The Insider | Insider share buys hint at upside for L’Occitane International, Guangdong Investment and Shun Tak Holdings

Buying rose for the third straight week as 58 companies recorded 329 purchases worth HK$580 million (US$74.29 million)

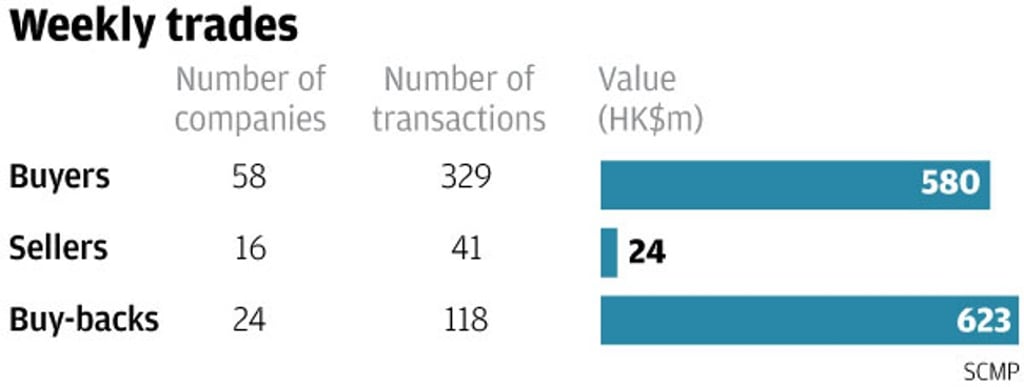

The buying rose for the third straight week while the selling among directors fell based on filings on the Hong Kong stock exchange from November 20 to 24. A total of 58 companies recorded 329 purchases worth HK$580 million (US$74.29 million) versus 16 firms with 41 disposals worth HK$24 million.

Meanwhile, the buy-back activity rose for the second straight week with 24 companies that posted 118 repurchases worth HK$623 million based on filings from November 17 to 23. The number of firms and trades were up from the previous five-day total of 22 companies and 108 repurchases. The value, however, was sharply down from the previous week’s turnover of HK$1.438 billion.

There were several significant purchases last week with buy-backs and purchases by the CEO in L’Occitane International, rare buys by the managing director of Shun Tak Holdings and purchases by BEA chairman David Li Kwok-po in Guangdong Investment.

L’Occitane International chairman and CEO Reinold Geiger added to his stake in the natural and organic cosmetics retailer with a combined 2.597 million shares bought from November 21 to 22 at an average of HK$14.70 each.

In addition, the company picked up where it left off in June with 1.299 million shares bought from November 21 to 22 at HK$14.70 each. The company previously acquired 1.29 million shares from June 13 to 15 at HK$15.85 each and 671,000 shares on January 24 at HK$15.27 each.