New | Chinese outbound investment to rise to another record

With China's overseas deals exceeding US$54 billion in the first half, the full-year figure is expected to top last year's US$92.8 billion

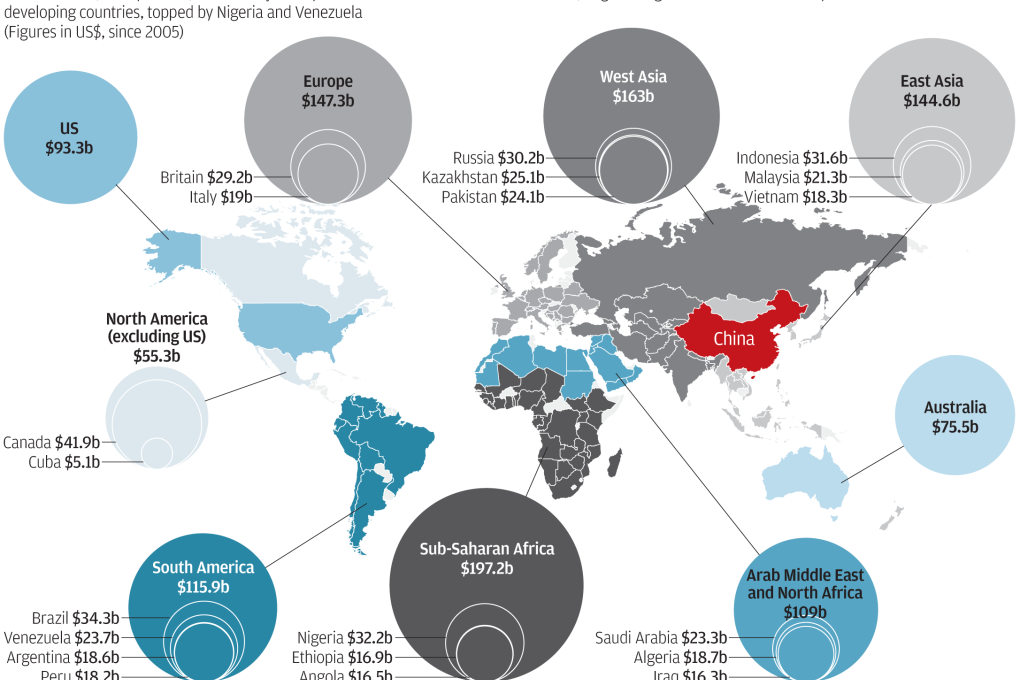

Chinese outbound investment is on track for another high this year, with first-half deals topping US$54 billion, although a new report warns that Chinese firms escaping a sliding economy now have to face rising protectionism and a cybersecurity backlash.

The United States remains the most popular destination for Chinese dealmakers, with resource-rich Australia pipped for second place by Italy after the US$7.7 billion acquisition of Italian tyremaker Pirelli by ChemChina.

Deal flow is up 14 per cent over this time last year and "is an impressive gain in light of declining global commodities prices", says Derek Scissors, a resident scholar at the American Enterprise Institute, in a biannual report on Chinese deals.

"The true level of China's global spending is likely to rise, if unsteadily for years to come. There will be more money to spend and fewer attractive investment options at home as the economy there slows."

The institute recorded US$55.9 billion in deals in the first half, compared to a US$54.4 billion figure from China's Ministry of Commerce, suggesting this year's total will top US$100 billion and beat last year's record US$92.8 billion.

Where once China's overseas investment was dominated by energy-focused state-backed projects, the latest data suggests greater diversity and confidence among private-sector players as tie-ups in real estate, finance, and transport dominate.