Foreign investors snap up battered Chinese stocks as trade war fears persist among local traders

Overseas buying hits US$4.3 billion in past three weeks

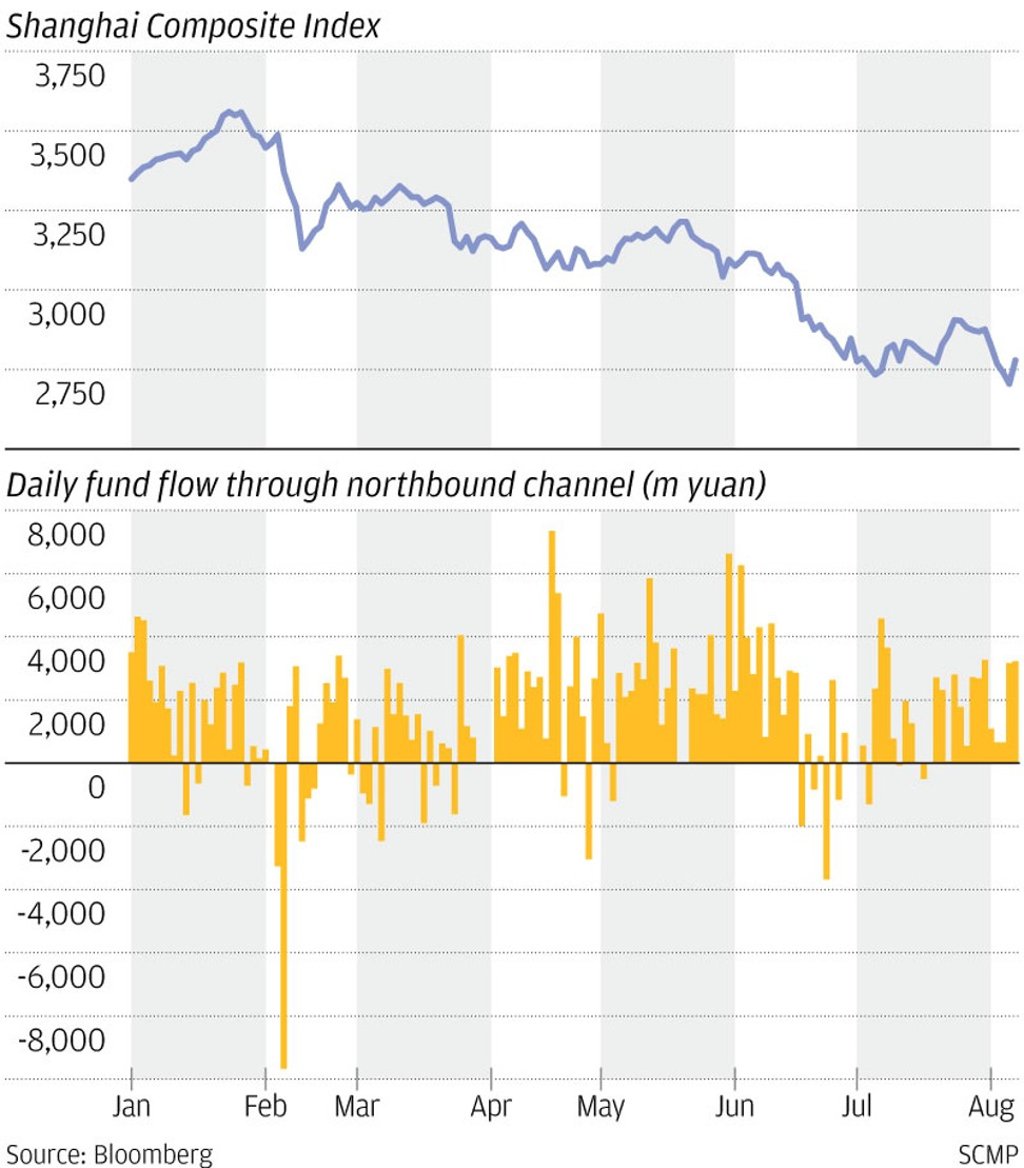

The turbulence on China’s stock markets, currently the world’s worst-performing, has done little to scare off overseas investors who have been net buyers of equities on the mainland’s exchanges every day for the past three weeks through the exchange links, or Stock Connects, with Hong Kong.

Overseas buying totalled 29.4 billion yuan (US$4.3 billion) during the period, according to Bloomberg data.

The active buying stands in sharp contrast with the sell-off by local traders, who remain worried that a trade dispute with the US and financial deleveraging will erode corporate earnings.

The benchmark Shanghai Composite Index (SCI) remains down 17 per cent this year, slipping very much into what is considered bear market territory.

Selling by Chinese investors has failed to slow even after top government leaders pledged more spending on infrastructure projects and fine-tuned monetary policies in a shift last month to put a floor on economic growth.

The SCI slid to its lowest level in 29 months on Friday.