JD Logistics’ shares debut with premium in Hong Kong as investors eye IPO turning point after Baidu and Bilibili fumble

- Shares began trading at HK$46.05, a premium of 14.1 per cent to offering price of HK$40.36, before closing with a 3.3 per cent gain

- Initial listing premium was a stark contrast to the fate of Baidu and Bilibili, which immediately flopped and tumbled thereafter

JD Logistics, the transport subsidiary of one of China’s largest e-commerce companies, ended its first day of trading with a smaller-than-expected premium to its offered price in Hong Kong.

The company’s stock opened at HK$46.05, 14.1 per cent higher than its initial public offering (IPO) price of HK$40.36. It ended with a 3.3 per cent gain at HK$41.70, smaller than the 20 per cent premium in pre-listing trading. Still, the initial pop was substantial compared with the recent flops involving Chinese search-engine company Baidu and short-video app operator Bilibili.

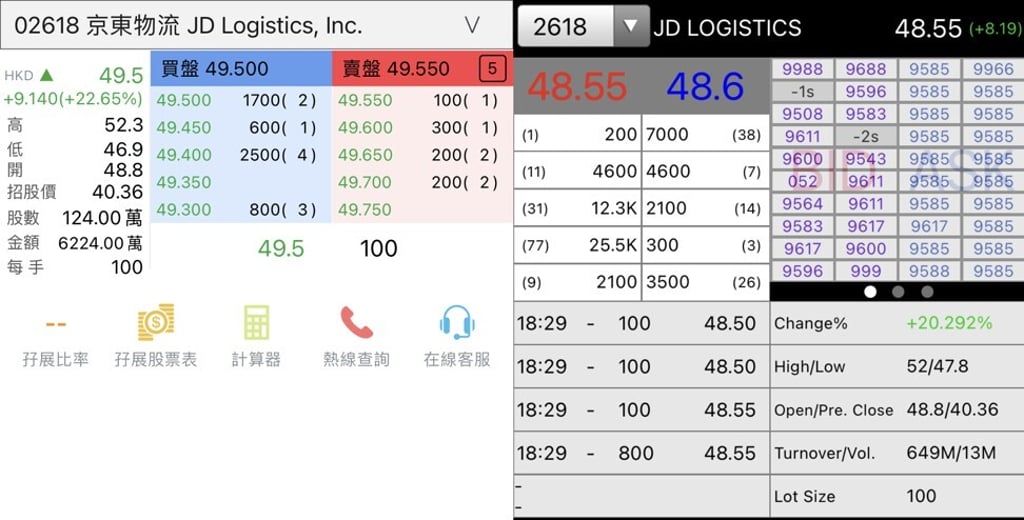

The shares were earlier indicated at HK$48.55 in grey-market prices on Thursday, according to prices from Phillip Securities. They fetched HK$49.50, according to Bright Smart Securities. The company sold 609.2 million shares at HK$40.36 each.

“JD Logistics is the first big listing since market sentiment worsened after China’s anti-monopoly crackdown,” said Kenny Tang Sing-hing, co-founder and chief executive of Royston Securities in Hong Kong before trading commenced. “A strong debut could mark a shift in sentiment for existing new-economy stocks.”