Bitcoin and crypto assets may one day threaten financial system, says report

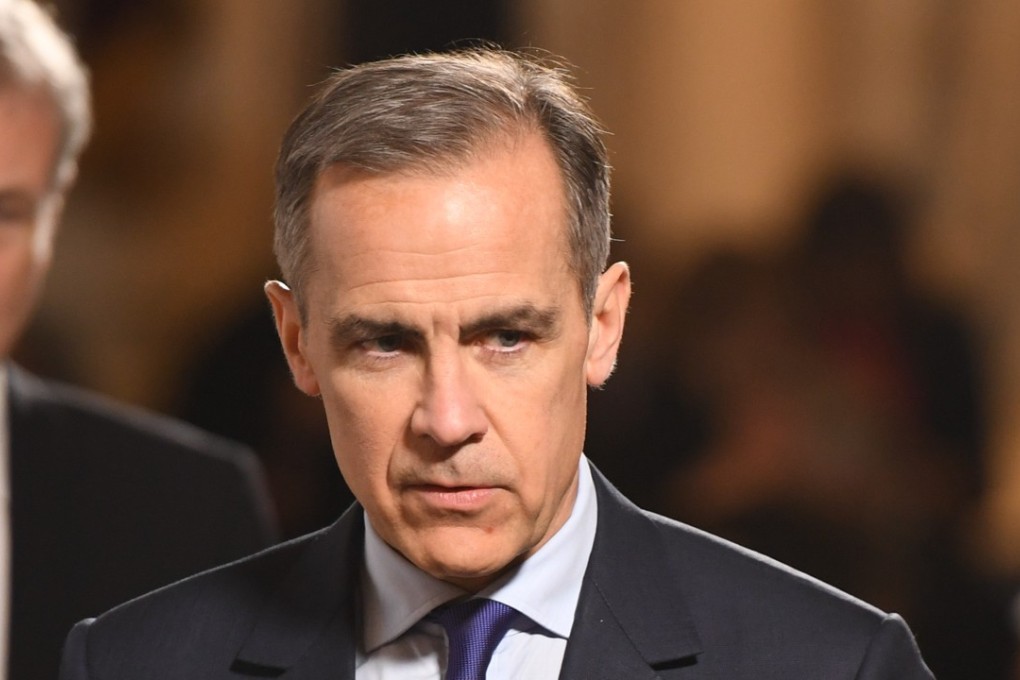

The rapid evolution of crypto-assets such as Bitcoin may one day make them a threat to the financial system, Mark Carney, chairman of the Financial Stability Board, said in a letter to G20 finance leaders.

“Wider use and greater interconnectedness could, if it occurred without material improvements in conduct, market integrity and cyber resilience, pose financial stability risks through confidence effects,” Carney wrote.

His letter, published on Sunday, was circulated for a meeting of G20 finance ministers and central bank governors in Buenos Aires.

Carney, who is also governor of the Bank of England, called earlier this month for more regulation to bring the era of cryptocurrency “anarchy” to an end.

In his G20 letter, Carney said the FSB would look for metrics and gaps in data to help monitor the growth of crypto-assets and identify emerging threats to financial stability.