China-US hostility to benefit Hong Kong investors as stock benchmark is set to decouple from old economy

- NetEase and JD.com are the latest US-listed Chinese companies to launch secondary offerings in Hong Kong amid fraying ties between Beijing and Washington. Many more are expected

- China’s new-economy stocks will account for about one-tenth of the weightings of the Hang Seng Index in 2022, Jefferies says

The escalating tensions between Beijing and Washington are turning into a gift for Hong Kong stock traders, offering them easy access to the fastest growing part of China’s economy.

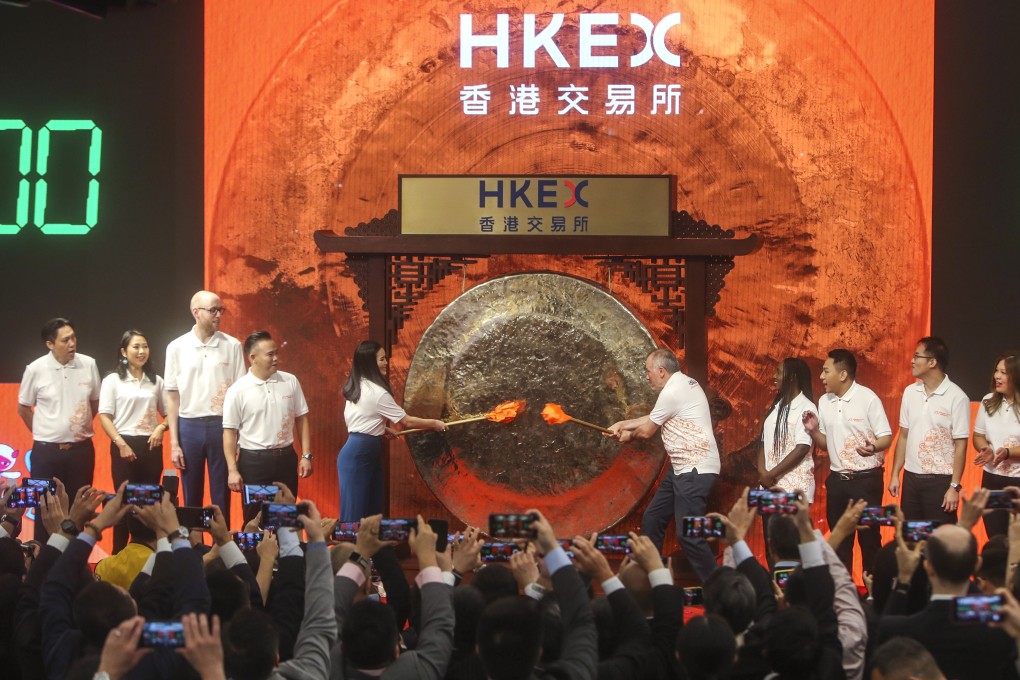

With the Trump administration pushing legislation that, if passed, could lead to delistings of US-traded Chinese companies, some companies are gearing up for secondary stock offerings in the city to fend off the threat. Gaming company NetEase and JD.com, China’s second-largest e-commerce platform, have spearheaded the expected stampede by debuting in Hong Kong this month.

The transition to listings in Hong Kong will leave local traders with more choices to invest in among the mainland’s burgeoning industries – such as e-commerce, mobile gaming and artificial intelligence – and reshape the landscape of the city’s stock market, according to Jefferies Group and China Renaissance Holdings. It will also cement Hong Kong’s status as one of Asia’s top markets. It is already Asia’s third-largest stock market after China and Japan, with a capitalisation of US$5.2 trillion.

China’s new-economy stocks will probably make up roughly one-tenth of the weightings of the Hang Seng Index in 2022, according to the estimate by Jefferies, while China Renaissance predicts that such stocks will account for as much as 35 per cent of Hong Kong’s total market cap in the following five to 10 years. That would spur higher growth potentials, valuations and increased trading volumes.

“The bottom line is that the evolution of the Hang Seng Index over the next 18 months will largely shift the index to a pure China one with a significant tech, e-commerce and information technology weighting,” said Sean Darby, a strategist at Jefferies.

One major benefit from the shift for investors is that they will be able to ride on the 56-year-old Hang Seng gauge with less volatility, as the benchmark is expected to reflect more of the performance of China’s hi-tech industries that are less susceptible to the swings in the economy, he said.