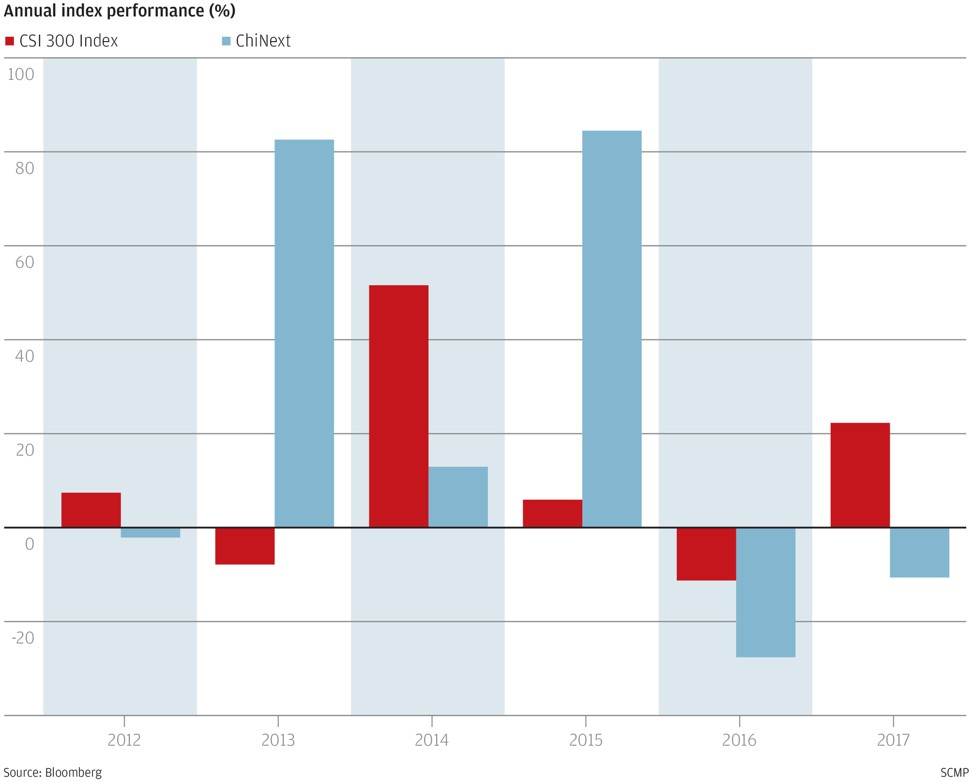

Chart of the day: Year of the big-caps in China

It was a stellar year for China’s big-cap shares in 2017. The CSI 300 Index of large companies ended the year with a gain of 22 per cent, beating the ChiNext gauge of smaller firms by 32 percentage points and marking the second-biggest margin on record the large-caps have had over their smaller peers. It was also the widest lead the CSI 300 has had over the ChiNext since 2014. Over the past year, financial deleveraging has prompted buying rotation out of small-caps into bigger companies as traders sought safe assets with low valuations and a secure earnings outlook. However, Hong Hao, a Hong Kong-based managing director at Bocom International, said big-caps would probably lose their lead over small ones in 2018 as the rally of the past year had made their valuations increasingly less attractive.