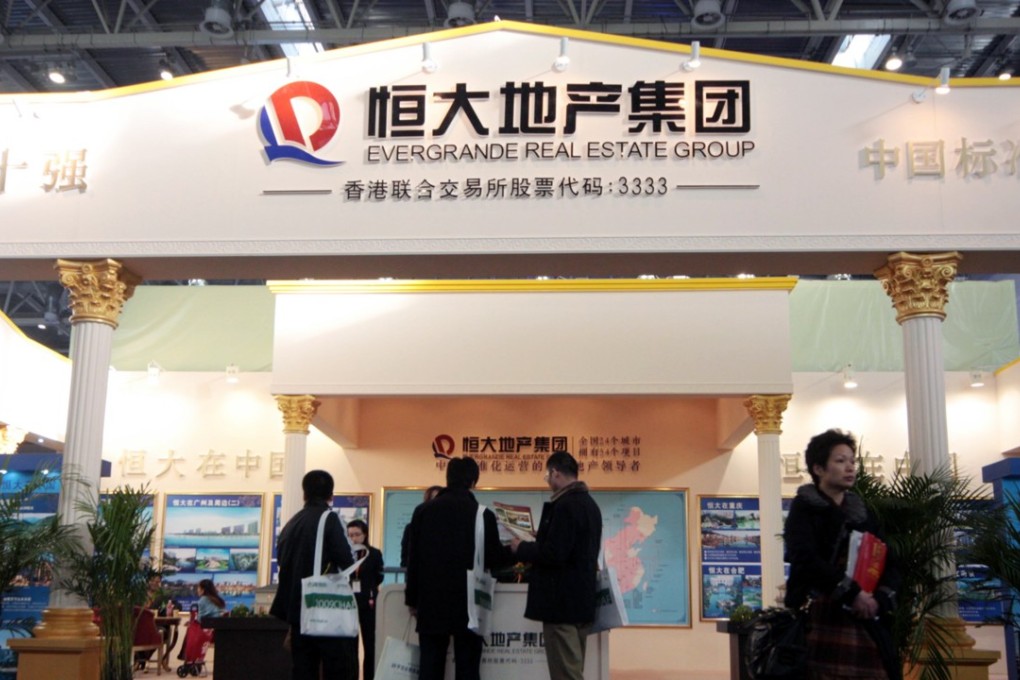

Top developer China Evergrande seeks US$2.9b from convertible perpetual securities issue

China’s largest property developer looks to refinance existing debts from the proceeds raised

China Evergrande Group, the mainland’s largest property developer by sales, is raising HK$23 billion (US$2.96 billion) from convertible perpetual securities at an indicative range of 3-4 per cent per year, according to terms seen by the South China Morning Post.

China Evergrande, which is based in Guangzhou in the southern Guangdong province, plans to use to the proceeds for refinancing existing debts and general corporate purposes, according to the preliminary term sheet.

The company has said previously that it plans to list its property arm Hengda Real Estate on the Shenzhen Stock Exchange.

The timetable for the spin-off and separate listing is not known, but the developer has been focused on reducing debt ahead of the planned listing, which at the time of its interim results announcement in June showed a debt ratio of 240 per cent. It hopes to reduce that to 70 per cent by June 2020.

Pricing of the securities is expected on Wednesday, according to sources close to the deal.

The latest issue will be China Evergrande’s second convertible perpetual securities issuance after it had raised US$1.5 billion in December 2015 at a much higher coupon rate of 9.5 per cent.