Advertisement

Advertisement

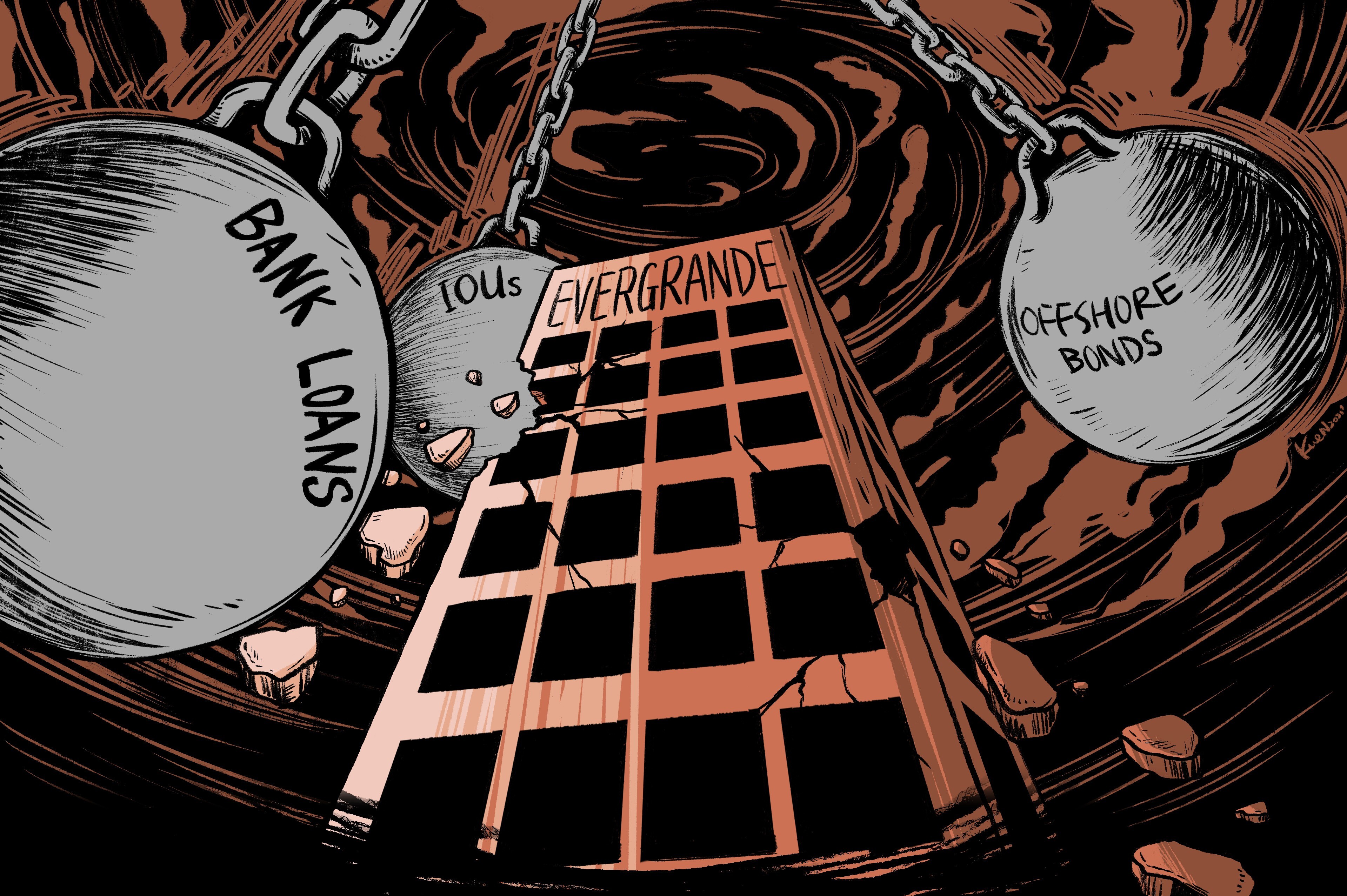

Is Evergrande too big to fail?

This series looks at the Evergrande crisis and what next for the Chinese property developer and home builder and its chairman, real estate magnate Hui Ka-yan.

Updated: 09 Oct, 2021

Advertisement

[1]

Childhood dreams fuelled a debt binge that’s taken Evergrande to the brink

Except for a rap on the knuckles, Evergrande was mostly spared from China’s 2017 debt crackdown, which led to the downsizing of Anbang, CEFC, HNA and Wanda.

25 Sep, 2021

Advertisement

Advertisement

[2]

Evergrande: End of the road for developer as US$37 billion bill looms?

The Shenzhen-based company tapped the bond markets nearly 40 times in a four-year period and amassed hundreds of billions of yuan in bank loans as it sought to expand its core residential housing business and diversify the scope of its operations.

02 Oct, 2021

[3]

Evergrande: default alarms put thousands of suppliers, jobs and economy at risk

Evergrande owed more than US$103 billion to its suppliers across construction, furnishings and materials sectors at the end of June. A collapse would put many out of business and jobs.

09 Oct, 2021

Select Voice

Select Speed

1.00x