Higher interest rates after HKMA intervention stoke property and stock worries

The HKMA has bought up to US$6.5b of the local currency over the past week to shore up the Hong Kong dollar, which hit its lowest level in 35 years

With the gap between the cost of money in Hong Kong and the US closing after the Hong Kong Monetary Authority’s recent intervention to shore up the local currency, the city is bracing for a regime of tighter liquidity and higher interest rates.

For the past three years, even as the HKMA increased its base rate six times in lock step with the US Federal Reserve, local commercial banks have managed to keep lending rates low, thanks to the abundant inflows into the city’s assets.

So much so that some market watchers are worried about the potential impact of higher borrowing costs on the city’s red hot property and equity markets.

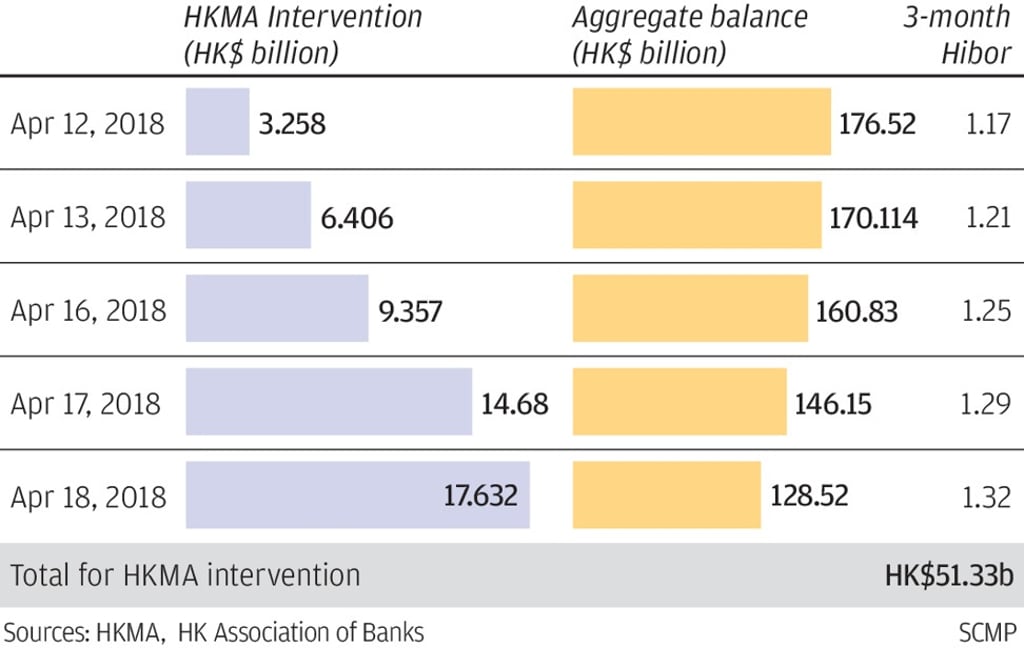

Hong Kong Monetary Authority bought HK$51 billion to stabilise currency

The HKMA has used HK$51 billion (US$6.5 billion) of its US$440 billion in foreign reserves over the past week to purchase the local currency, mopping up cash from the banking system, which could finally compel commercial banks to raise rates to be in sync with their US counterparts.

Higher borrowing costs will translate to higher mortgage repayments for homeowners while other debtors may also need to roll over old debt into higher interest rates that will add on new loans, analysts said. Banks may also shrink lending, which could force investors to liquidate their stock holdings, playing out a domino effect that hit Hong Kong in the Asian financial crisis in 1997 when the overnight Hibor rate soared to 280 per cent.

Hong Kong’s property prices, rising with no sign of letting up, are already among the highest in the world. Property-related lending accounted for 45 per cent of the banking sector’s loans in Hong Kong as of December 2017, according to S&P.

The city’s benchmark Hang Seng Index remains about 9 per cent lower than its all-time record high of 33,484 points hit at the end of January.