China shares slide on lack of stock connect news, Fed rate rise jitters

Shanghai Composite down 1.3 per cent; Hong Kong's Hang Seng Index off 1.5 per cent

Chinese stocks tumbled on Wednesday to close sharply lower as investors were generally disappointed that a state leader did not mention the launch of a much-anticipated trial scheme connecting Hong Kong and Shenzhen markets during his visit to Hong Kong, while jitters on a rate rise by the US Federal Reserve as early as June also spooked markets.

The Shanghai Composite Index opened lower and deepened losses in the afternoon session, falling up to 2.1 per cent. It closed down 1.3 per cent, or 36.17 points, at 2,807.51. Large-cap CSI300 dropped 0.6 per cent, or 17.98 points, to 3,068.04. The Shenzhen Composite Index lost 2.7 per cent, or 48.6 points, to end at 1,766.08.

Trading on the startup board ChiNext Index was even more volatile. The index slid as much as 3.9 per cent in the final hour of trading, before finishing at 2,020.48, down 2.9 per cent.

Combined turnover for Shanghai and Shenzhen shrank to 417 billion yuan, from 431 billion yuan on Tuesday.

Hong Kong’s Hang Seng Index retreated after two days of gains, off 1.5 per cent, or 124.77 points, to close at 19,826.41. The Hang Seng China Enterprises Index fell 1.5 per cent, or 124.77 points, to 8,301.01. Turnover stood at HK$59 billion, almost unchanged from Tuesday.

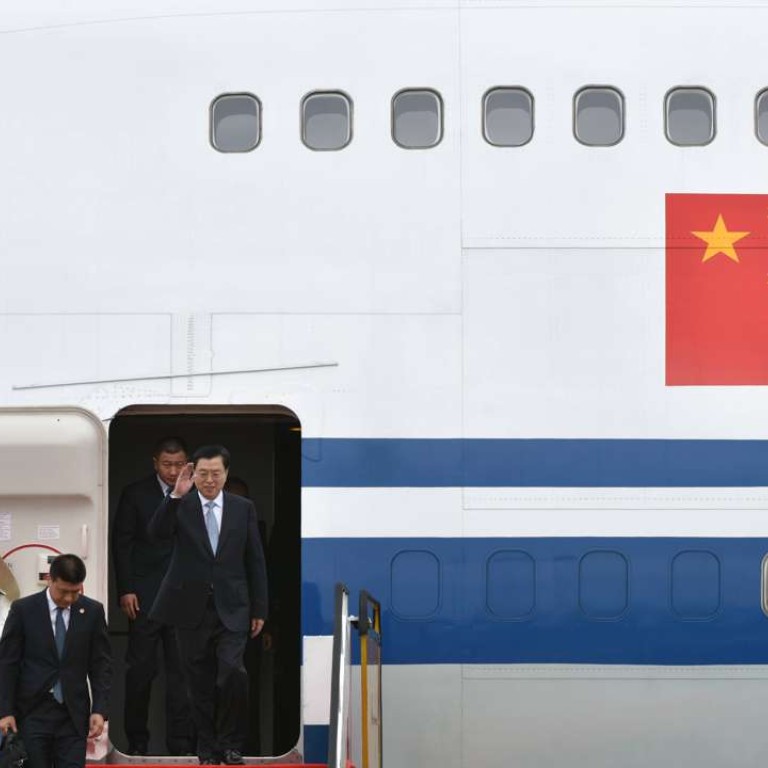

Talk of the Shenzhen-Hong Kong Stock Connect, a long-discussed scheme that will give both cities’ retail investors direct access to each other’s equity markets, had been circulated ahead of this week’s Hong Kong visit by Zhang Dejiang, chairman of the National People’s Congress Standing Committee and overseer of Hong Kong affairs. He started the visit on Tuesday.

“We haven’t seen any exciting news from Zhang’s visit so far, or additional details on the launch of the Shenzhen-Hong Kong stock connect programme. That may disappoint the market,” said Victor Au, chief operating officer of Delta Asia Financial.

Analysts from Essence International said “the probability is low” for Zhang to bring any news on the Shenzhen-Hong Kong Stock Connect this week as he is not officially in charge of the programme.

“However, after Zhang visits Hong Kong, the possibility still exists for the Chinese authorities to announce the launch before MSCI’s annual index review in June, as it may increase the possibility for the global index compiler to include A shares in their benchmark indexes,” they said.

Meanwhile, renewed fears on a Fed rate increase shattered global markets and dampened investor sentiment.

US stocks fell heavily on Tuesday after two US Federal Reserve officials said the US central bank could raise interest rate as early as June.

Au from Delta said investors took “the possible US interest rates hike” as an excuse to sell Hong Kong stocks, because gains during Tuesday’s session did not have any fundamental support.

In Shanghai, several major property developers slipped, after official data showed new home prices grew at a slower pace in China’s first-tier cities last month.

Poly Real Estate Group dropped 1.3 per cent to 8.44 yuan, Beijing North Star Company lost 1 per cent to 4.04 yuan, and Gemdale Corp pulled back 0.8 per cent to 11.39 yuan.

However, insurers bucked the weak trend. New China Life Insurance advanced 1.5 per cent to 40.29 yuan and Ping An Insurance gained 0.8 per cent to 31.77 yuan.

In Hong Kong, Chinese developers were also weaker. Poly Property Group gave up 1 per cent to HK$1.94 and Country Garden was off 0.3 per cent at HK$3.

Chinese online major Tencent Holdings shed 1.1 per cent to close at HK$161.1 before the release of its quarterly results later in the day.