Which Hong Kong stocks have skyrocketed during the coronavirus pandemic? Hint: one makes toilet paper

- Makers of toilet paper, respiratory devices are among Hong Kong-listed companies reporting juicy profits – and boy have their share prices soared

- Vincent Medical Holdings has shot up nearly 150 per cent in just over two weeks

People may be staying away from hotels, airlines and luxury toys during Covid-19, but they’re still buying toilet paper – lots of it – explaining why Vinda International Holdings is one of the lucky few Hong Kong-listed companies reporting surging profits.

Others besides Vinda that have recently issued so-called “profit alerts” include makers of respiratory devices and cleaning products as well as a game developer. Unlike the endless stream of companies warning of expected profit losses usually blamed on the pandemic, these companies recently told investors to expect excellent news ahead. One – Vincent Medical Holdings – has shot up nearly 150 per cent in just over two weeks.

“The coronavirus hasn’t been all bad for businesses,” said Gordon Tsui Luen-on, managing director of Hong Kong-based brokerage Hantec Pacific. “Some companies have been boosted by the pandemic, particularly those manufacturing personal hygiene, cleaning and medical products that have seen a real need during these times.”

That tendency to stockpile has been a boon for a company like Vinda, China’s largest producer of tissue and toilet paper. It announced it expects a whopping 107.5 per cent increase in net profit to HK$913 million (US$117.8 million) for the six months ending June 30 compared to the same period last year, according to the company’s interim results announced on Friday.

03:58

Coronavirus fears spark toilet paper panic buying around the world

Its brands of toilet paper, tissues and other products include Vinda, Tempo, Libresse and Dryper for babies. It has shot up 115 per cent this year. That is more than some high-flying new economy stocks, such as Tencent, China’s social media and online games giant, which has gained 39 per cent this year.

Vinda issued a positive profit alert on Monday, before confirming it in a filing of its results in the first half of the year on Friday.

“The group achieved remarkable revenue growth thanks to the continuous portfolio mix enhancement and low pulp price,” chief executive Christoph Michalski said on Friday.

He added that the pandemic has heightened consumers’ hygiene awareness and changed their habits, which they expected would benefit their premium household paper and personal care products going forward.

Analysts tracked by Bloomberg love the stock, with 14 rating it a “buy”, two a “hold” and none a “sell,” and its most bullish call predicting it will rise to HK$45.30 over the coming 12 months.

Others are also soaring in a world shaken and shaped by the coronavirus.

01:08

Elderly people help themselves to toilet paper at public washroom in China

Take for instance China Sanjiang Fine Chemicals, which produces the ingredients needed to make household cleaning products. It said in a recent profit alert that it expects a net profit of more than 350 million yuan for the six months ending June, an eye-popping increase of 1,000 per cent from the same period last year.

The company’s share price has jumped nearly 68 per cent over the past six weeks, and shot up nearly 22 per cent on Monday.

Meanwhile, medical device manufacturer Vincent Medical Holdings expects to post a net profit of at least HK$80 million for the six months ending June 30, up more than 480 per cent from HK$13.7 million for the same period last year.

The company said it saw a “significant increase in sales of respiratory devices and disposables during the Covid-19 pandemic and growth in demand for the 02FLO respiratory unit and the humidification system”, in a positive profit alert filing this week.

The stock has shot up nearly 150 per cent in just over two weeks. It has gained nearly 350 per cent in 2020.

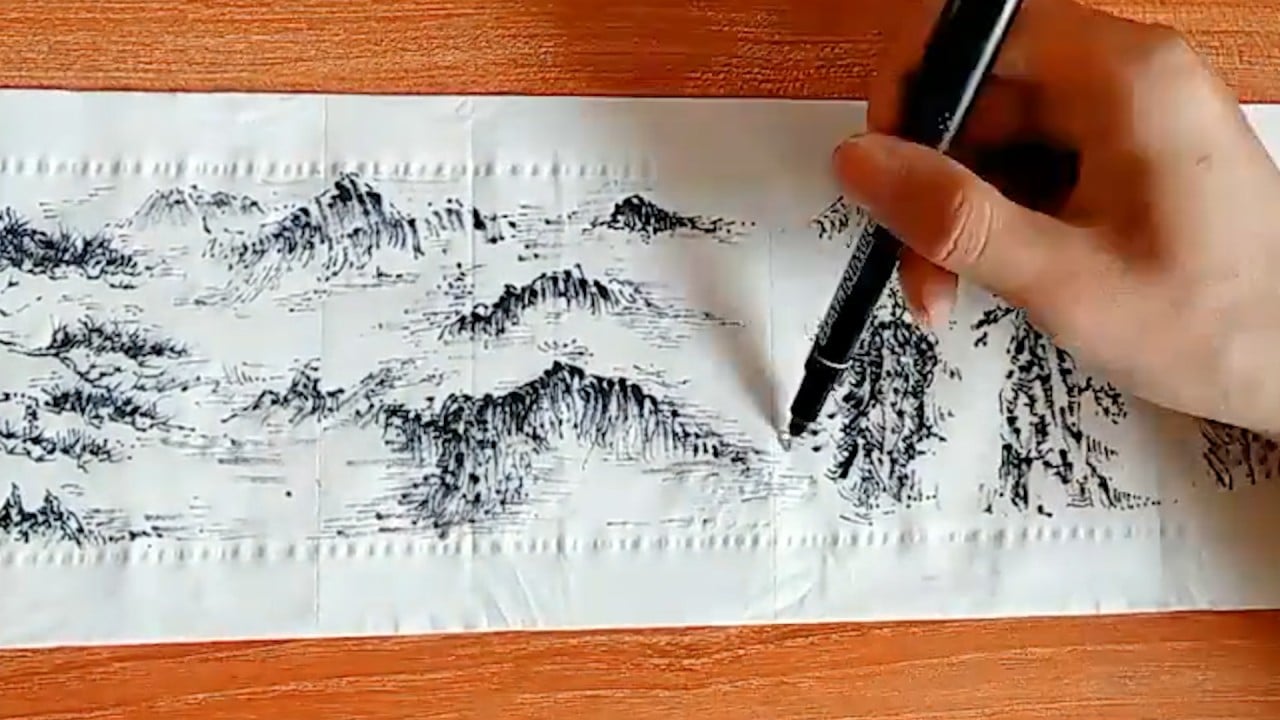

01:22

Beautiful Chinese paintings … on toilet paper

Others thriving during the outbreak include online service and home entertainment providers, analysts said.

“The real economy has taken a huge hit from the coronavirus. But on the other hand, online shopping has seen a huge surge amid Covid-19, benefiting online service providers,” said Hantec’s Tsui.

IT services provider Digital China Holdings, which focuses on big data, IOT – the internet of things – and artificial intelligence, expects its net profits will be HK$200 million for the six months ending June – 757 times more than the HK$264,000 in the same period in 2019.

In its positive profit alert, the company said its smart supply chain business has benefited from the surge in e-commerce in China due to increased online shopping.

Its share price shot up nearly 28 per cent in less than two weeks.

Companies that provide home entertainment for those who have to spend more time indoors, including mobile game developers, have gotten a boost, said Louis Tse Ming-kwong, managing director of VC Asset Management.

These include mobile game developer Zengame Technology, which recently announced it expects its net profit will have increased by 80 per cent for six months ending June 30.

Shandong Gold Mining, one of China’s largest miners of the precious ore, said it expects an increase in net profits from 80 per cent to 110 per cent, or 1 billion yuan to 1.25 billion yuan, for the six months ending June compared to the same period last year.

The increase was “mainly attributable to factors including significant increase in the global price of gold since 2020 due to global economic downturn and global quantitative easing and risk aversion,” the company said in a positive profit alert filed on the stock exchange on Tuesday.

The company added they had “seized the opportunities of the increase in gold prices and made sales of gold at appropriate time”.

The share price of the gold mining company has risen 75 per cent since mid-March. According to analysts surveyed by Bloomberg, five rate the stock a ‘buy,’ one “hold” and “zero” sell, with the highest target price was HK$21.53 by brokerage UOB Kay Hian.

“You never know. You can still find some survivors [out there],” VC Asset’s Tse said.

Additional reporting by Deb Price