Coronavirus vaccine developer CanSino offers shares in China’s second-most expensive initial public offering

- CanSino has priced the A shares of its secondary listing at 209.71 yuan each, the second-most expensive offering price on the mainland’s bourses

- Hong Kong-traded shares of CanSino more than tripled this year on prospects of the Covid-19 vaccine

CanSino Biologics, the Tianjin-based pharmaceutical producer that is conducting human trials on its coronavirus vaccine, has set the second-highest price in its secondary listing on the Shanghai Star Market.

The company priced its A shares at 209.71 yuan (US$29.96) each, opening them for subscription on Friday, CanSino said in an exchange filing. Its stock jumped by as much as 13 per cent on the Hong Kong stock exchange to an intraday record of HK$277.40 after the news, before ending the day at HK$265.

The offer price for CanSino’s secondary listing made it the second-most expensive initial public offering in China, as the nation’s tentative signs of economic growth fuelled optimism and sparked an almost 8 per cent rally this year in Asia’s largest capital market.

CanSino’s 2019 loss widened 13.3 per cent to 156.8 million yuan, according to its prospectus. Its offer price is only lower than Beijing Roborock Technology, a maker of smart vacuum cleaners that sold its IPO shares for 271.12 yuan apiece in February.

Shares of Beijing Roborock peaked on the first day of trading after an 84 per cent jump and are currently down 22 per cent from that level.

CanSino’s Hong Kong shares have soared 350 per cent so far this year, on optimism that its vaccine is making progress.

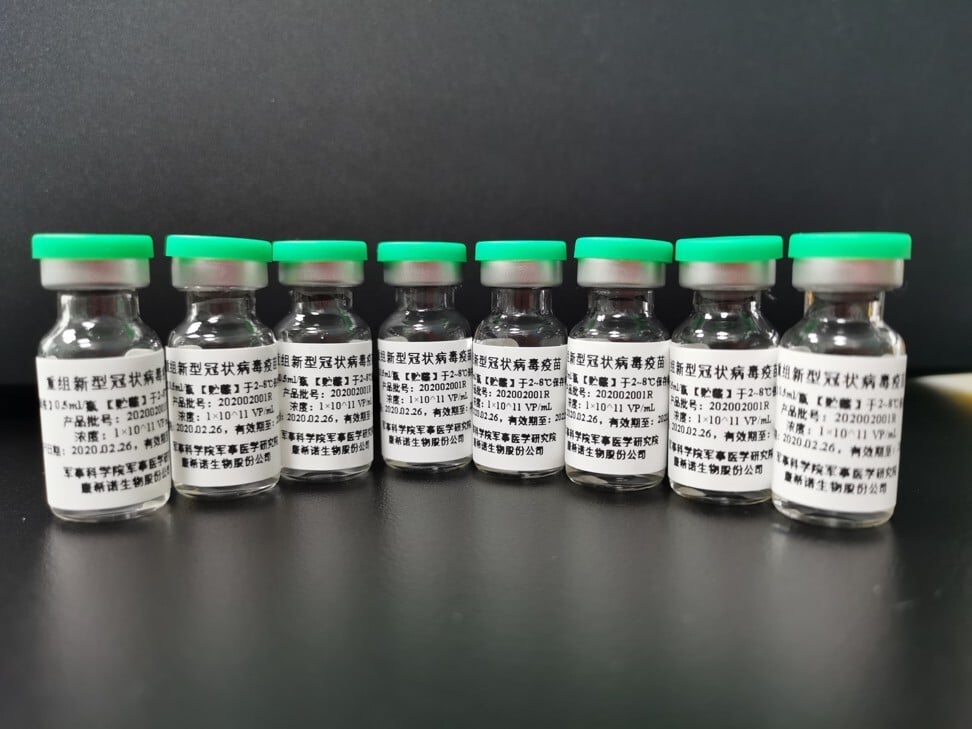

The Ad5-nCov vaccine for Covid-19, being developed with the Chinese military’s research unit, has completed the phase-two trial and the phase-three one is expected to start soon.

CanSino plans to sell 24.8 million shares on the Star Market, which would help the company raise about US$600 million to build a manufacturing base, fund the research on vaccines, build cold-storage logistic and information technology systems and replenish working capital, CanSino said.

Losses will probably narrow to 100.7 million yuan this year at CanSino, based on Bloomberg’s average estimate of five analysts. Its Hong Kong-listed shares may fall to HK$169.56 in the following 12 months, implying a 36 per cent decline from the current level, the data showed.