Smart money shuns China stocks as foreign and leveraged traders wary of state bailout

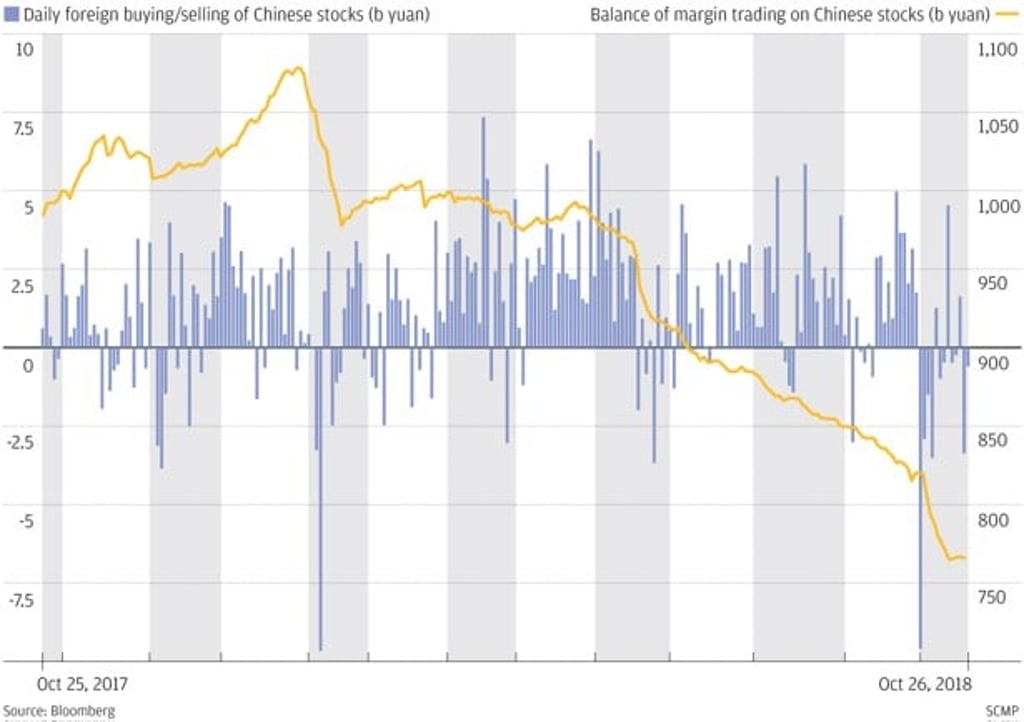

- Foreign investors record net selling of Chinese equities via exchange links last week

- Stock holdings of leveraged traders languish close to lowest level in four years

Smart money is steering clear of Chinese stocks, putting into question whether the efforts by top policymakers to shore up the world’s worst-performing equity market this year will find traction.

Foreign investors this week were net sellers of Chinese shares through the connect programmes, while stock holdings by leveraged traders lingered around a four-year low. The tepid responses highlight the challenges facing Chinese regulators to lure investors back to the stock market after they unveiled a deluge of measures to arrest declines earlier this month.

Chinese stocks have stabilised after sharp decline early last week, but the relative calm is at risk of faltering any time with the benchmark Shanghai Composite Index falling again on Friday.

The gauge had fallen by 21 per cent as of Friday’s close, having touched a four-year low in early October, and is now in what’s known as a bear market. Confidence has been roiled by an escalating trade war with the US, intensified surveillance of shadow banking and a worsening liquidity crunch among smaller companies.