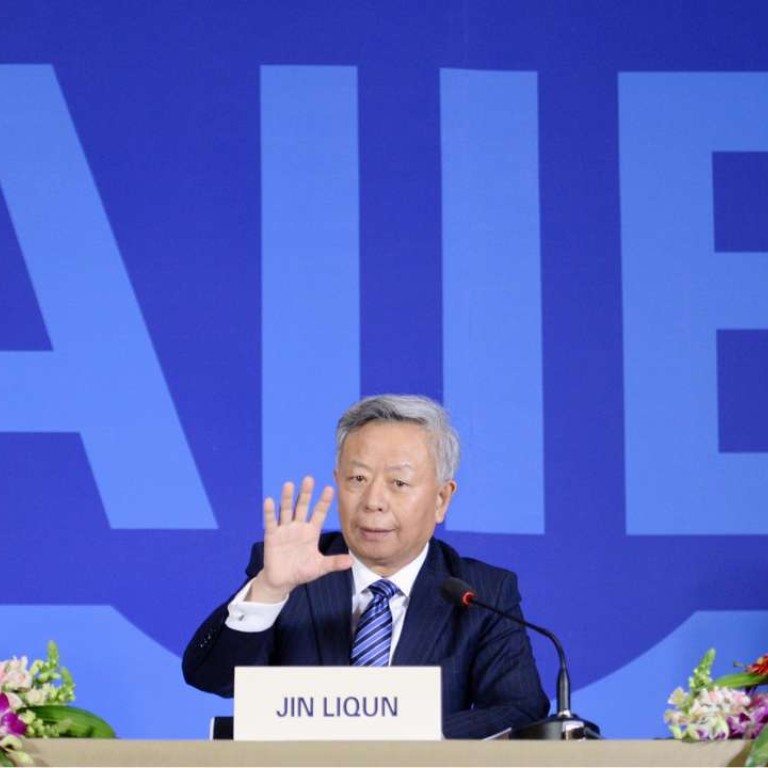

AIIB chairman urges private sector not to worry over sovereign risks in Belt and Road investments

Faced with mounting questions from business leaders on the economic viability of the proposed investment ideas under China’s One Belt One Road vision, the chairman of the Asian Infrastructure Investment Bank (AIIB) Jin Liqun reached out publicly on Tuesday and sought to reassure private sector business leaders on their concerns over sovereign risks in the destination countries.

Jin reassurances have come as a wide spectrum of private sector players, including former Hong Kong financial secretary Anthony Leung, who is now a chairman of the private sector developer Nan Fung Group, have increasingly stepped up and said the high degree of sovereign risk presented by the 60-plus countries along the Belt and Road region is a key deterrent to investing in the projects.

Leung has urged Chinese government-backed financing bodies that are experienced in doing business in the high risk countries to step in and help resolve the investment gridlock. One idea he has pitched is to have the Export Import Bank of China step in and provide a new form of dedicated insurance to remove or lessen the sovereign risks that private investors face.

But Jin told audiences and panel members at the Boao Forum for Asia Financial Cooperation on Tuesday not to worry too much about these issues.

“Sovereign risk is not a big issue,” said Jin. “I’m not worried about the sovereign risks – as long as the project is good for that [recipient] country.”

He told private sector players to turn their focus to the standalone project-level economic benefits and their chances of them being executed, as well as whether the infrastructure projects could bring synergy to the given markets they are in.

“What’s important is whether the project can be funded or right away rather than be there and wait for five or six years’ time. If you can get a project done as soon as possible, you don’t even have to worry about high interest rates. A little bit of interest rate is not that much. But a project can be costly if it is delayed and year in year end in implementation.”

In Jin’s view, the real challenge ahead for the region may be severe risk aversion from global capital allocation. As a sign of the “perverseness” and troubled times ahead, he cited the US$12 trillion of global government bonds which are now subject to negative yield. He said this will have future implications for nations in the region.

To overcome the threat ahead, he urged nations that have yet to jump on board with the AIIB to join and work together with the group. He made a call to countries that have not yet joined to take the opportunity of the second application deadline that will end in September.

“If you have missed the first bus, the second bus is definitely something you should not miss.”

Despite Jin’s best efforts in encouraging private players how best to proceed with the Belt and Road vision on Tuesday, his speech was followed in later sessions by still more private sector questions over the lack of “bankable” projects and the lack of standardisation in the sector.

The Hong Kong Monetary Authority set up a dedicated Infrastructure Financing Facilitation Office on Monday to help increase communications and find solutions with a view to resolve some of the private sector concerns.

The Asia Development Bank estimated Asia’s total infrastructure needs will reach a total of US$8 trillion up to the year 2020.