Fed easing triggers sharp rise in HK stocks

Investors in Hong Kong pounce on property and commodity plays, sending the Hang Seng Index to the highest close in four months

Hong Kong stocks rose yesterday to their highest in four months, led by property and commodity-related issues.

The rally was driven by speculation that the US Federal Reserve's potentially unlimited quantitative easing measures will boost asset prices in the region.

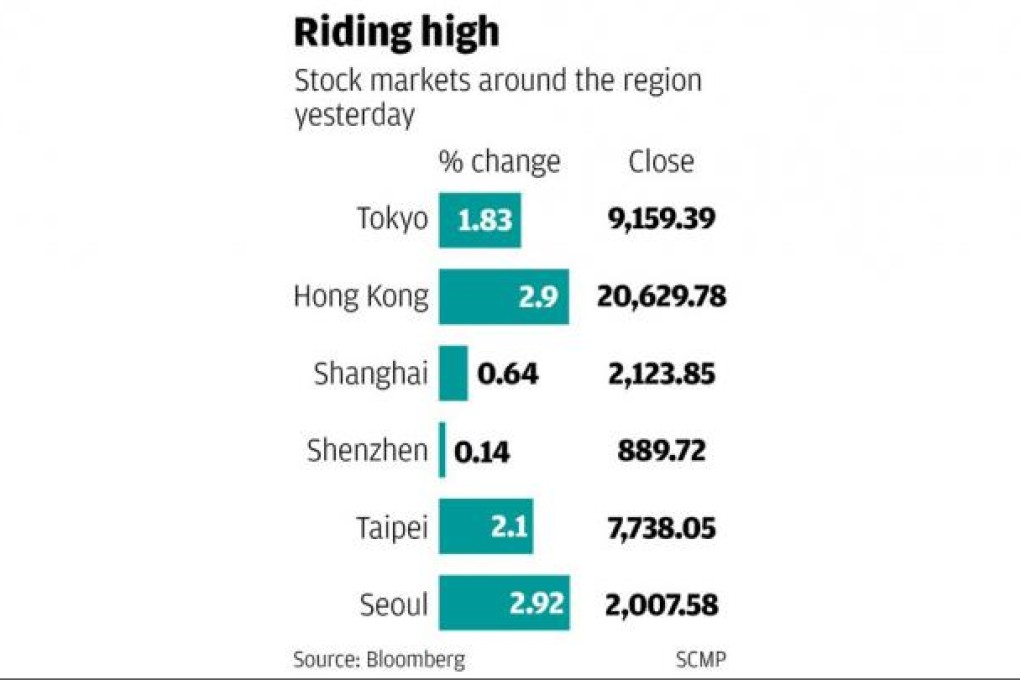

The Hang Seng Index surged 582.15 points or 2.9 per cent to end at 20,629.78, the highest level since May 4. The H-share index rose 3.68 per cent to close 349.16 points higher at 9,829.43.

Mainland markets, however, posted milder gains with the Shanghai Composite Index rising just 0.64 per cent. Market watchers said the effect of the US easing on A shares was limited, as the market was still largely closed to foreign capital flows.

In London, the FTSE 100 closed up 1.6 per cent at 5,915.55, its highest close since March. In the US, the S&P 500 was up 0.5 per cent in morning trading.

JP Morgan economist David Hensley said in Hong Kong the Fed was underscoring its determination to get the US economy back on track: "Potentially, the package could turn out to be a much larger commitment than the US$200 billion to US$300 billion we had in our minds."

The Fed announced overnight it would buy US$40 billion a month of securities supported by property loans and maintain ultra-low short-term interest rates until mid-2015 in its efforts to bolster an anaemic recovery in the world's largest economy.