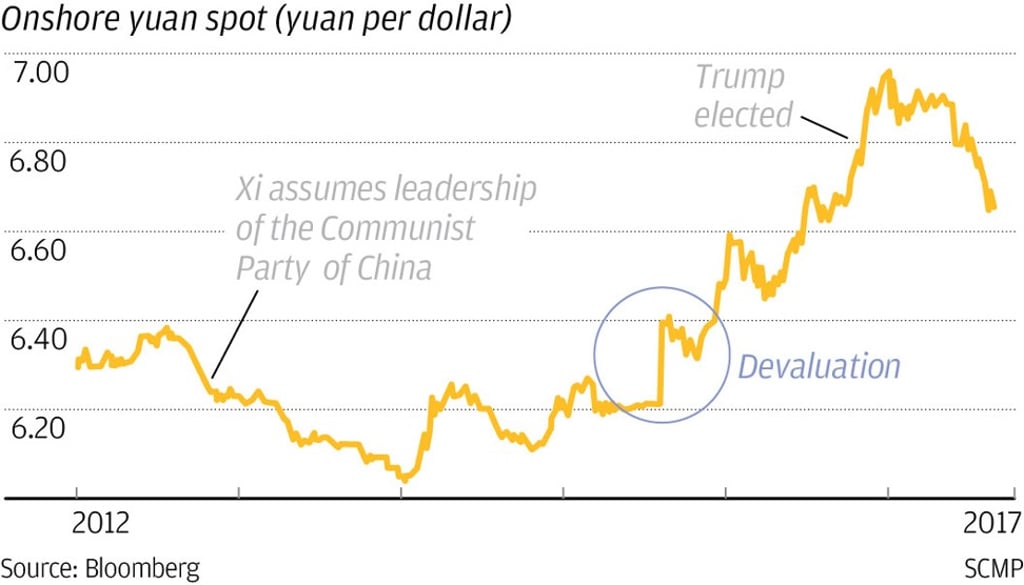

China may let the yuan depreciate gradually as a tactical move in its trade war with the US

China is evaluating the economic impact of a weaker yuan as a countermeasure to US tariffs, although it doesn’t mean the currency’s devaluation

China is evaluating the potential impact of a gradual yuan depreciation, people familiar with the matter said, as the country’s leaders weigh their options in a trade spat with US President Donald Trump that has roiled financial markets worldwide.

Senior Chinese officials are studying a two-pronged analysis of the yuan that was prepared by the government, the people said. One part looks at the effect of using the currency as a tool in trade negotiations with the US, while a second part examines what would happen if China depreciates the yuan to offset the impact of any trade deal that curbs exports.

The analysis doesn’t mean officials will carry out a devaluation, which would require approval from top leaders, the people said, asking not to be named as the information is private. The yuan weakened as much as 0.2 per cent to 6.3186 per dollar in onshore trading on Monday before trading little changed as of 5:49pm local time. China’s central bank didn’t immediately respond to a faxed request for comment.

“It seems as if Beijing is showing the full extent of policies they could deploy in response to Trump’s protectionist rampage,” said Viraj Patel, a strategist at ING Bank NV in London.

Other markets have been far more turbulent as both the US and China proposed tariffs on US$50 billion of goods and Trump instructed his administration to consider levies on an additional US$100 billion of Chinese products.

The S&P 500 Index has slumped more than 9 per cent from this year’s peak in January, while the Shanghai Composite Index has lost 12 per cent on concern that tensions between America and China could devolve into a full-blown trade war. Yields on US Treasuries have also declined from this year’s highs as investors shifted into haven assets.