US stocks, so far impervious to trade war, face tipping point as tariff pain deepens, analysts say

Investors have repeatedly shrugged off the trade dispute and pushed markets to new highs, but warnings of risks and uncertainty are growing

The latest round of US tariffs on another US$200 billion of Chinese imports took effect on Monday, making it the biggest so far. But instead of US stocks reeling amid the spiralling trade war, the S&P 500 Index has held up.

That market strength has given US President Donald Trump support to remain tough in the escalating dispute without facing a domestic backlash from investors. But analysts believe the stock market is at an inflection point if the trade war between the world's two largest economies continues to deepen.

The markets keep hitting new highs because the US tariffs against China are “largely viewed as a tactic – that the president was trying to be strong”, said Michelle Girard, chief US economist at NatWest Markets, the investment banking arm of the Royal Bank of Scotland, said recently at Yahoo Finance's All Market Summit. “People expect to see some agreements so that the worst-case scenario will be avoided.”

Watch: Trump slaps China with tariffs on US$200 billion more of goods

But a near-term resolution looks increasingly unlikely, as Beijing has retaliated with its own tariffs on US$60 billion worth of US goods and called off scheduled talks. And a breakdown in negotiations is likely a precursor for further escalation.

“If China takes retaliatory action against our farmers or other industries, we will immediately pursue phase three, which is tariffs on approximately US$267 billion of additional imports,” Trump said in a statement last week.

The next batch of tariffs, analysts say, will probably bring an end to the run-up in US equities.

Until this round, the US had made adjustments, amid resistance from multiple industries, to minimise the tariffs’ impact on consumers. The latest duties include 10 per cent tariffs on US$200 billion worth of Chinese goods such as furniture, appliances and lamps.

But it excluded many consumer goods, from baby products to smartphones. The administration has also left room for negotiations before the rate goes up to 25 per cent at the start of 2019.

“Today I don't think anything that has happened deters me from an optimistic outlook for the rest of this year or into 2019,” Girard said. “What has been announced to date won't have material impact on growth. But if the tariffs go into 25 per cent next year, then it will become more significant.”

So far, investors have repeatedly shrugged off the trade dispute and pushed the US equity markets to new highs. There was an initial quick drop when Trump threatened China with tariffs in mid-June, but the S&P 500 has since risen more than 13 per cent, to above 2,900 when trading began on Tuesday.

This is against the backdrop of a US economy that is doing remarkably well across the board. Initial jobless claims have dropped to their lowest level since 1969. US corporations reported stronger earnings growth across sectors in the second quarter compared with a year ago.

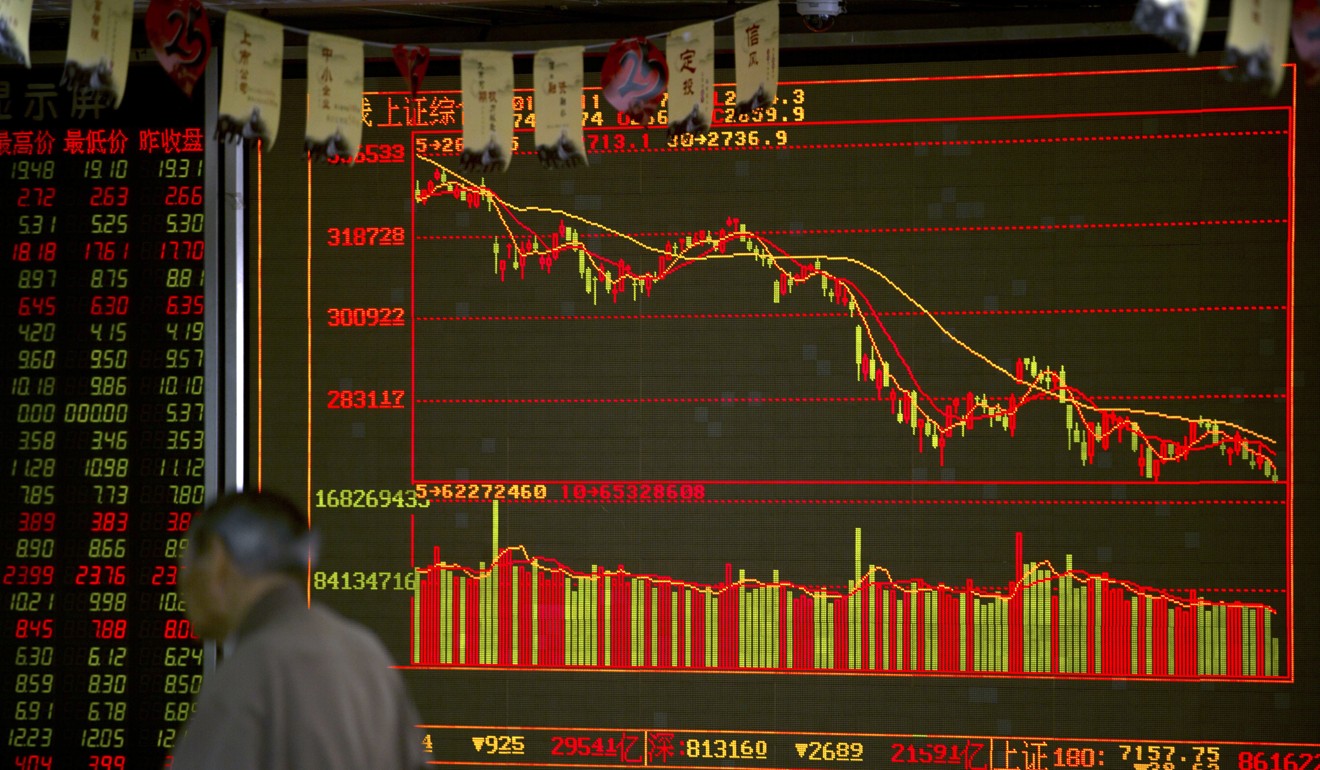

China, on the other hand, saw its Shanghai Composite Index lose 15 per cent in the same period.

BlackRock, the world's largest asset manager, said in a note on Monday that the US was experiencing “unmatched earnings momentum”.

“Corporate tax cuts and fiscal stimulus underpin our positive view,” analysts led by Richard Turnill, BlackRock’s global chief investment strategist, wrote. But they also cited “rising uncertainty around the outlook”, referring to risks that included the prolonged trade war.

And the expectation that no quick resolution is in sight increases the likelihood of a downturn in US stocks.

Watch: Escalating US-China trade war makes European firms nervous

“One or two negotiations won't do the trick,” said Yong Ma, executive vice-president at Bank of China New York. “I am hopeful for a deal. But like a lot of things in life, the timing is important because a deal can only be struck when people realise how painful it is.”

Trump has said the tariffs are necessary to battle China’s requirement that American companies hand over technology in exchange for market access.

“It's a balancing act,” Ma said. “China wants part of the tech advancement as well.”

According to Girard: “This administration is playing a longer game that this is the time to address a long-standing situation of unfair trade practices such as intellectual property. This administration is hoping to push through some difficult times even if in the short term it might hurt the stock market.

“But in the longer run, the hope is we get to a better place for both countries.”