Qihoo’s back-door listing approval could be followed by a select few other former US-listed Chinese tech firms

Returning companies considered in line with the mainland’s industry development strategies and which could take leading positions in their sectors could be fast tracked onto mainland exchanges

Qihoo 360 Technology’s approved back-door listing in Shanghai is unlikely to reopen the floodgates to many others, after firms were banned from buying shell companies in June 2016 by the Chinese mainland’s stock regulator to stop dozens of US-listed Chinese firms from returning to the A-share market.

But it is expected that a handful of carefully chosen market leaders with technology actively sought after by China will now be secured fast track approvals by the China Securities Regulatory Commission (CSRC) to gain A-share status, according to venture capitalists and analysts.

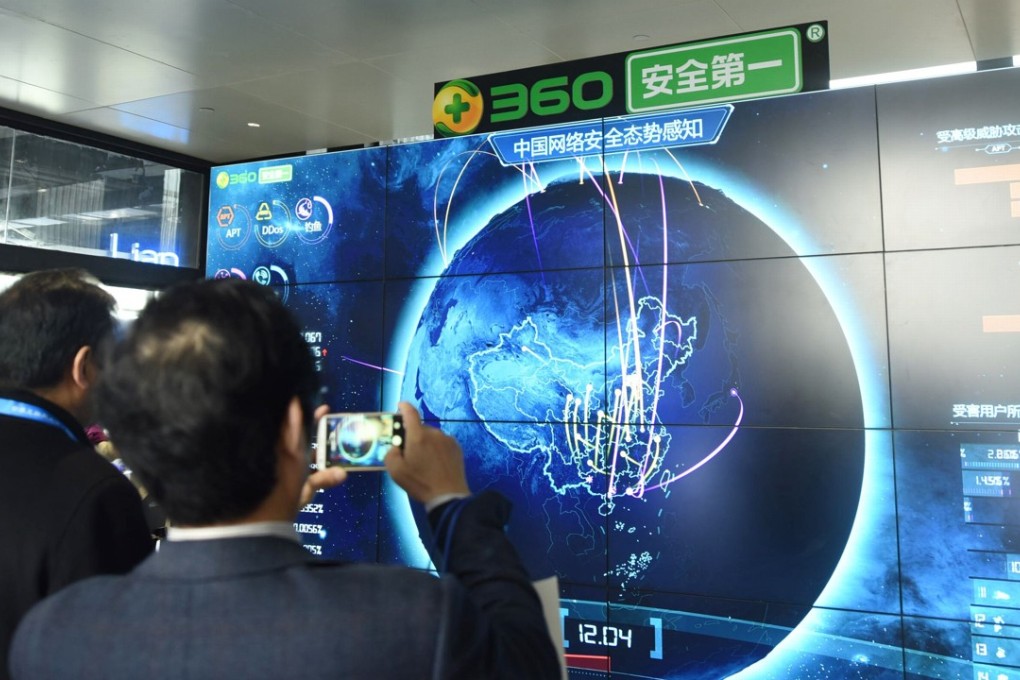

Anti-virus software maker Qihoo first announced its back-door listing plan at the start of November.

Controlled by its founder Zhou Hongyi, one of the country’s IT moguls, Qihoo was finally cleared on Friday by the China Securities Regulatory Commission (CSRC) to go ahead with a reverse merger that allows it a listing on the Shanghai Stock Exchange, after taking over lift maker SJEC Corp.

Analysts expect the next name likely to be given the nod could be AppTec, a leading domestic pharmaceutical and biotechnology firm, which awaits IPO approval on the mainland, after its parent Wuxi PharmaTech privatised in New York two years ago.