Donald Trump postpones decision on metals tariffs for Canada, European Union and Mexico

US President Donald Trump has postponed the imposition of steel and aluminium tariffs on Canada, the European Union and Mexico until June 1, and has reached agreements for permanent exemptions for Argentina, Australia and Brazil, the White House said on Monday.

The decisions came just hours before temporary exemptions from the tariffs on these countries were set to expire at 12:01 am on Tuesday during US East Coast hours.

In a statement, the White House said that the details of the deals with Brazil, Argentina and Australia would be finalised soon, and it did not disclose terms.

A source familiar with the decision said that there would be no further extensions beyond June 1 to stave off tariffs.

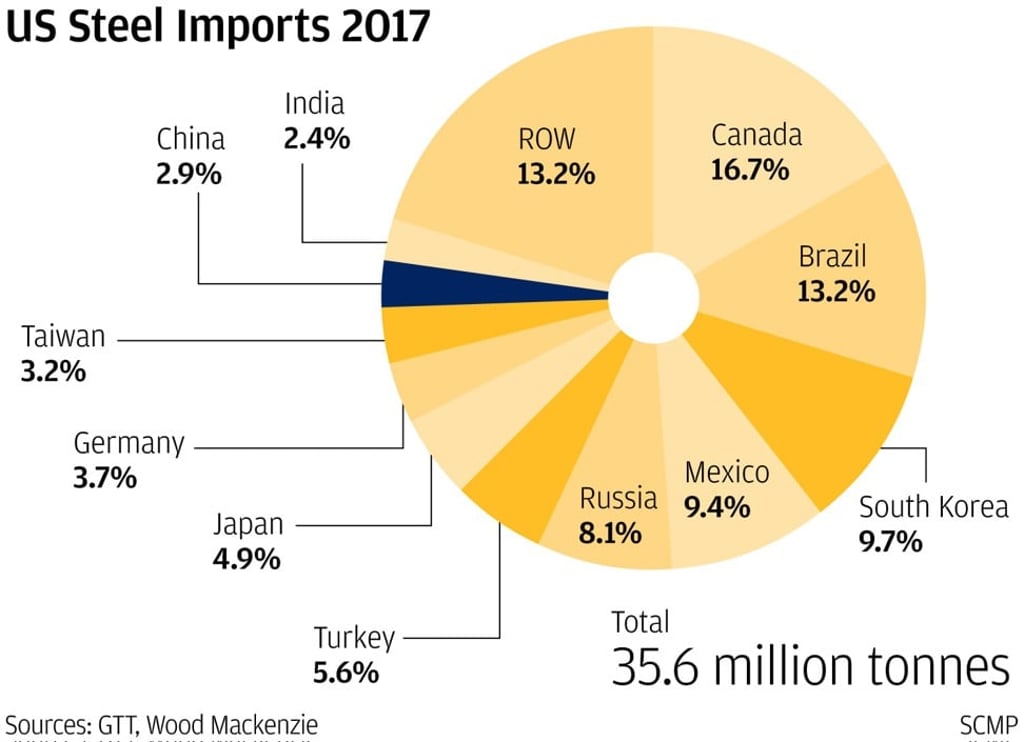

Trump on March 23 imposed a 25 per cent tariff on steel imports and a 10 per cent tariff on aluminium in March, but granted temporary exemptions to Canada, Mexico, Brazil, the EU, Australia and Argentina. He also has granted a permanent exemption on steel tariffs to South Korea.