The Asia-Pacific overtook North America to become the region with the largest population of high-net-worth individuals for the first time last year, but Hong Kong's wealthy ranks shrank by nearly 17 per cent because of weaker global stock markets.

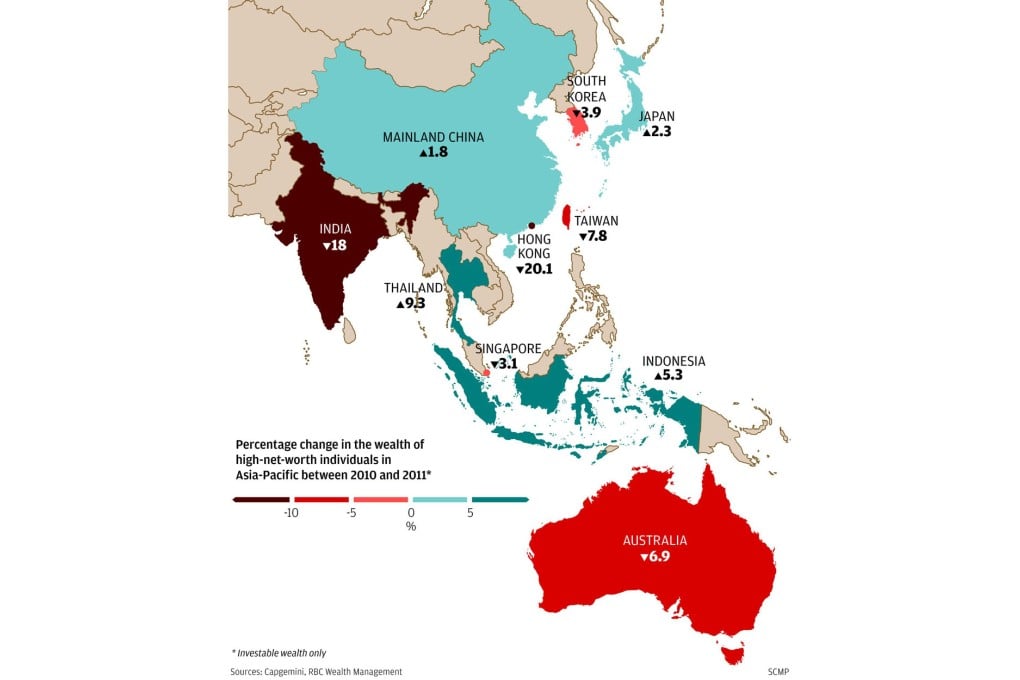

Countries that saw the fastest rise in such rich people, defined as individuals having investable assets of US$1 million or more, came from Thailand, Indonesia and mainland China. Investable assets exclude a person's primary residence, collectibles and goods that can be consumed. The Asia-Pacific surpassed Europe in 2010.

The latest findings are contained in the seventh annual Asia-Pacific Wealth Report, co-produced by consulting firm Capgemini and RBC Wealth Management, a unit of Royal Bank of Canada.

Of the 3.4 million high-net-worth individuals in the Asia-Pacific, more than 99 per cent were individuals with investable assets of US$30 million or below, pointing to the difficulty in accumulating wealth after reaching a certain threshold, the report's authors said.

In Hong Kong, 17,000 individuals fell off the high-net-worth chart, and total investable wealth dropped by US$103 billion, or about 20 per cent, from 2010.

Hong Kong investors' preference for equity products, coupled with the sluggish stock market performance, were the main reasons for the decline, said Alex Khein, the chief operating officer at BlueBay Asset Management, a wholly owned subsidiary of RBC Wealth Management.