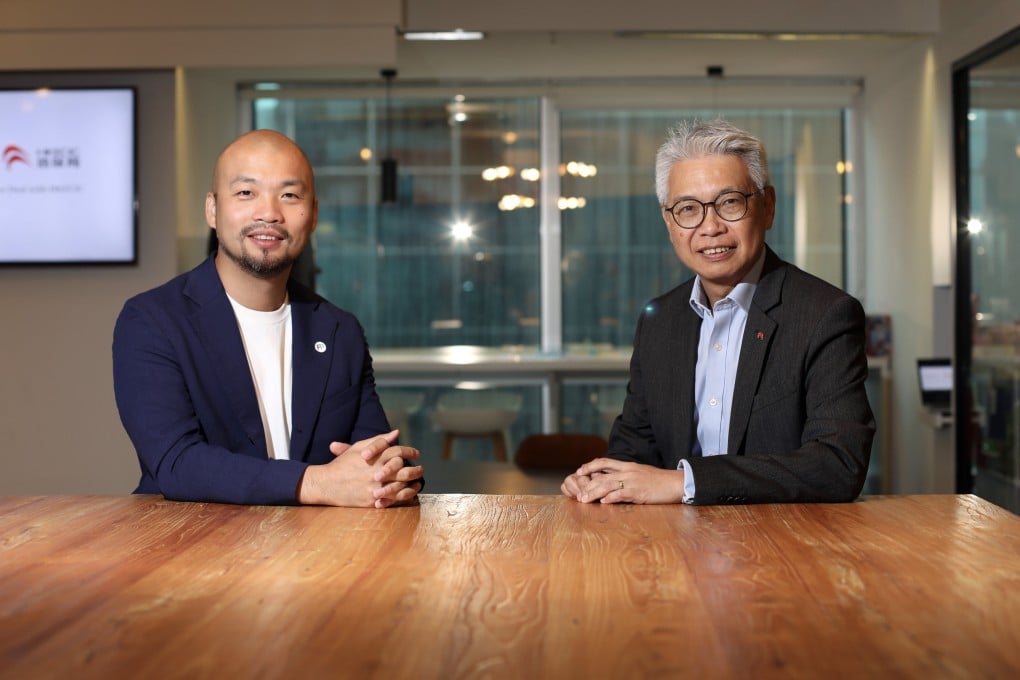

“This is the first credit trade insurance based on alternative data to help Hong Kong-based e-commerce merchants, most of whom are SMEs [small and medium-sized enterprises],” ECIC commissioner Terence Chiu Man-chung said in an interview with the Post. This will allow SMEs to get pre-shipment funding needed to support their businesses, he added.

“The mandate of the ECIC is to use insurance and other solutions to encourage the export trade in Hong Kong,” Chiu said. “We believe this new solution will address the pain points of many e-commerce merchants who find it hard to get loans from banks.”