Investors concerned by conflicts of interest over Malaysia’s stock market rescue plan

Investors concerned by conflicts of interest over fund to buy undervalued shares

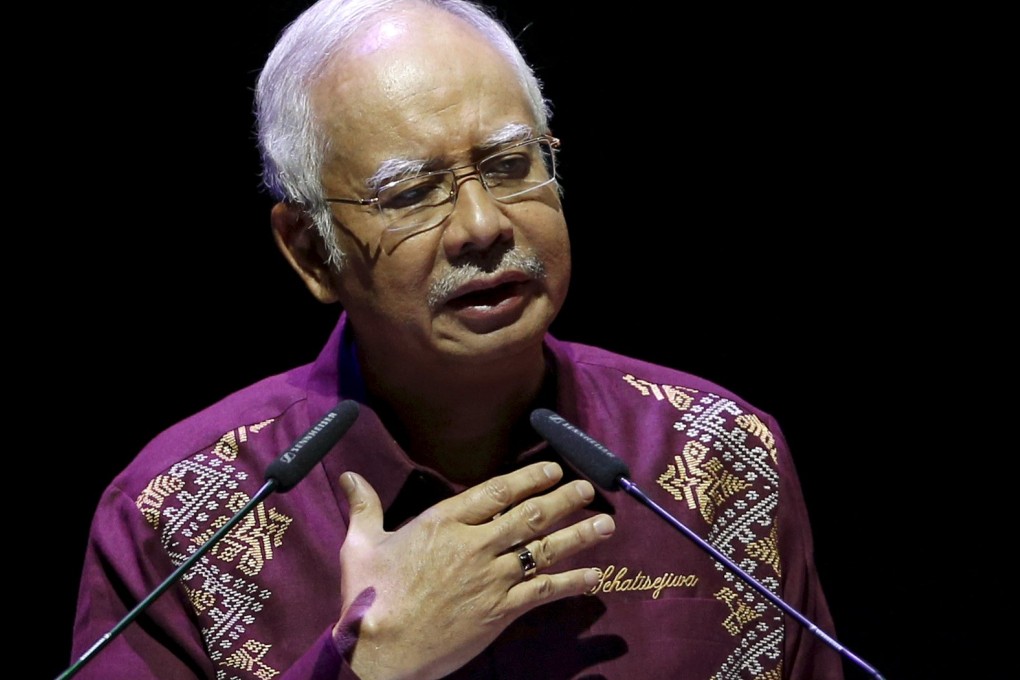

Investors have voiced doubts over potential conflicts of interest posed by Malaysia’s plan for an equity fund to buy “undervalued” shares, reflecting their growing unease as a scandal over an indebted state fund engulfs Malaysian Prime Minister Najib Razak.

Last week, Najib announced measures to support the economy. Chief among them was a plan to infuse 20 billion ringgit into a defunct equity fund called ValueCap so that it can buy underperforming shares.

Analysts and investors have raised questions over the plan.

“Why is the government intervening into the private sector?” said Tricia Yeoh, chief operating officer of Malaysian think tank IDEAS. “How is the government planning to identify which companies are undervalued versus those that are sufficiently-valued?”

Malaysians are still awaiting answers to questions thrown up by investigations into allegations of financial mismanagement and graft at state fund 1Malaysia Development, whose advisory board is chaired by Najib.

On Tuesday, the government’s special economic committee sought to dispel some of the scepticism over ValueCap.