Listing by China’s biggest investment bank, first flotation of Chinese depositary receipts in Shanghai set stage for Ant dual IPO

- China ranks second with US$55.1 billion raised through IPOs this year, according to Bloomberg, behind New York and ahead of Hong Kong

- Investor enthusiasm and a government push for more listings by home-grown technology companies have fuelled a boom in IPOs this year

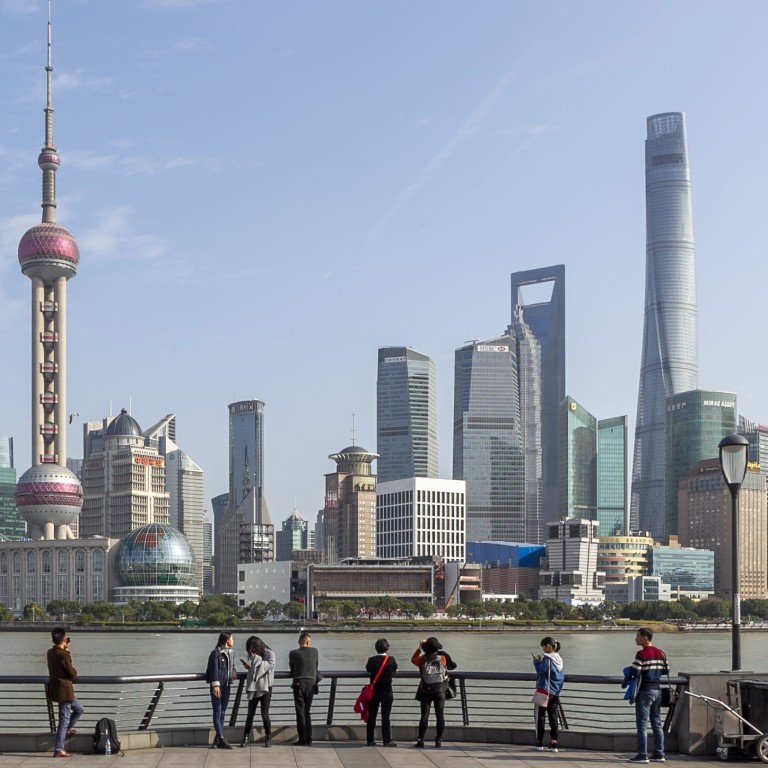

All eyes are on Shanghai, where four out of five initial public offerings (IPOs) are due this week in China, including the country’s very first sale of Chinese depositary receipts (CDRs). The four Shanghai IPOs will raise a combined 16.3 billion yuan (US$2.4 billion), extending a bull run in the world’s second-largest capital market.

China’s biggest investment bank and an electric carmaker are among the five IPOs that open to public subscription this week. A world-beating run-up in China’s onshore stocks and a boom in the IPO market has stoked optimism that China International Capital Corporation (CICC) stands to benefit more than its smaller rivals. Meanwhile, Ninebot, a maker of smart electric scooters, will be the first company to float CDRs on Shanghai’s technology-heavy Star Market.

Investor enthusiasm and a government push for more listings by home-grown technology companies have fuelled a boom in China’s IPO market this year. A total of 113 companies have raised a combined 187 billion yuan on the Star Market alone in the first nine months, which beats a full-year estimate of 144 billion yuan by Tianfeng Securities. China ranks second with US$55.1 billion raised through IPOs so far this year, according to Bloomberg data, behind New York with US$63 billion raised, and ahead of Hong Kong, which has raised US$29.2 billion.

01:12

Ant Group poised to be world’s biggest private firm making public debut, with Hong Kong-Shanghai IPO

Unlike in Hong Kong, where IPO shares can decline during trading debuts, subscription to new shares floated on the mainland is a lucrative and sure shot bet, with stocks typically soaring on their first day of trading. First-day gains on the Star Market are even more stunning, as there is no cap on how much new listings can rise or fall during the first five days of trading.

“With a bunch of IPOs in the pipeline, decent gains from listings will continue to attract funds to new share subscriptions,” said Zhang Qiyao, an analyst at Guosheng Securities. “Liquidity will be an important driver for the capital market this year.”

Moreover, China’s benchmark stock gauge, the Shanghai Composite, has been the best performer among the world’s major markets this year. The yuan, meanwhile, posted its biggest quarterly appreciation in more than a decade in the July to September period.

A survivor’s guide for simultaneous dual listings in Hong Kong and mainland China’s markets

The investment bank, which is already listed in Hong Kong, has seen its shares rise 26 per cent this year. Its net income for the first nine months of this year probably increased by as much as 38 per cent from a year earlier to 4.31 billion yuan, according to its listing prospectus. It plans to raise 13.2 billion yuan from the offering in Shanghai, with an offer price of 28.78 yuan apiece. CICC’s oversubscription ratio reached 1,170 times, according to the bank.

The subscription for Ninebot, which is registered in the Cayman Islands and has a variable interest entity structure, kicked off a day earlier, on Monday, and has drawn 2,500 times the shares on offer in orders. It is expected to raise 1.33 billion yuan from the sale of 70.4 million CDRs to fund an electric-car project, the construction of a research centre and to replenish working capital. Each CDR is priced at 18.94 yuan and 10 such surrogate securities can be converted into one underlying share.

Xiaomi, China’s biggest smartphone maker, holds a 10.9 per cent stake in Ninebot through an affiliate, and sales to Xiaomi have made up more than 50 per cent of Ninebot’s annual sales over the past three years, it said in its listing prospectus.

Foreign-funded mainland tech firms given nod to sell CDRs on Shenzhen’s ChiNext market

Ninebot has yet to make a profit. It reported an annual loss of 454.8 million yuan in 2019 and has been unprofitable for three consecutive years. Moreover, it might have posted a loss of as much as 75 million yuan in the first nine months of this year, according to its prospectus.