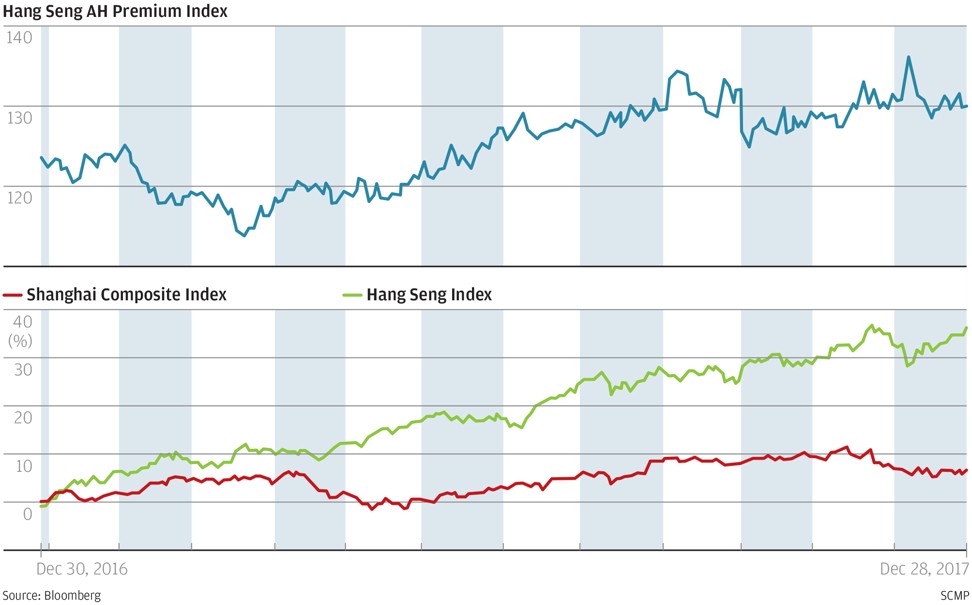

Chart of the day: Widening price differentials

Even a 36 per cent rally in Hong Kong’s Hang Seng Index this year has failed to narrow the price gap of the Chinese companies that trade both in the city and China. The Hang Seng AH Premium Index finished at 129.88 on Thursday, compared with its last close of 122.35 in 2016. That means China-traded shares are now almost 30 per cent more expensive than their Hong Kong-listed counterparts. One reason might be that dual-listed companies are lagging Chinese firms while companies only listed in Hong Kong such as Geely Automobile Holdings and Tencent Holdings are the leading annual gainers on the Hang Seng Index. Among dual-listed firms, Anhui Conch Cement is the only one whose mainland-listed equities are cheaper than their Hong Kong peers. Luoyang Glass has the widest premium, with the domestic equities almost six times as expensive as the Hong Kong stock.