Retirement dream dies: only 37 per cent of Hongkongers expect comfortable ‘golden years’, HSBC survey shows

Hongkongers undergo a dramatic shift in social expectations, as only 37 pc of working age individuals expect a comfortable retirement, down from 61 pc recorded two years ago

Hongkongers are becoming more sceptical about their retirement prospects, as a darkening outlook for global trade and a sense that the best years of economic growth in greater China have drawn to a close foster a dramatic shift in social expectations, according to a HSBC survey.

Only 37 per cent of working age Hongkongers believe they will enjoy a comfortable retirement, a sharp erosion from the 61 per cent who looked towards retirement favourably two years ago.

The bleak finding came from a survey of 1,012 working age respondents in Hong Kong, HSBC said.

It also found that 8 per cent of working age people would be willing to defer their retirement by at least two years to secure better income. As many as 30 per cent said they would work for longer or get a second job to sustain their retirement savings.

Planning for retirement has never been more challenging

Greg Hingston, head of retail banking and wealth management at HSBC, said that the bleaker outlook on retirement reflects the lack of confidence in the current economic trajectory, impacted by recent geopolitical events such as Brexit and change in US policy.

“Planning for retirement has never been more challenging” Hingston said.

He added that it is attributable to volatile markets, low interest rates and rising health care costs.

“The findings show that 56 per cent believe millennials have experienced weaker economic growth than previous generations,” he said. “While 59 per cent agree that millennials are paying for the economic consequences of older generations, such as the global financial crisis.”

The survey also found that seven in 10 millennials believe that their generation will live much longer and will need to support themselves longer.

Meanwhile, most millennials expect to retire at 61, two years younger than the working age average of 63, with only 16 per cent of millennials expecting to continue working after 65.

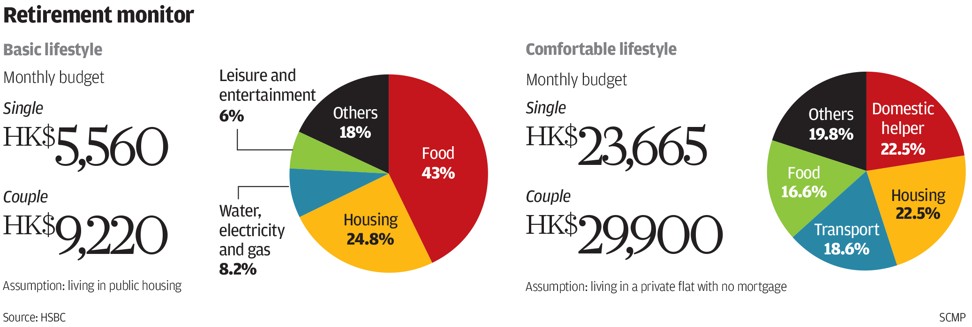

HSBC’s retirement monitor found that in order for a couple to live a basic lifestyle in public housing, they must have a monthly budget of HK$9,220.

For a couple to live a comfortable lifestyle, with the assumption that they have already paid off their mortgage, they would need HK$29,900 per month.

Edward Moncreiffe, interim chief executive of HSBC insurance, said that the millennial generation has not been as fortunate as the previous generation, which has experienced very strong economic growth.

“The challenge is for our millennials to prepare early by taking advantage of a number of savings channels available to them,” he said.

The report reveals that property is still viewed as a good way of saving for retirement, with 61 per cent of working age people thinking it delivers the best returns.

About 55 per cent of people believe that stocks and shares can also deliver the best returns.