US elections: Who is better for the stock markets of China and Hong Kong, a Democrat or Republican president?

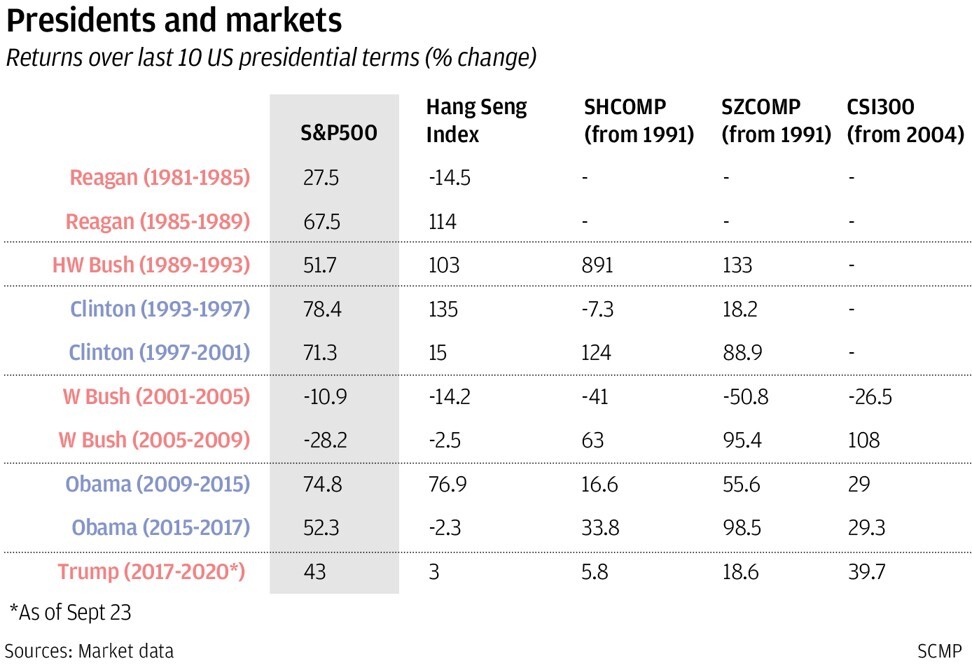

- S&P 500 index rose during eight of the past 10 US presidential terms, with the biggest gains made during the first terms of Bill Clinton and Barack Obama

- Still, Donald Trump’s tenure has seen the US and Chinese stock indices scaling historic peaks, prompting some traders to keep the good times going

As voters in the United States prepare for the presidential election in November, the South China Morning Post takes a look at the correlation between the occupant of the Oval Office and global stock markets. In this 14th part of the series, Yujing Liu looks at 40 years of market data to see whether a Democrat or Republican was better for the markets in China and Hong Kong.

Traders from Wall Street to Central to Shanghai’s Lujiazui are looking for clues to ascertain where global equities are headed, as four years of a roller-coaster ride in the financial markets during a volatile American presidency approaches its end.

The S&P 500 index advanced during eight of the past 10 US presidential terms since 1981, comprising four Republicans and two Democrats in the Oval Office, with the biggest gains recorded during the first terms of Bill Clinton and Barack Obama.

Traders are hoping for a replay of the market euphoria during the two first-term Democratic administrations, as they correlated with the biggest increases in the key indices of Hong Kong, Shanghai and Shenzhen, according to four decades of data.

11:15

Trump vs Biden: The 2020 US presidential election

Notwithstanding US-China relations at their lowest point in decades, Donald Trump’s tenure has seen the US and Chinese stock benchmarks scaling historic peaks, buoyed by US$8 trillion of central bank funds unleashed around the world to combat the coronavirus-led recession.

That leaves traders with the vexing questions: where will China and Hong Kong markets go after November 3? Who is better for the stock market – a Democrat or Republican president?

“History does not repeat itself, but in the stock market, there are consistent patterns because human behaviours really do not change that much,” said Andrew Slimmon, head of Morgan Stanley Investment Management’s applied equity advisory team, in a September 11 note.

The “elusive big pullback” in the US stock market is nowhere to be seen, despite brief corrections since its rally began in March 2009, he said.

The 30-stock Dow Jones Industrial Index averaged 7.8 per cent of gains since 1990 under a Democratic president, double the 3.3 per cent advance under a Republican, according to a July study by Manulife Investment Management.

A detailed analysis of control over Congress showed that a Democratic president was better for the New York market’s benchmark, regardless whether the House and Senate were friendly, hostile, or split.

That track record tallies with the broader S&P 500 index, with its biggest four-year growth under a Democratic Chief Executive. It declined only during the tenure of the 43rd president George W. Bush, a Republican, falling by 36.7 per cent over eight years.

The Bush years were book ended by the September 11 terrorist attacks during the first term, and a global financial crisis that stemmed from US subprime loans during the second term, both of which sapped investors’ appetite for risk.

Hong Kong’s stocks soared by a whomping 135 per cent during Clinton’s first term, from 1993 to 1997. Chinese state-owned enterprises such as Guangshen Railway, which operates a commuter train service between Guangzhou and Shenzhen, were taking tentative steps to raise capital on the Hong Kong exchange.

At the end of 1997, 15 per cent of new listings in Hong Kong were by Chinese companies. Today, 80 per cent of the turnover and capitalisation of Asia’s third-largest capital market belongs to companies mostly controlled by Chinese shareholders.

Clinton’s second term, from 1997 to 2001, was the best for Shanghai’s stock market, with the benchmark composite index soaring 124 per cent over the optimism leading up to China’s membership in the World Trade Organization (WTO). The Shenzhen gauge rose 88.9 per cent in the same period while Hang Seng chalked up a 15 per cent increase.

Market optimism lasted barely a year during Bush Jr’s first term until September 11. The subsequent years, defined by America’s “war against terror,” buffeted global financial markets.

The S&P 500 fell 10.9 per cent during Bush’s first term, the Hang Seng declined 14.2 per cent, with the key indices plunging 41 per cent in Shanghai, and 50.8 per cent in Shenzhen. The CSI 300 index, which tracks the biggest stocks on both mainland Chinese bourses, did not start until January 2002.

The Hang Seng Index jumped 76.9 per cent during the first four Obama years, with gains seen in Shanghai and Shenzhen bourses.

“Historically, presidents have been hurt or helped by monetary policy conditions,” said David Chao, Invesco’s Asia-Pacific global market strategist, adding that Reagan and Clinton were helped by falling interest rates, while the two presidents from the Bush family were hurt by tightening policies during their terms.

Looking ahead, investors in Asia are warming up to the idea that a win by former vice-president Joe Biden could bring more predictability and normality to US foreign policy, which is good news for China and Hong Kong stocks, at least initially.

A Biden administration will adopt foreign policies that are more “market-friendly,” said Invesco’s Chao. “I expect Biden to build a more multilateral approach towards foreign relations, instead of Trump’s vitriolic rhetoric, which has really spooked the market at times. I think that will be a welcome change.”

Biden’s foreign policy is likely to “remain tough against China, especially on trade, but more multilateral and more predictable,” UBS analysts led by Niall MacLeod said in a September 17 report. The Trans-Pacific Partnership (TPP), the cornerstone of Obama's strategic pivot to Asia involving 12 countries, could also be revived if the Democrats secure victory in both houses of Congress, they said.

“Markets with greater overseas revenue exposure, especially North Asian exporters, could benefit” from this approach, the UBS analysts said.

“Biden appears better on the surface, because he is less confrontational, and more likely to rely on seasoned foreign policy advisory than Trump, who often seems to shoot from the hip,” said Bank Julius Baer’s head of Asia research Mark Matthews.

Another factor that makes a Biden presidency better for China and Hong Kong stocks is the exchange rate.

A more predictable trade policy means a lower risk premium on Asian currencies and especially the yuan, which has been driven by trade tensions since early 2018, according to UBS.

All eyes will be on the first debate between the two presidential nominees, scheduled for September 29, for investors to gauge the direction that the yuan is headed, said AxiCorp’s chief global market strategist Stephen Innes.

“A poor performance by Biden in the initial debate that leads to Trump’s recovery in the [opinion] polls could reignite concerns that a second [Trump] term would have the US putting more unilateral pressure on China,” he said. A Biden presidency, on the other hand, “is more predictable, which would be a good outcome for China-sensitive assets,” he said.

In addition, Biden’s plans to increase corporate taxes in the US will also be a boost to markets elsewhere. “[T]hey will undercut US corporate earnings relative to global,” said Matt Gertken, geopolitical strategist at BCA Research.

UBS estimates Biden’s tax increase would shave off 8 per cent in earnings from the S&P 500 Index. In the short term, this could lift the relative attractiveness of Asian equities, pushing their relative price-to-earnings ratio to the US to the lowest level since 2005, according to the report.

A third scenario lurks in the shadows, little discussed, with even greater implications for global financial markets: a delayed result.

This could happen if either side loses by a narrow margin and tries to challenge the outcome in court, or if the large number of postal ballots – a consequence of social-distancing rules to contain the coronavirus outbreak – overwhelm and slow down the final tally.

“The worst outcome would be a narrow loss for Trump that he refuses to accept, plunging the US into a constitutional crisis far worse than the 2000 Florida recount,” said State Street Global Advisors’ Asia-Pacific head of investments Kevin Anderson, adding that such a crisis could potentially alter the safe-haven perception of US assets.

Protests on both sides would likely ensue during that intermediary period, which would also cause market volatility, he said.

“Given the US market is still the bellwether for the world, volatility should be expected in other large markets like Hong Kong, which is a cheap and liquid place to express a bearish view,” he said.