Tech stocks sink in Hong Kong in worst sell-off since mid-November amid valuation jitters, rotation to reflation plays

- The Hang Seng Index slid 1.1 per cent to 30,319.83 on Monday as tech stocks as a group plunged by most since mid-November

- HSBC advanced 2.1 per cent on dividend hopes as a rally in banking stocks softened market sell-off

The Hang Seng Index fell 1.1 per cent to 30,319.83 at the close of trading on Monday, reversing a 0.5 per cent gain during the day. The Shanghai Composite Index slipped 1.5 per cent to 3,642.44 to cap its worst day since January 28.

The Hang Seng Tech Index tumbled 5.5 per cent as 30 of its 31 constituents registered losses. The sell-off was the most since a 6.2 per cent slide on November 11 in the week after a clampdown on fintech companies. A similar barometer in Shenzhen’s ChiNext market fell 4.5 per cent.

Meituan crashed 5.5 per cent to HK$400.20 while Alibaba Group Holding, the owner of this newspaper, dropped 2.5 per cent to HK$250.60. Tencent Holdings retreated 3.7 per cent to HK$713.50. Xiaomi Corp added to the pressure as the stock declined 5.4 per cent to HK$29 after denying Chinese media reports that it was planning to produce electric vehicles.

Schroders expressed a cautious view on internet or e-commerce companies, given high valuations and regulatory risks, “which could cloud things for the sector in the near term,” the UK money manager said in an emailed note on February 18.

“The whole theme is now about reflation and economic reopening,” said Alex Wong, a director at Ample Finance Group. “People are switching into laggards and selling [tech] stocks which have recorded big gains” while southbound funds are expected to support local shares for some time, he added.

Reflecting the reflation plays, resources stocks surged. Zijin Mining advanced 6.6 per cent in Hong Kong and 7.3 per cent in Shanghai. China Molybdenum jumped 5.9 per cent in Hong Kong.

01:44

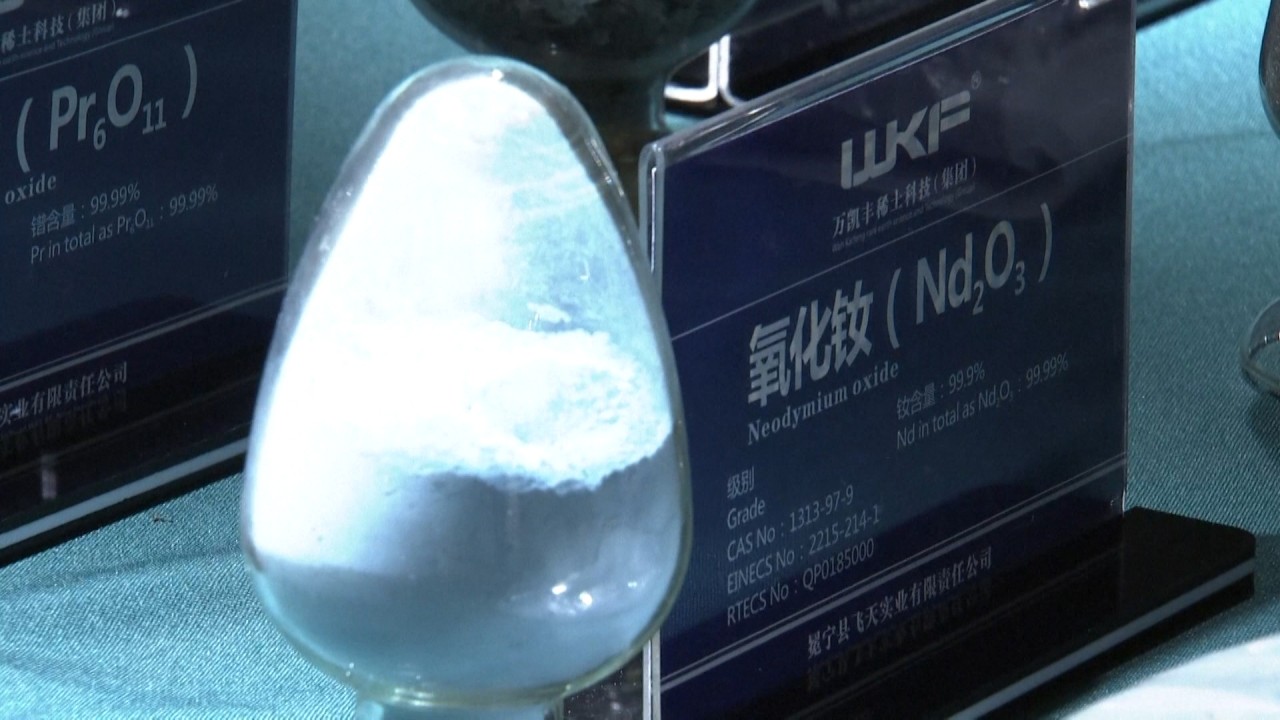

Amid US-China trade war, China aims to elevate its domestic rare earth industry

Telecommunications companies also gained with China Mobile – one of the Stock Connect’s consistent picks – climbing 3.5 per cent to HK$55.65. Mainland stock fund managers spent HK$3.7 billion (US$477 million) in net purchases of Hong Kong stocks on Friday, according to stock exchange data.

Markets in Asia-Pacific region also surrendered most of their gains at the close. The Nikkei 225 jumped 0.5 per cent and the Kospi Index in South Korea dipped 0.9 per cent, while Australia’s S&P/ASX 200 declined 0.2 per cent.

Mainland-listed A shares are likely to underperform compared with other markets in the world, Wong of Ample Finance Group said, as Beijing is seen to control leverage ratio to contain risks.

China Fortune Land Development plunged by another daily cap of 10 per cent, after losing as much on Friday when the stock resumed trading after a halt. The developer is facing a liquidity crunch with 5.26 billion yuan (US$813 million) of overdue loans.