Mr. Shangkong | Will Beijing really be the last rescuer for everyone in the stock market?

Many Chinese investors have a planned economy mindset, believing government should help them

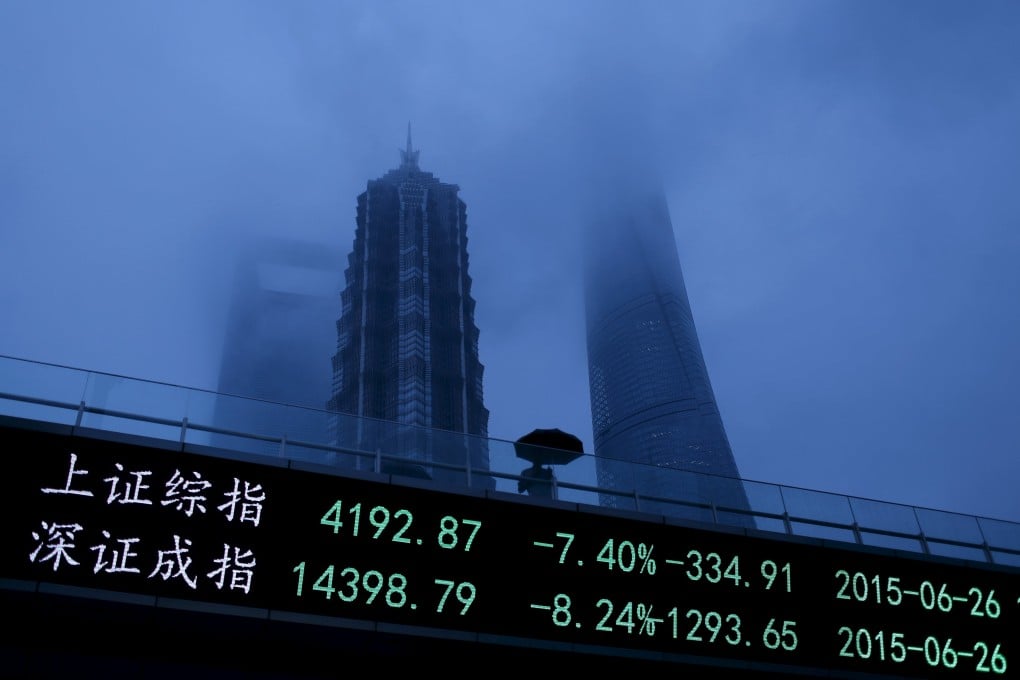

The most dangerous idea gaining traction in the Chinese stock market is the naïve consensus among ordinary investors that no matter how bad the market gets, the Communist Party will eventually rescue everyone.

The central bank surprised everyone with its announcement on Saturday that it will cut its benchmark deposit and lending rates by 25 basis points - the fourth reduction since November.

Meanwhile, it also decided to reduce the reserve requirement ratio at selected banks to further ease liquidity in the banking system.

The unusual "double cut" move came just 24 hours after more than US$760 billion was wiped off the value of mainland stocks - equivalent to the market capitalisation of US technology giant Apple. The reasons for the market crash are complicated, including margin calls, tight liquidity at the end of the month, and panic. Afterwards, the most frequently heard question was, what will the government do to rescue the market. Rescue? Is this really government's responsibility?

China has been through the planned economy model for decades. This is especially ingrained in the generation of my parents, who make up the bulk of individual investors. Just as everything once belonged to the government, many of these people believe the stock market should also belong to the government. So it's the job of the government - in other words, the Communist Party - to rescue the market.

Unfortunately, many Chinese experts and professors are also promoting this naïve view of the relationship between domestic investors and the government.