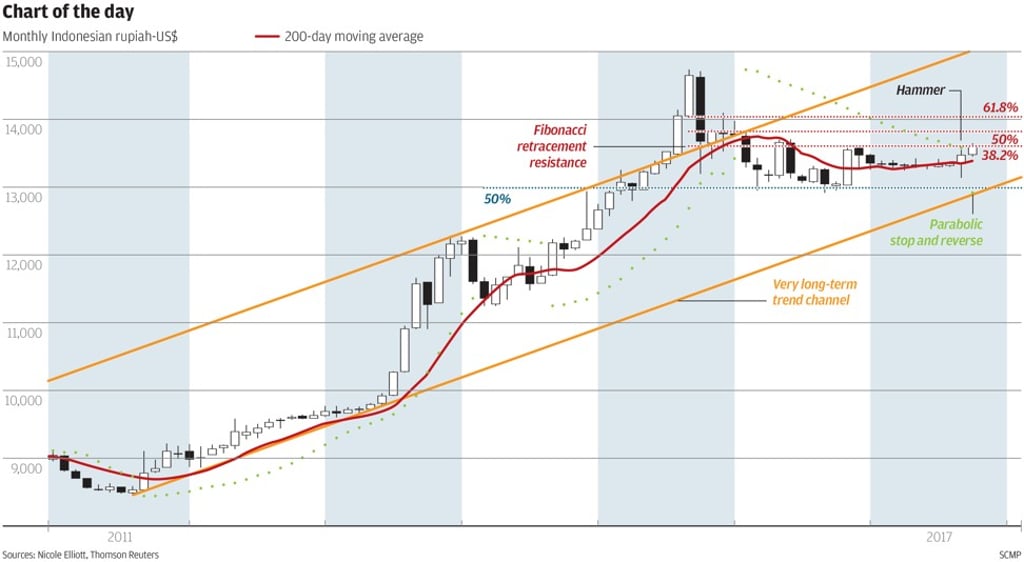

On October 19, Bank Indonesia kept its key seven-day reverse repurchase rate unchanged at 4.25 per cent following two consecutive 25-basis-point cuts in August and September. What is interesting is that standing pat has caused an acceleration in recent rupiah weakness against the US dollar. Volume and observed volatility have increased as the exchange rate pulls away from its 200-day moving average at 13,370. On Friday, we closed exactly on Fibonacci retracement resistance at 13,600, triggering a buy signal in the parabolic stop-and-reverse indicator. A break higher is possible this week as September’s hammer candle has added bullish momentum for the US dollar, as would a break above the May and June highs at 13,700.

Nicole Elliott is a technical analyst