US Fed buys some time in push to wind down stimulus

Cautious statement on economic recovery gives US central bank scope to continue bond buying

The US Federal Reserve secured itself some wiggle room this week with the tactical deployment of three words in its policy statement: "modest", "mortgage" and "inflation".

In a statement many had expected to set the stage for a reduction in the central bank's massive stimulus starting as early as next month, Fed officials' use of those three words instead introduced some doubt about their confidence in the strength of the economic recovery.

While the Fed said the US economic recovery continued apace, it pledged to continue buying US$85 billion of bonds each month and pointed to modest growth, higher mortgage rates and low inflation as risks to overall economic well-being.

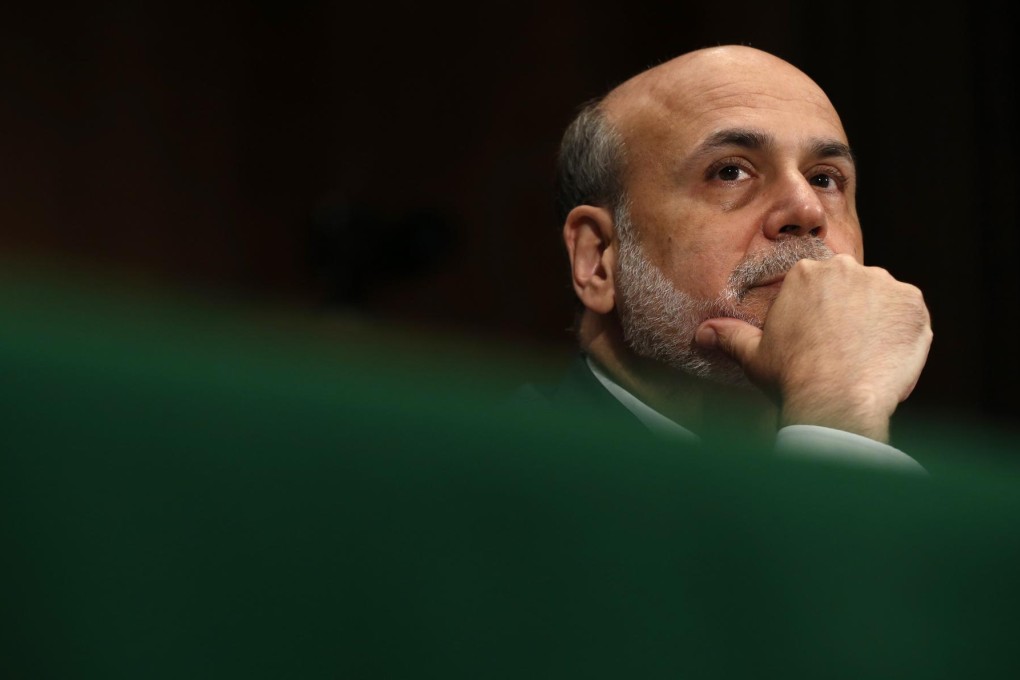

Missing entirely was any mention of pulling back on bond purchases - also known as quantitative easing, or QE - this year, with an eye on ending them altogether by mid-2014. That had been the suggested timeline Fed chairman Ben Bernanke disclosed as recently as June 19.

"It's pretty obvious that at some point in the near future, the Fed will start tapering. But there's a long way to go," said Thomas Simons, a money market economist at Jefferies & Co. "The general tilt of the Fed is still very accommodative."

Blame the US economy for that.

As Bernanke has repeatedly said, the Fed's timeline for winding down asset purchases was always going to be contingent on the overall health of the economy and whether it grows as quickly as central bank policymakers expect it to.