America’s creditors are fed up with Trump’s squander of US economic growth as he picks fights

Donald Trump is irked about many things – China’s trade policies, Russia-related investigations, critics in the media. Now, add the Federal Reserve to the US president’s fed-up list.

Trump finding a foe in his own Fed head, Jerome Powell, would be dreadful for Asian economies, companies and investors. The spectre of the most powerful leader brawling with the world’s top monetary authority throws yet another imponderable at a region on the ropes.

In 2013, developing markets quaked at the mere prospect of Fed “tapering,” never mind assertive tightening. Back then, Morgan Stanley made a “fragile five” list clumping India and Indonesia together with perennial weak links Brazil, South Africa and Turkey. Now, Asia needs to worry about Fed tussling.

That puts Powell in an impossible situation. Hiking interest rates at the forthcoming policy meeting from July 31 to August 1 could have Trump slamming the Fed on Twitter. Throttling back could increase overheating risks. Either outcome risks denting the dollar’s credibility and driving up US bond yields.

Trump, let’s remember, added to Powell’s stress level with a US$1.5 trillion tax cut, which an economy at full employment didn’t need. What did the former businessman think would happen when he tossed additional financial lighter fluid at a blazing economy?

As Powell sorts things out, Asian markets will be caught in the crossfire. Trump’s escalating trade war is already hitting export-led economies from Japan to Singapore to South Korea. A shaky dollar and gyrating borrowing costs could savage Asia’s equity bourses. Such uncertainty also could throw 2019 corporate planning into disarray.

Will the reserve currency rise 10 per cent by year-end or plunge 10 per cent? Nobody knows, least of all chief financial officers around Asia tasked with deciding whether wages should increase. The virtuous cycle of increased pay and consumption, on which Japan’s Shinzo Abe, Korea’s Moon Jae-in and others are relying, is now in doubt.

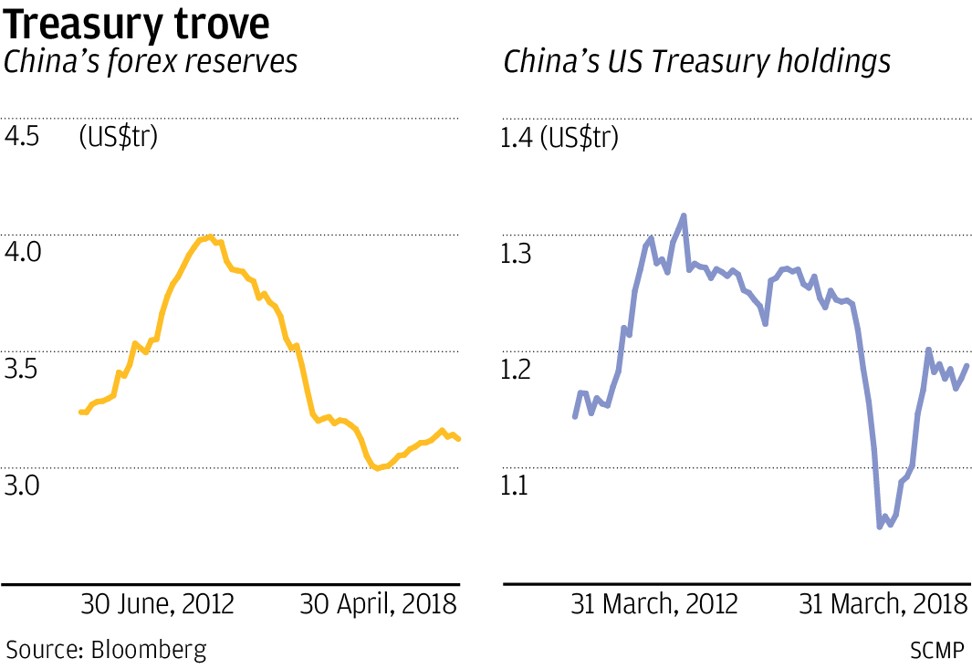

Fiscal authorities face their own hell. Asian governments hold the deed to an economy Trump is mismanaging – more than US$3 trillion of US Treasuries. The spectre of massive fiscal losses will be keeping Trump’s Asian bankers awake at night.

It’s weird that Trump would cosy up to Russia’s Vladimir Putin, whose economy is about the size of South Korea’s, and make a foe out of China’s Xi Jinping, Washington’s top creditor.

On top of the Russia-collusion scandal, Trump might be courting a controversy of meddling in the Fed’s affairs. It might give Asia less confidence to hold trillions of dollars of American IOUs.

The last time a president meddled was in the early 1990s, when George H.W. Bush urged the Alan Greenspan Fed to go easy on rate hikes. Bush would later blame the central bank for his 1992 election loss.

Trump might be trying to head off a similar turn of events come 2020. “I’m not happy about” the Powell Fed hitting the brakes, he told CNBC last week. Trump added: “I don’t like all of this work that goes into doing what we’re doing ... and then I see rates going up.”

Rising US rates are actually a positive sign. They signal the economy is back to normal after post-2008 stimulus, which included a quantitative easing experiment. The Fed wants to raise the benchmark rate once again from today’s 1.75 per cent to 2 per cent target.

With unemployment at 4 per cent, growth zooming along and tax cuts kicking in, how could any serious economist disagree? Trump should hire a couple to explain why the Fed is right to drain liquidity from markets.

In the meantime, the second half of 2018 just became more uncertain. Asia’s leaders, CEOs and investors could be excused for feeling a bit fed up, too.

William Pesek is a Tokyo-based journalist and author. He has written for Bloomberg and Barron’s