Advertisement

Didi offers ‘sell on Friday’ lesson to hedge losses as China humbles tech billionaires, investors in latest regulatory offensive

- A new round of regulatory review is only starting, according to Bocom International; UBS Asset Management says the curbs are not over yet

- Chinese investors have in the past lightened their positions to skirt weekend surprises from unscheduled PBOC policy decisions

Reading Time:3 minutes

Why you can trust SCMP

1

China’s July 4 crackdown on Didi Chuxing has signalled the start of a new regulatory offensive against tech companies, challenging market views on the extent policy tightening. That Sunday rebuke suggests stock investors should consider trimming their bets on Fridays to avoid weekend shocks.

From the US-China trade war to Donald Trump’s Twitter bombs and China’s central bank policy edicts, many of the headline news events on weekends in the past two years have preceded steep market losses. As China shows tech billionaires who’s the boss, UBS Asset Management said the curbs are not over yet while CCB International predicted more losses ahead.

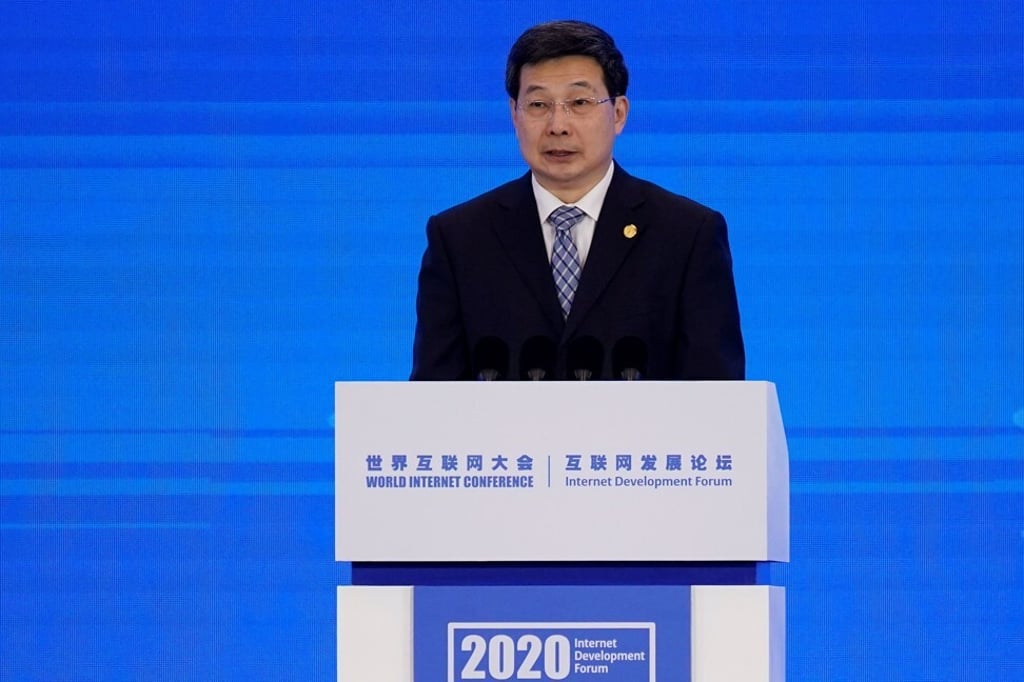

“There is plenty of regulatory uncertainty,” said Hong Hao, managing director at Bocom International Holdings in Hong Kong. “The review is just starting and will be ongoing. In the near term, the uncertainty will make people think twice” about buying or adding to their positions, he added.

Advertisement

Unwinding trades on Friday July 2 would have helped investors avoid a US$67 billion slump in the Hang Seng Tech Index members on that day alone, which snowballed into US$155 billion in the ensuing week. Didi Global, the US-listed entity, plunged 20 per cent on the next trading day in the US.

Advertisement

Some of the biggest sell-offs this year included a 5.7 per cent plunge on February 26, and a 2.2 per cent decline in two early weeks of May, according to the Post’s calculations. On average, investors avoided a 0.6 per cent loss if they sold Chinese tech stocks on Fridays.

Last week was no different. The Hang Seng Tech Index tumbled 5.9 per cent in the biggest pullback since February. The ATM trio – Alibaba Group Holding, Tencent Holdings and Meituan – retreated by 6.3 to 8.2 per cent. The index may have another 8 per cent to fall before the sell-off eases, according to CCB International.

Advertisement

Select Voice

Select Speed

1.00x