Will the coronavirus take a bite out of Apple’s suppliers in China? Traders remain upbeat

- Virus hit during typically lower production first quarter, meaning Apple-linked companies have time to catch up

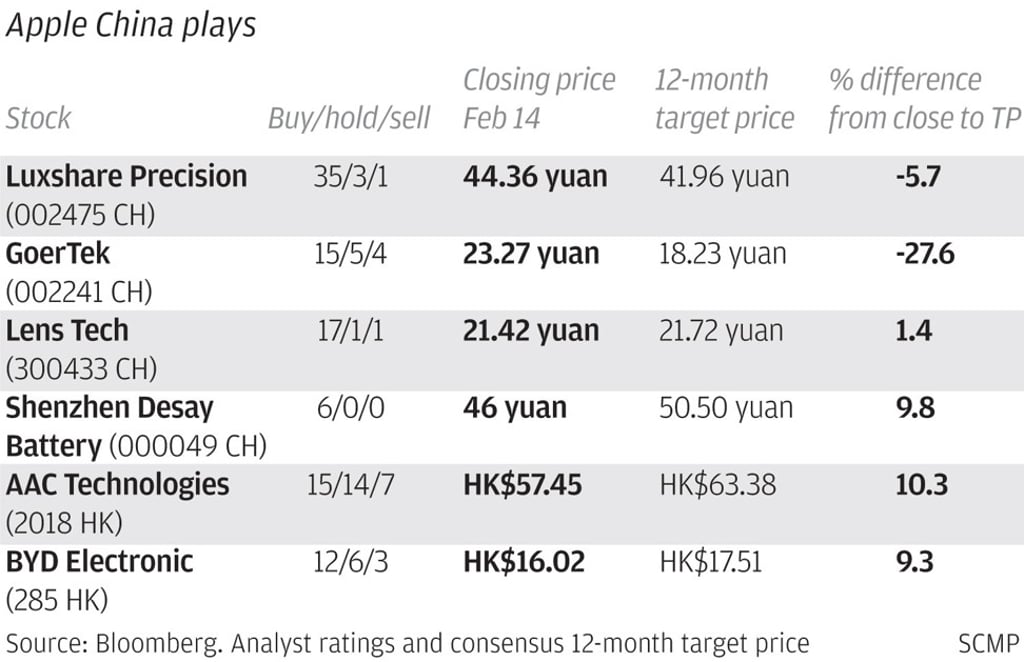

- Analysts still bullish on hot Apple suppliers like Luxshare Precision, GoerTek

Investors should focus on the structural opportunity in Apple’s rising sales in China and around the world, they say. Look past any short-term shocks triggered by the public health crisis that extended factories’ Lunar New Year shutdown and prompted Apple to close all of its mainland stores temporarily, they add.

“The virus situation is very likely to be a temporary disruption to production instead of a change in the structural trend,” said Edison Lee, head of telecom research at Jefferies. “If you are willing to take a longer term view on the stocks and the industry … I don't think the market will really derate the stocks as a result.”

All four of those are heavily rated as “buys” by analysts tracked by Bloomberg. While the ratings tend to have been set before the virus broke into the news, interviews with analysts confirmed bullish sentiment for stocks of suppliers with a large portion of their revenue tied to Apple.