Macron sill faces mammoth task as the old bogeymen still set to haunt the euro longer term

Europe’s tradition of political unity is breaking down, as the rest watch Germany pulling away to greater economic glory

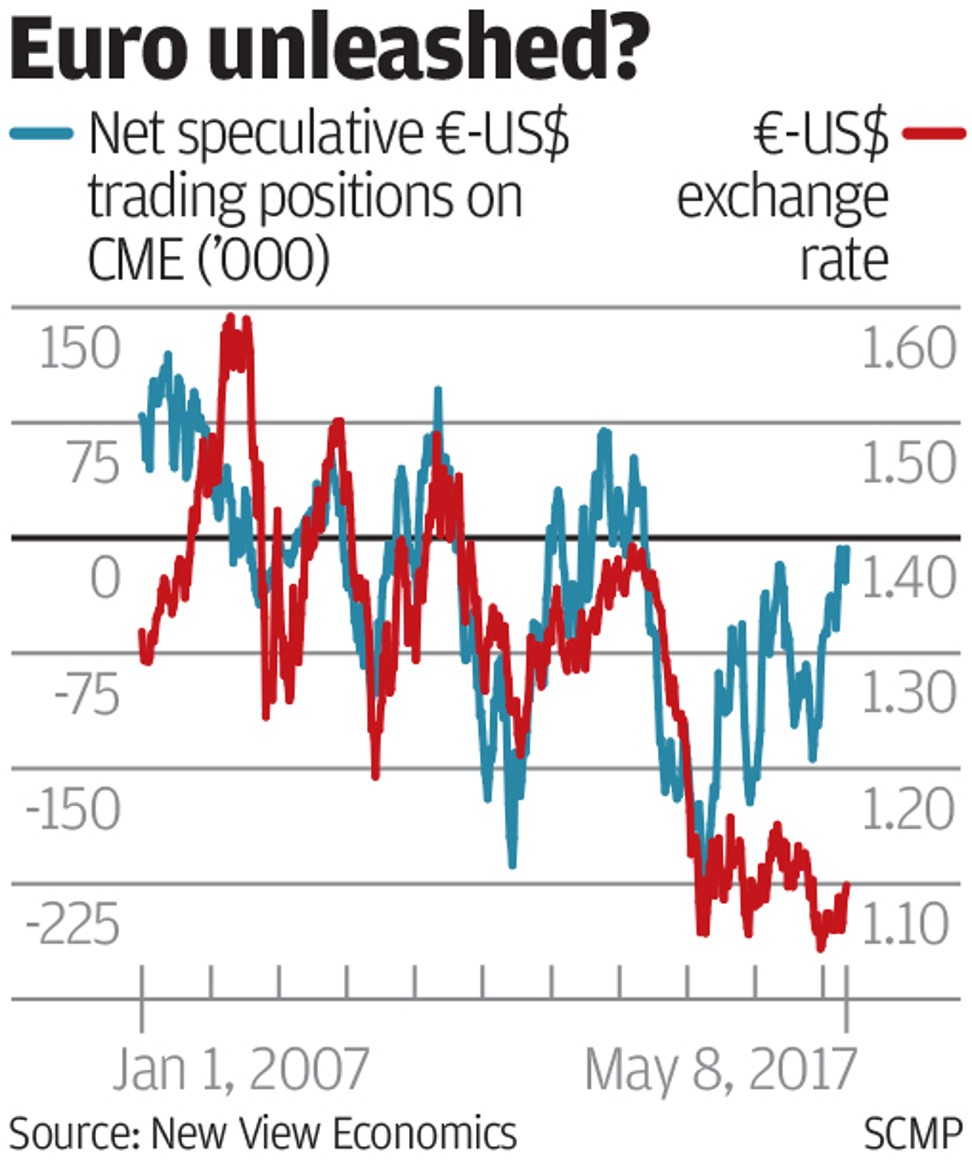

With France’s presidential elections over and the nation now in the “safe hands” of independent Emmanuel Macron, the euro should have escaped the jaws of death.

Markets have been spared the fate of a French exit (Frexit) from the European single currency, threatened by the National Front’s Marine Le Pen. By rights, markets should breathe a sigh of relief, leaving the decks clear for a euro lift-off.

Peace is unlikely to last too long. Notwithstanding a spell of post-poll euphoria, the old bogeymen are set to haunt the euro in the longer term. The rising tide of anti-euro polemic and populism might have been held at bay in France this time, but Europe’s existential crisis of national identity versus increasingly centralised Brussels power-building is still bubbling over. The euro is not out of the woods by a long stretch of the imagination.

The list of problems hanging over Europe is endless. How policymakers deal with cranking up growth and employment once the European Central Bank’s quantitative easing taps are turned off later this year is one of the biggest challenges facing European unity ahead. The disparities between Europe’s rich and poor nations are feeding cancerous politics of envy and populism within the European Union.

Wealth inequality and the lack of job opportunities for young and old outside of prosperous Germany are becoming more acute. The EU should be a level playing field for all nations to enjoy but statistics tell a very different story. Germany is running close to full employment, while distressed economies in southern Europe are suffering unemployment rates bordering 20 per cent.

With close to half of young people out of work in Greece and Spain, the odds of some Europeans never having proper jobs in their working lifetimes is a real possibility.

It is no wonder European voters feel alienated and looking for answers in extreme political parties. Europe’s tradition of political unity is breaking down, posing a major threat to the euro’s existence.

Globalisation, technological change and rising job insecurity remain at the root of Europe’s growing political discontent. Macron might have won the French presidency but he still faces a mammoth task in turning his success into a broader movement, building a political base that can tackle France’s post-industrial decline.

National Assembly elections in June could prove an even bigger test for the euro.

Macron’s election victory may well prove a short term respite for the euro as the same thorny issues surface again in next month’s elections. Macron needs to address France’s dispossessed unemployed, reassure its insecure workforce and win over the poor and disadvantaged. In order to achieve this Macron will be tempted to use similar anti-euro, pro-Frexit rhetoric as Le Pen, pressing home the case for future EU reform. Raising the stakes on Frexit is not what the markets want to hear right now.

The EU should be a level playing field for all nations to enjoy but statistics tell a very different story. Germany is running close to full employment, while distressed economies in southern Europe are suffering unemployment rates bordering 20 per cent

In the past, France has always had a bias towards running a weak currency policy. Former French governments devalued the old franc a number of times during the 1980s and 1990s to redress crucial economic imbalances and to keep a competitive edge with its major trade competitor Germany. Sadly for France, the euro’s fixed exchange rate regime has meant productivity and competitiveness differences with Germany have deteriorated at an alarming rate.

Germany is getting stronger while other euro-zone nations are falling behind under the euro’s regime and Europe’s single market. And it is not just France that is feeling the pinch. Italy, Spain, Portugal and Greece are watching Germany pulling away to greater economic glory.

Germany’s burgeoning budget and trade surpluses and its rip-roaring economic performance are going down like a lead balloon with its struggling EU partners.

While Germany continues to resist the closer fiscal integration that might help to tackle these problems, the gap between strong and weak European nations can only widen. In the absence of a unified fiscal policy, the risks are that Germany will be out-gunned on ECB monetary policy as other euro zone countries plug for a softer bias to interest rates and a weaker euro to stimulate recovery. This will not be lost on the markets as the battles rages for an early shutdown down on QE operations later this year.

The moment of truth is fast approaching for the euro. If Europe faces a stark choice between national prosperity and currency stability, the euro will be left fighting for its existence.

David Brown is chief executive of New View Economics