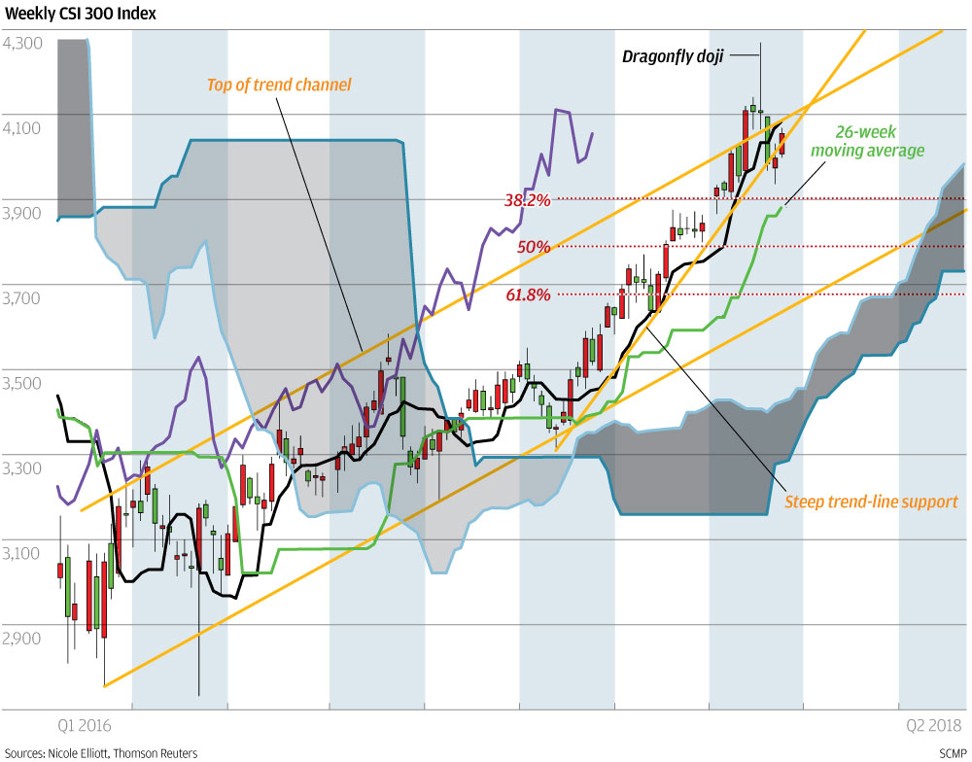

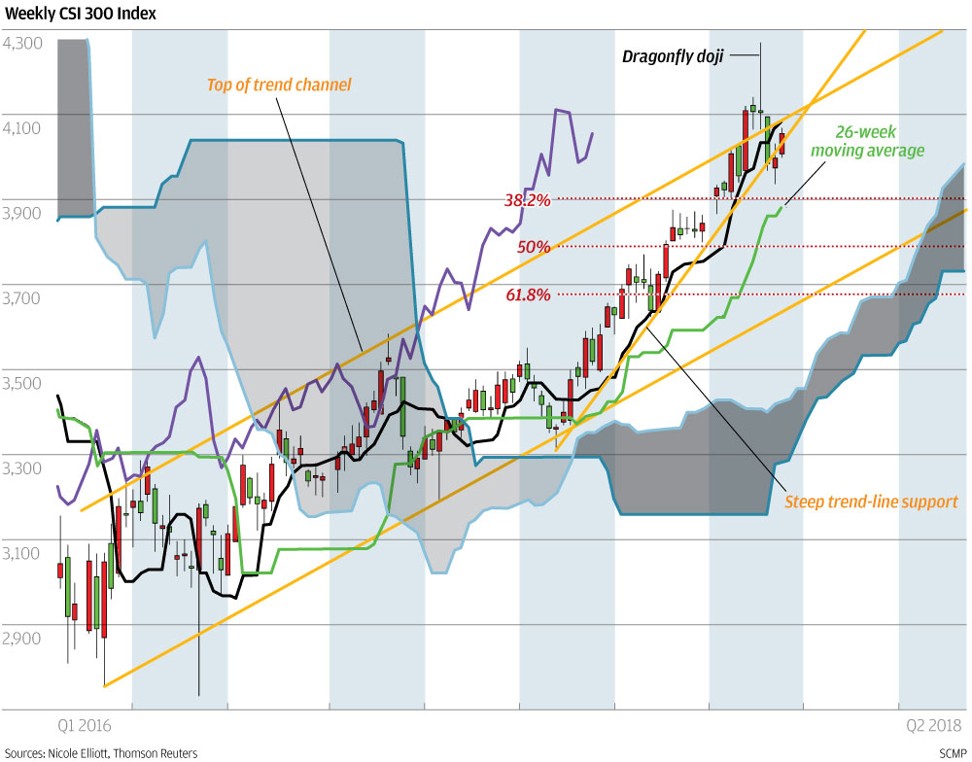

The CSI 300 Index, which tracks the top 300 shares on the Shanghai and Shenzhen exchanges, burst above the top of the long-term trend channel in late November. The surge culminated in a large dragonfly doji, a well-known candlestick pattern that denotes instability, and an overbought RSI. The subsequent pullback has brought the market back inside the channel and it is currently clinging to the very steep upward trend line. Coupled with good volume this month, it suggests this market still has more bullish momentum than might be expected. If it can hold above the 26-week moving average (currently at 3,882 points), the index is on track to hit our second target at 4,400 points around the end of this year.