China’s fund manager who made 134 per cent in 2020 sees major risk from rally in red-hot stocks

- Valuations of market darlings have overshot their fundamentals, says Lu Bin of HSBC Jintrust, whose fund beat peers in 2020

- Lu is buying selectively based on valuations and tells investors to lower expectations on stock returns in 2021

The CSI 300 Index, which tracks 300 biggest stocks on the Shanghai and Shenzhen exchanges, advanced 27 per cent last year, buoyed by policy loosening and China’s successful containment of the pandemic. The index has risen 4 per cent in the new year.

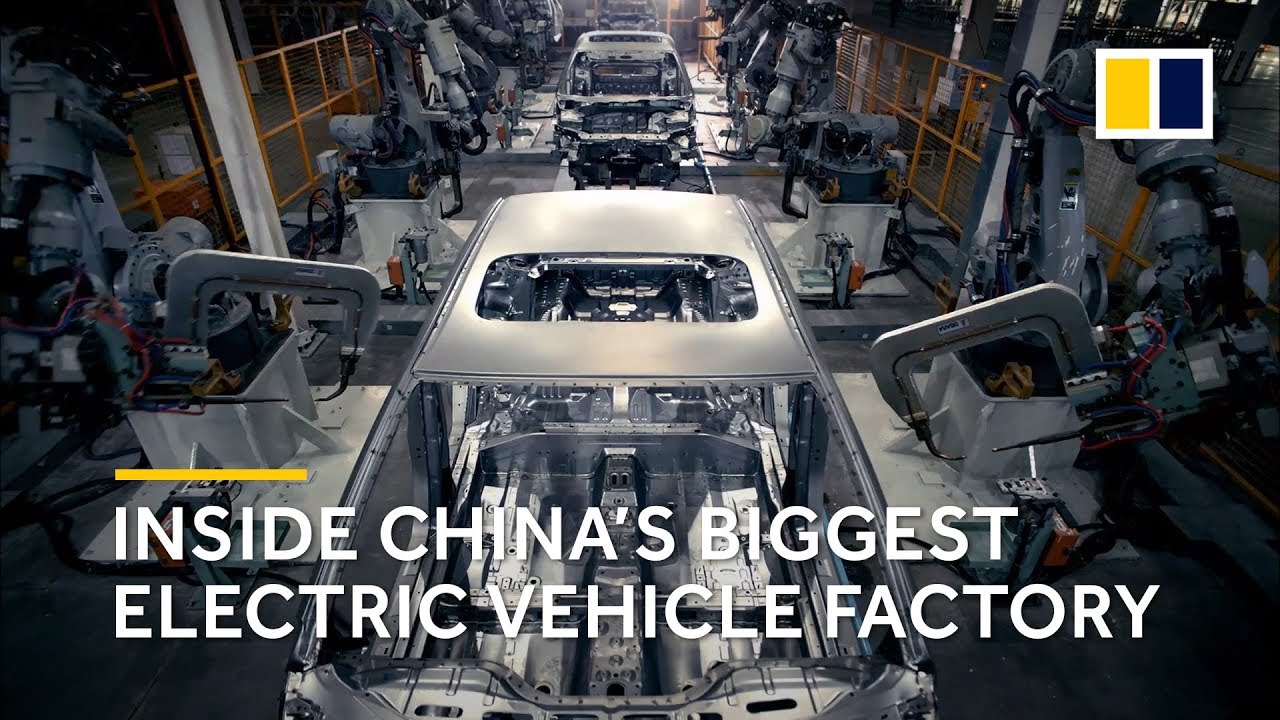

While Lu did not name specific stocks or sectors, bullish sentiment has dominated Chinese consumer companies and electric vehicle makers following an impressive run-up last year to record highs.

01:47

Behind the scenes at BYD Auto: China’s biggest electric vehicle factory

A group of consumer-staples stocks within the CSI 300 Index jumped 75 per cent in 2020, pushing their average multiple to 41 times earnings, a level not seen since at least 2011, according to Bloomberg data. Contemporary Amperex Technology, China’s biggest maker of lithium batteries for electric vehicles, trades at a record multiple of 212 times earnings after its shares surged 230 per cent last year.

These multiples compare with an average of 16 times for CSI 300 companies, according to Bloomberg data, which is also the most expensive since July 2015.