US economy: fiscal cliff or financial pothole?

In late 1999, the world went into a spin over Y2K, the millennium bug triggered by the arrival of the year 2000, threatening global chaos. In late 2012, investors have the "fiscal cliff" to worry about: a package of US federal tax cuts that expire on New Year's Day 2013, forcing Americans to pay more tax.

At the same time, a number of automatic spending cuts, from defence to public health, also kick in. This, the naysayers predict, will lead to US financial ruin with dire implications for global growth.

Why is the so-called fiscal cliff being flagged as more significant for the US economy than the recent presidential elections?

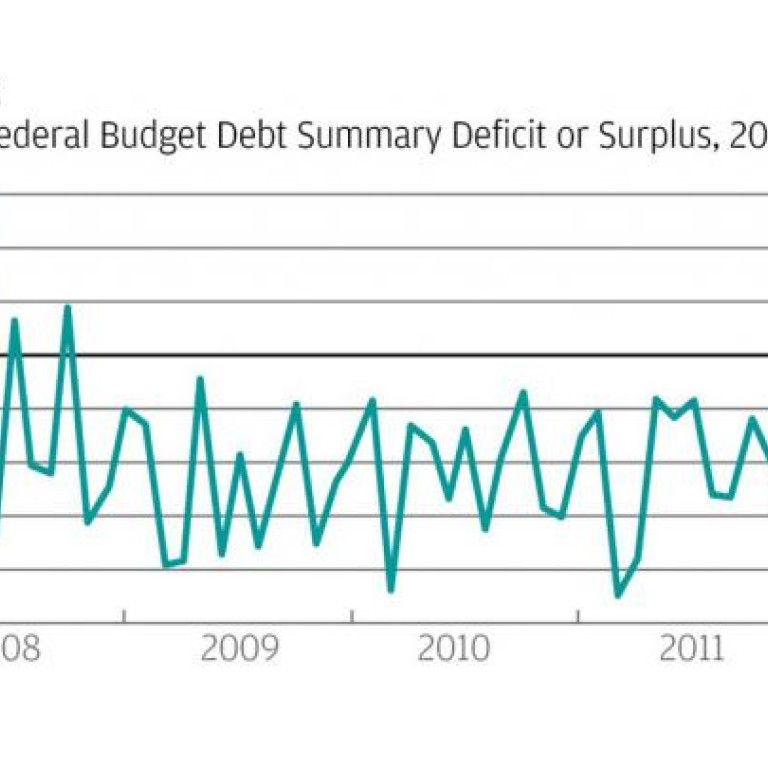

At present, the US government debt burden is believed to be above US$16 trillion - perilously close to the US$16.4 trillion debt ceiling. The debt burden is a can that has been kicked down the road by successive US administrations, with Congress raising the debt ceiling as and when required. The main preoccupation of American leaders over the past five years has been to pull the economy out of its slump. And stimulating growth requires governments to spend money, through tax cuts encouraging consumers to spend, or via company incentives to hire workers.

The fiscal cliff threatens growth prospects by doing the opposite: taking dollars from consumers' pockets and company coffers and transferring them to the US Treasury. The full effect, if allowed to run for the year, would reduce the 2013 deficit by half.

It is a sign that the US is addressing its national debt burden. But its timing is questionable and the fiscal cliff threatens to become a political time bomb given the fragile state of the US economic recovery.

The facts are that a combined "normalisation" of tax rates and new public spending cuts next year would remove US$650 billion, or about 4 per cent of gross domestic product, from the economy. For an economy growing at an annual rate of 2 per cent as of the third quarter of 2012, this spells disaster and would plunge it into recession next year.

Of course, Obama's administration will not allow this to proceed unchecked, and there are a number of possible outcomes. But these require political accommodation within the Republican Party, which controls the lower house and holds entirely different views on government spending and tax cuts.

The Republican sticking points are that there should be no tax hikes, and that reform of entitlement programmes such as Medicare should be a precondition for any agreement to be reached.

Additional sensitive issues for both Republican and US investors are that under the fiscal cliff, dividend taxes are subject to the highest income tax rate of 39.6 per cent and capital gains taxes rise to 20 per cent. Adding fuel to the fire is the prospect that approval by the bipartisan Congress to raise the national debt ceiling - a likely requirement before year-end - will become politicised, with the Obama administration held hostage in any grand-bargain negotiations.

Despite the daunting prospect of a political impasse in the run-up to January 1, 2013, implementation of these fiscal measures is not a given. For example, prior tax cuts and spending privileges could be temporarily extended by Congress while an agreement is still under negotiation. And if, in a worst case scenario, the measures were to go into force in January, they could also be retroactively reversed once an agreement is reached.

In UBS's view, the fiscal cliff is more likely to be a fiscal pothole, with some of the measures going into effect for less than a month (a "temporary cliff") or with only a few measures permanently expiring (a "mini cliff"). Ultimately, UBS expects a grand bargain to be reached with a deficit reduction of US$4 trillion over 10 years. UBS also believes the debt ceiling will not be breached, but would probably be lifted at the eleventh hour.

This view has important implications for financial markets, as it could avert a downgrade of US Treasuries by credit rating agencies who anticipate serious fiscal reform. Currently, Moody's, Standard & Poor's and Fitch have Aaa/AA+/AAA ratings on American senior credits, with a negative outlook over the intermediate term. Less convincing fiscal reform could trigger further downgrades in the short term.

Y2K came and went with little ado. Expect the cliff to be steeper.