Taiwan’s economy burns less brightly than its ‘tiger’ peers as smartphone product cycle ends

Of Asia’s fabled “tiger” economies, one is burning less brightly than the rest.

Taiwan is set to lag further behind its three peers -- Singapore, Hong Kong and South Korea -- economies which underwent rapid industrialisation starting around the 1960s, according to data from the International Monetary Fund.

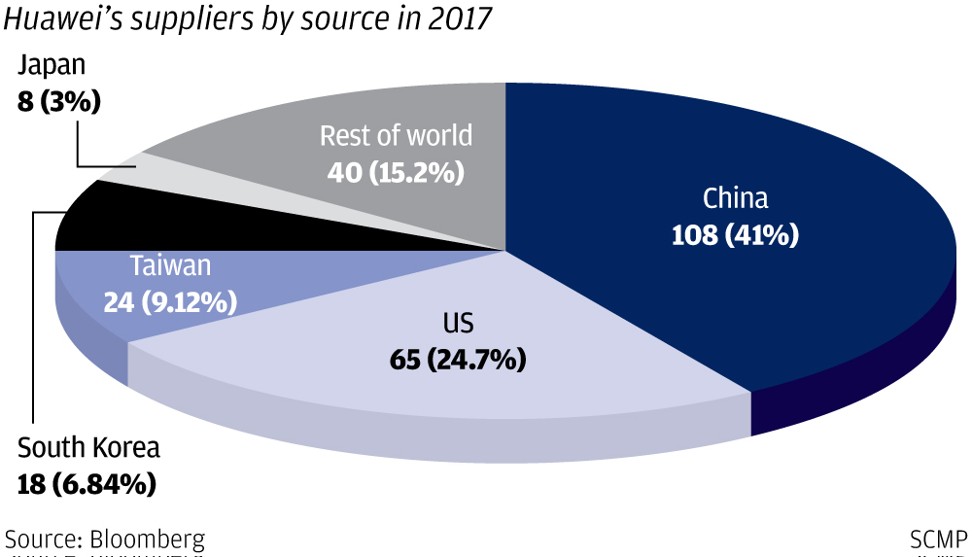

The disparity is clearest when Taiwan is stacked against South Korea, the manufacturing and consumer-electronics powerhouse that’s structurally most similar. Apple’s five largest suppliers are either Taiwanese or Korean.

Taiwan is forecast to have a gross domestic product per-capita this year of US$25,977, which is 26 per cent less than South Korea’s US$32,775. By 2023, when Korea exceeds US$40,000, that gap will widen to 47 per cent, according to IMF projections.

A surge in Taiwanese exports since 2016 has prompted accelerating economic growth, partly a result of the island’s deep integration into the global consumer-electronics supply chain. A continuation of that trend is looking less certain, as the current smartphone product cycle comes to an end and China gets dragged into a trade stand-off with the US

Taiwan is expected to report 3.2 per cent first-quarter growth on Friday, according to economists surveyed by Bloomberg, down from the previous quarter’s 3.28 per cent. For the full year, forecasters see output growth slowing to 2.7 per cent from 2.9 per cent in 2017, and dipping further after that.

What explains Taiwan’s longer-term malaise? A key weakness has been Taiwan Inc.’s inability develop to develop global brands. Meanwhile, Korea has built powerhouses such as Samsung Electronics, Hyundai Motors and LG Electronics Inc.

Taiwan’s best-known companies, led by Taiwan Semiconductor Manufacturing (TSMC) and Hon Hai Precision Industry, have much of their fortunes tied to supplying other companies, led by Apple.

Any hopes HTC would become a household name around the world for its mobile devices came to an end last year when Google bought its main smartphone engineering business.

“The manufacturing sector’s ability to innovate and upgrade to higher value-added sets Taiwan and Korea apart,” DBS Group Holdings’ economist Ma Tieying said via telephone. “This explains why productivity is higher in Korea than in Taiwan.”