Hong Kong IPO market outlook bright in 2023 as listing reforms to attract tech, international firms, analysts say

- Tech listing reforms and a push to attract international firms will draw more IPOs to Hong Kong in 2023, UBS banker says

- Analysts are optimistic that Hong Kong could move up on the IPO fundraising charts in 2023 after clinging to its No 3 rank last year

Hong Kong’s biggest listing reform in five years targeting technology companies is likely to help the city reclaim the crown as the world’s top fundraising market, according to industry watchers.

Five types of tech firms, such as those in cloud computing, artificial intelligence as well advanced hardware like electric and autonomous vehicles, semiconductors and metaverse, could qualify under the new requirements.

“The new Big Tech listing regime under Chapter 18C will be the catalyst that boosts Hong Kong as a listing revenue for technology companies,” said John Lee Chen-kwok, the Hong Kong-based vice-chairman and head of Greater China global banking at UBS.

“The new reform plan, which can meet the fundraising needs of many of these large technology companies, is expected to repeat the success of the 2018 listing reform that has attracted companies with multiple voting rights and pre-revenue biotechnology firms to list in Hong Kong.”

Hong Kong to be among top three IPO hubs in 2023 with US$26 billion in deals

The number of IPOs by overseas companies in Hong Kong plummeted from a record high of 24 in 2018 and 21 in 2019 to only one in 2021 and two in 2022, according to data from accounting firm EY.

Hong Kong’s IPO market saw a moderate turnaround in the second half of 2022 after a dry spell in the first half. After five companies debuted on December 30 – the last trading day of 2022 – Lee expects the onslaught to continue in 2023.

While 2022 was a difficult year for the IPO market because of the interest-rate rises and market volatility, the outlook for 2023 is more optimistic as interest rates are expected to stabilise, he said.

“More importantly, with China announcing the reopening of the border from January 8, market activity will return to normal. We can expect more large IPO deals in 2023.”

Lee expects electric vehicles and related ecosystem to be among the major IPO candidates.

Hong Kong, which has been the world’s largest IPO market seven times in the past 14 years, retained the third rank in 2022 after languishing in 10th place in June. A total of 75 new listings raised US$12.69 billion, according to Refinitiv. However, fundraising slumped 70.5 per cent year on year in 2022.

“We are optimistic that Hong Kong could strive for the top three [ranking] in the world in terms of IPO fundraising in 2023,” said Edward Au, the southern region managing partner at Deloitte.

Deloitte expects some 110 firms to raise around HK$230 billion, backed by factors such as a slowdown in US interest rate increases and the reopening of the Hong Kong-China border, Au said.

“Hong Kong’s road map of being an international innovation and technology hub, which is part of China’s 14th five-year plan, will increase Hong Kong’s competitiveness in the long run, albeit we expect only a handful of such listings in 2023,” he said.

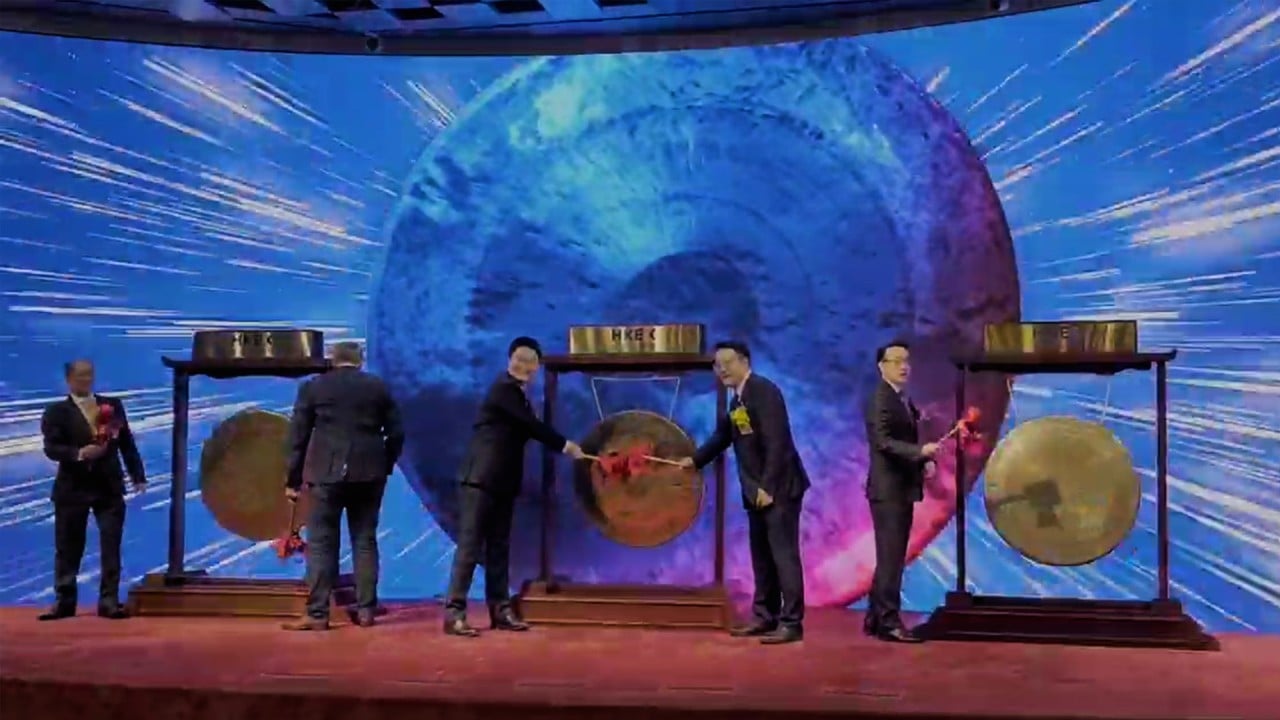

HKEX ends 2022 with its busiest listing day in 30 months as IPOs return

The proposed tech listing reform will expand the range of companies that can assess Hong Kong’s capital market and offer a wider choice for investors, Au said.

He also said the inclusion of international companies with a primary listing in Hong Kong in the Stock Connect schemes would be an “absolute game changer that would enhance the city’s super-connector position and strengthen its appeal for international listings”.

Hong Kong will face competition from the US and mainland China to fight for specialist tech firms to list, according to Victoria Lloyd, partner in Baker McKenzie’s capital markets practice in Hong Kong.

“Whether the specialist tech companies will come to Hong Kong to list will depend on how the final Chapter 18C rules shape out,” she said.

“Right now, the market capitalisation threshold is set higher than other securities markets, in particular mainland China and the US, which could be a deterrent especially when many of these companies have lost much of their valuation in the last two years.”

.jpg?itok=zSWXqQCw)