New | Fed official sees gradual US rate hikes, downplays timing

The Federal Reserve will probably only gradually raise interest rates, irrespective of whether it decides to take the first step a few months earlier or later, a top US central banker said on Tuesday.

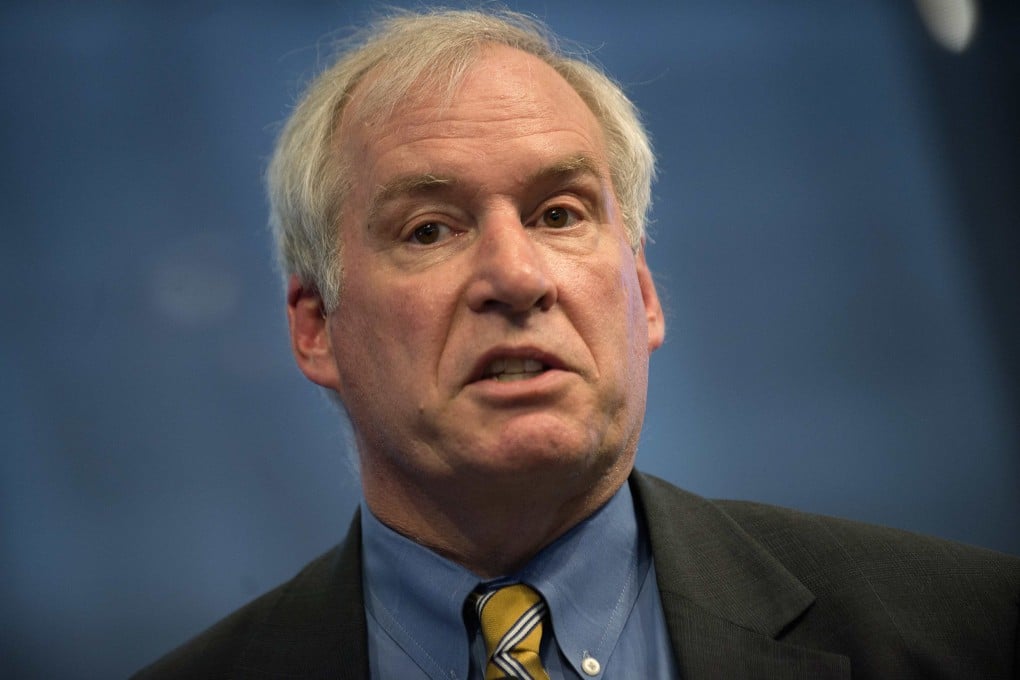

The dovish president of the Boston Fed, Eric Rosengren, said a more modest policy tightening cycle than in the past is appropriate because of low inflation and threats to US economic growth.

Dodging the question of whether he would prefer to start hiking rates at a September 16-17 policy meeting, Rosengren, who does not have a vote on the Fed’s policy committee until next year, said US inflation could come under yet more pressure if the economies of China, Japan, and the euro zone slow down, and if recent market turmoil persists.

"There are very good reasons to expect a much more gradual normalisation process than occurred in the previous two tightening cycles," he said of pending rate hikes, adding, "this more modest tightening path is both necessary and appropriate."

Rosengren downplayed the timing of so-called liftoff, saying it makes little economic difference whether it is moved "forward or backward by a couple of months."

A recent stock market selloff, which accelerated on Tuesday, was sparked by fears of slower Chinese growth, which could keep US inflation below target. The turmoil has given some Fed officials pause, and prompted investors to cut their predictions of a September US rate hike to about 32 per cent.