China’s investors are flooding Hong Kong’s capital market in search of value as they dodge US sanctions

- Fear of missing out on some of world’s best-performing stocks has made Hong Kong a gateway for Chinese capital seeking overseas investment

- Chinese enterprises accounted for 52 per cent of listed companies in Hong Kong in January

In the second of a two-part series on global capital flows, Zhang Shidong explores the sentiment behind record-breaking Chinese fund flows into Hong Kong stocks. It also shows why the city has become an indispensable gateway for global capital seeking to juice returns from some of China’s best companies. Click here for the first part.

Few could have foreseen that the first three trading weeks of 2021 would turn into the best start to a new year in nearly four decades for the Hang Seng Index.

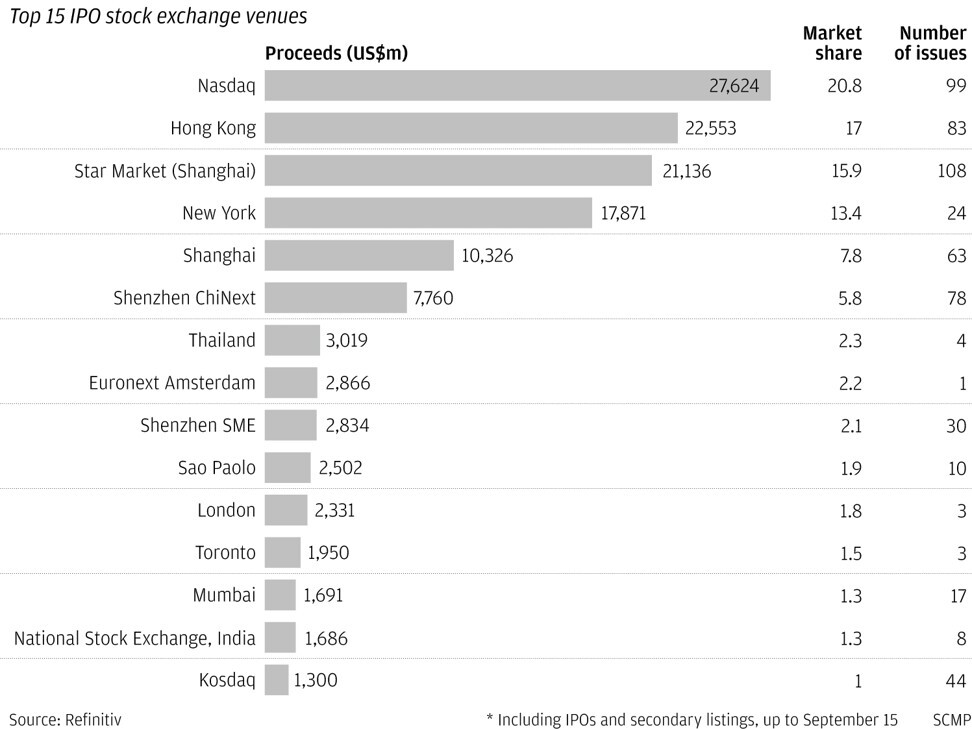

“More Chinese companies are seeking IPOs and secondary listings in Hong Kong, given tightened regulations in the US,” said Mike Shiao, chief investment officer at Invesco, with US$1.35 trillion of assets under management. “They are leaders in industries such as e-commerce, social media and live-streaming. They represent great investment opportunities.”

The Hang Seng Index’s 7.6 per cent advance so far this year is among the best worldwide. Along the way, Hong Kong’s market capitalisation of US$7.25 trillion has pulled ahead of Japan, according to Bloomberg data.

That performance has made Hong Kong into an indispensable gateway for onshore and offshore funds seeking a springboard into China and fear missing out on some of the world’s most profitable companies. Mainland Chinese enterprises accounted for 52 per cent of the 2,545 listed companies in the city at the end of January, and 81 per cent of the market capitalisation and 90 per cent of the trading volume.

While mainland Chinese funds have been buying Hong Kong stocks at an unprecedented pace – inflows in January were equivalent to 55 per cent of the total in 2020 – there is still plenty of gas in the tank, judging by the fundraising momentum onshore, analysts said.

Mutual funds launched this year may funnel more than 160 billion yuan (US$24.7 billion) into Hong Kong equities in the coming months, almost matching their purchase amounts for the whole 2020, according to an estimate by Haitong Securities. Of China’s 650 new mutual funds last year, almost half were eligible to invest in Hong Kong, a 142 per cent jump over 2019, Haitong said.

Inflows, including purchases by onshore mutual funds, hedge funds and individual investors, will amount to as much as 600 billion yuan annually in the coming years, according to China International Capital Corporation (CICC).

02:01

What is Kuaishou? Understanding China’s video-sharing app

Goldman Sachs raised its projection of net purchases by Chinese investors to US$95 billion for 2021, from US$50 billion in November, citing the prospect of more stocks being eligible for investment by mainland Chinese funds via the Stock Connect cross-border investment channel.

Trump’s hasty ban on Chinese stocks deprives US funds of payouts

The Stock Connect was established in November 2014 to link Hong Kong’s market with Shanghai, followed by a cross-border channel with Shenzhen in December 2016. The scheme enables global capital to access Chinese stocks through Hong Kong, while Chinese funds can trade Hong Kong-listed stocks.

Piling money onto cheaper Hong Kong shares via Stock Connect requires no regulatory pre-approvals. It has become one of the few investment options for Chinese investors seeking higher returns overseas, partly because many of the nation’s fastest-growing companies are not listed at home.

The Stock Connect programmes created a “One China” market, promising investors one of the biggest pools of stocks and trading liquidity. Diversification efforts fuelled a 77 per cent compounded annual growth in portfolio value of the southbound Connect to HK$1.7 trillion at the end of October, from HK$115 billion in 2015, according to stock exchange data.

The momentum has slowed since the Hang Seng topped 30,000 points for the first time since May 2019. The impending Lunar New Year holiday could stall that flow. Yet, investors from Invesco to JPMorgan Asset Management and HSBC Jintrust Fund Management remain optimistic.

“We expect strong liquidity to become a key catalyst for the share price of Chinese stocks listed in Hong Kong,” said Invesco’s Shiao, who said this year’s issuance by funds remains robust after a record year in 2020. “Onshore investors see these developments as an opportunity to buy at more attractive levels.”

Several factors encourage mainland Chinese funds to embrace more Hong Kong’s stocks. Stretched valuations of Chinese-traded shares, falling yields on wealth management products and liquidity concerns from Beijing’s crackdown on runaway home prices, are some concerns.

Hong Kong stocks are priced at 13.1 times earnings, according to Bloomberg data, having climbed up from an eight-year low of 8.6 times in 2020. The Dow Jones Industrial Average trades at 20.7 times, and European stocks at 18.3 times.

“The short-term upside for A-shares may be limited after the recent rally,” said Marcella Chow, a strategist at JPMorgan Asset Management. “Since the PBOC is returning to a neutral policy stance, there is likely [to be] limited room for valuation expansion this year.”

H-shares, those issued by state-controlled enterprises in Hong Kong, “may therefore bring better returns to investors,” Chow added. “There is room for the premium to drop further this year.”

“We expect mainland portfolio inflows into Hong Kong to favour leading private sector enterprises with brands, platforms and innovative capability,” said Wendy Liu, head of China strategy at UBS Group. “In general, the new generation of stock investors born post the 1990s prefers household names that are part of their daily life.”

To be sure, there are concerns that China’s economy will weaken in the post-pandemic era. Growth will probably slow to 4.3 per cent in 2022 from 9 per cent this year because of unsustainable expansion in investments, exports and credit, according to Morningstar.

04:33

As Biden enters White House, world leaders express ‘relief’ and welcome ‘friend’ and ‘mate’ back

Besides, rule changes by the Hong Kong exchange have also enabled the listings of new-economy and biotech companies without the traditional profit track record. They accounted for almost one in every five new listings between January 2017 and October 2020.

Goldman Sachs predicted that Chinese funds will channel US$38 billion into Hong Kong, or 10 per cent of the record money to be raised in 2021. Southbound investors are also assumed to absorb all the selling by Americans in 24 Chinese stocks under the US sanctions, while more new additions to the Connect programmes could also be a magnet.

If the US bank is right about its capital flow projection, the flood of Chinese funds into Hong Kong this year is only just the beginning.

Additional reporting by Martin Choi