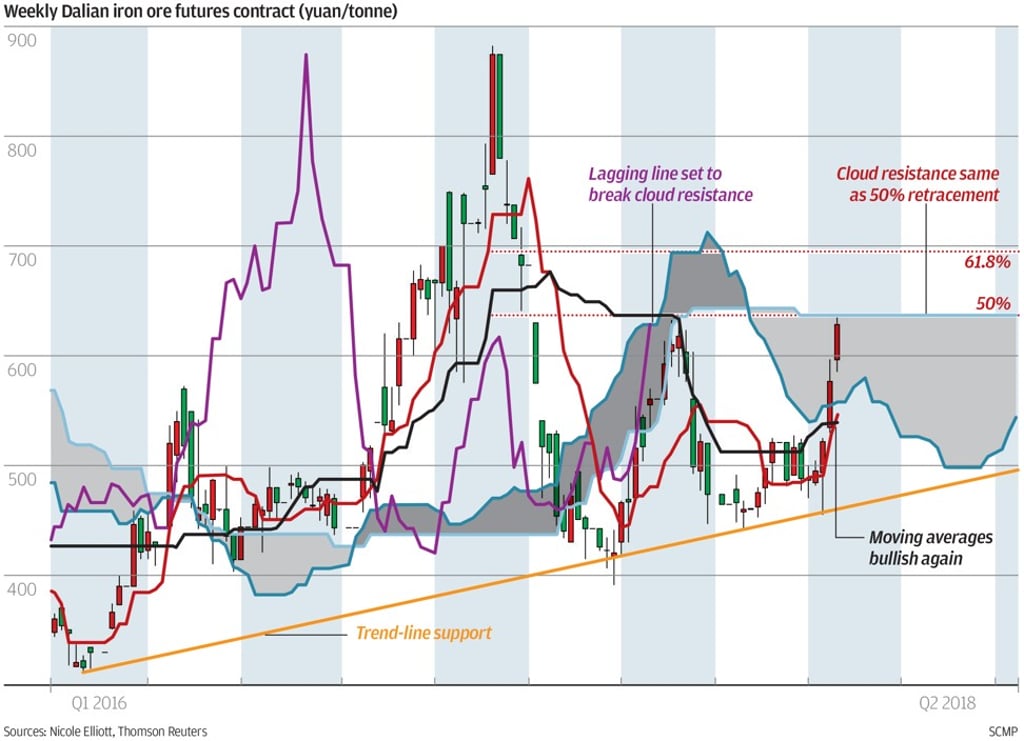

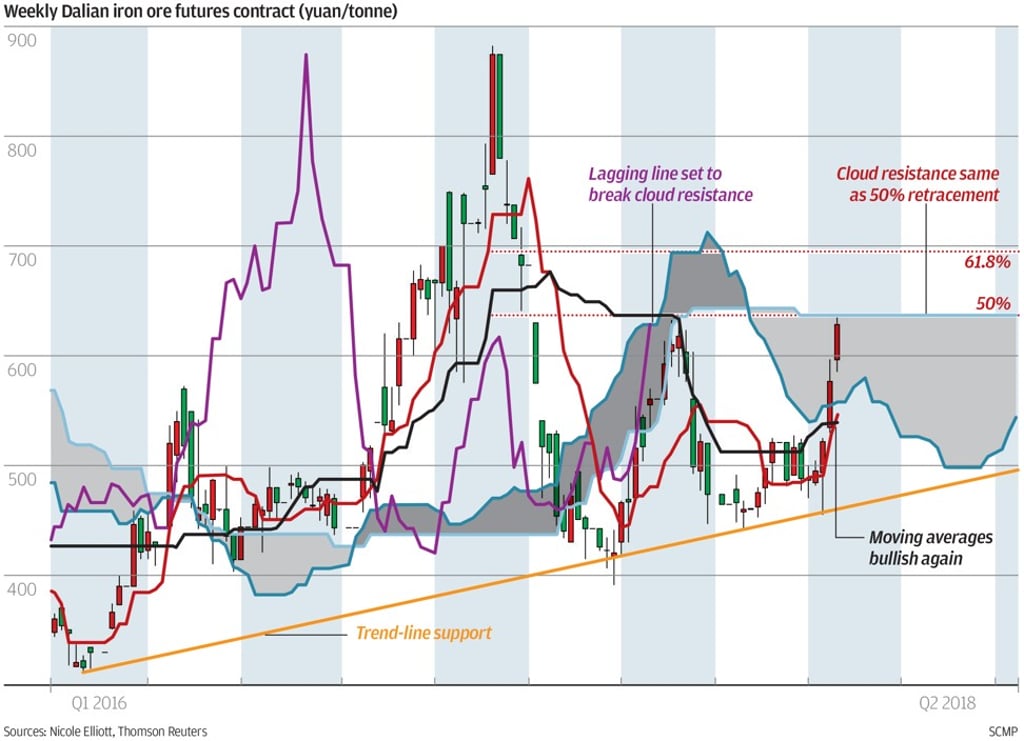

Since the second quarter of 2017, Dalian iron ore futures prices have been held in a vice-like grip, stuck between 50 per cent retracement resistance (and now the top of the weekly Ichimoku cloud) and trend-line support. January’s three consecutive red weekly candles, known as the “three white soldiers” candle pattern, have turned momentum bullish at last. Observed volatility has picked up, too, suggesting a break higher is imminent, helped by the bullish golden cross of the 50- and 200-day moving averages last week as well as the nine- and 26-week ones. A weekly close above 637 yuan (US$101) per tonne will probably lead to another surge of the size and speed we saw in late 2016 and early 2017. Our new target is now about 840 yuan.