Chinese semiconductor stocks extend gains while liquor makers suffer sell-off on safety, valuation concerns

- A gauge of 117 semiconductor stocks jumps 4.3 per cent

- Market looking for new growth engines as traditional sectors decline, analyst says

China stocks fluctuated before ending mostly higher on Wednesday, with chip makers extending a two-day rally on renewed optimism over state fund support, while liquor makers weakened on concerns over food safety and high valuation.

The Shanghai Composite Index closed almost unchanged at 2,981.88, after swinging between gains and losses throughout the trading day. The more tech-heavy Shenzhen Component Index added 0.4 per cent, while the ChiNext Index of start-ups gained 0.8 per cent.

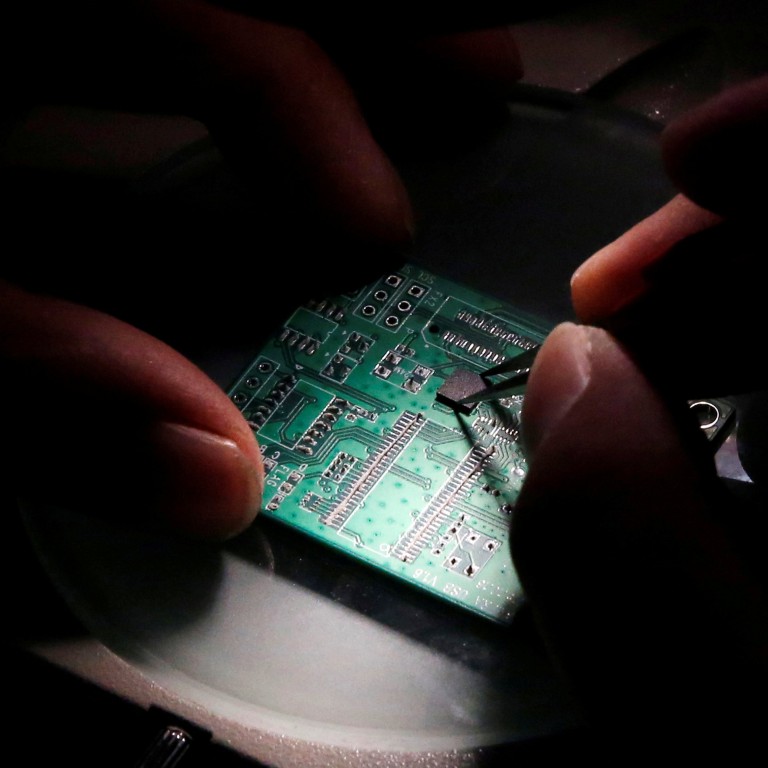

Semiconductor-related companies surged broadly for the second straight day. Investors speculated that the US$29 billion state-led China National Integrated Circuit Industry Investment Fund will soon expand its shareholding in such firms to lend further support to the industry, against the backdrop of an intensifying race among nations to become the world’s tech superpower.

“As traditional sectors such as real estate have entered a downward cycle, the market has been looking for new growth spots among technology and computer stocks,” said Yang Xiaolei, a Shanghai-based independent market analyst.

“Now the government policy is clearly supportive of home-grown technology shares ... so the enthusiasm over semiconductors is likely to continue into next year, making such stocks one of the most important sectors to look at in the first quarter,” he said.

A gauge tracking 117 semiconductor-related stocks rose 4.3 per cent, according to financial data provider Wind.

Memory devices maker Gigadevice Semiconductor Beijing led the advance, jumping by the daily 10 per cent limit to an all-time high of 214.92 yuan.

The shares had fallen 7 per cent on Monday after the semiconductor-focused fund – also known as the “Big Fund” – said it would cut its stake in the firm.

Rattled investors have since digested the move and took the opportunity to buy the dip on Gigadevice, which has skyrocketed 246 per cent this year.

Several brokerages also published bullish reports on the semiconductor sector on Tuesday, arguing China’s long-term strategy to reduce reliance on imported chips will lead to huge opportunities for home-grown chip makers.

Meanwhile, Chinese producers of the fiery liquor baijiu were the biggest drag on the Shanghai market. They continued to decline despite rebounding slightly on Tuesday, as a controversy remains unresolved over whether one firm added artificial sweetener to some of its products.

Authorities in the southern province of Hunan on Tuesday carried out a quality test on Jiugui Liquor’s products, which has been accused by a dealer of mixing an additive restricted in baijiu.

Hunan-based Jiugui Liquor has denied the claim and accused the dealer of intending to extort money.

The results of the test will come out later this week, the authorities said, according to reports by local media.

Shares of the distiller fell 3.4 per cent to 34.4 yuan. The stock has lost 12 per cent of its value since the controversy broke out over the weekend.

A gauge of 18 distillers declined by 1 per cent. Investors also pulled out on concerns that valuation of the sector has become too high after a year of rapid gains, Yang said. Jiugui Liquor, for example, has soared 117 per cent since the beginning of this year.