Advertisement

Buffett-backed BYD’s market cap seen rising 75 per cent by 2022 as UBS warns against red-hot EV trades

- BYD should be worth at least 1.5 trillion yuan (US$231.6 billion) by 2022, or 75 per cent above its current market cap, CSC Financial analysts estimate

- UBS Group says risks on popular bets like EV makers and chip makers are piling up with weak prospects for more monetary policy easing

2-MIN READ2-MIN

3

Zhang Shidongin Shanghai

The red-hot trades in shares of China’s electric-vehicle (EV) makers are splitting stock analysts as differences in policy assessment and valuation cloud the sector’s outlook.

Industry leader BYD, which counts Berkshire Hathaway among its shareholders, should be worth about twice its market current value, according to CSC Financial, a mainland brokerage backed by Citic Securities, citing the potential of an eight-fold increase in demand for green cars in smaller provincial cities.

The bullish take contrasted with UBS Group’s view on the market. The Swiss investment bank cautioned that risks associated with popular bets, such as new-energy vehicles and chip makers, are building up because there is no room for further easing of monetary policies to buoy demand.

Advertisement

The difference in opinion calls for caution after an upsurge has lifted the EV sector to trade at an average of 10 times the book value. EV-linked stocks from BYD to lithium-battery maker Contemporary Amperex Technology have been on a roll this year, as other fast-growing industries such as technology and private tutoring have come in the crosshairs of Beijing’s crackdown.

01:47

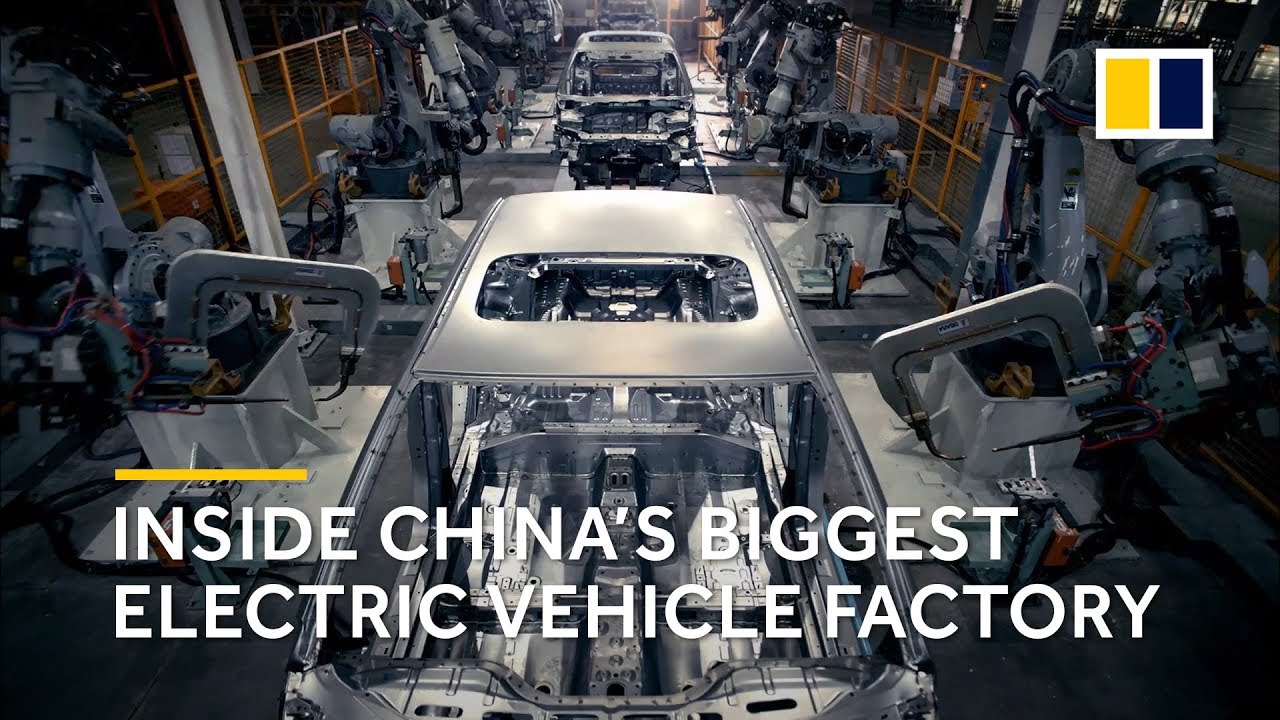

Behind the scenes at BYD Auto: China’s biggest electric vehicle factory

Behind the scenes at BYD Auto: China’s biggest electric vehicle factory

BYD, the Shenzhen-based EV maker controlled by billionaire Wang Chuanfu, should be valued at no less than 1.5 trillion yuan (US$231.6 billion) by 2022, or 169 times its projected earnings, analysts led by Cheng Siqi and He Junyi at CSC Financial wrote in a report on Wednesday. That is 75 per cent above its current market cap of 858.4 billion yuan.

Advertisement

“For new-energy vehicles, it’s a blue ocean market in China’s second-tier and even lower regions that has eight fold room for growth,” the analysts said.

Advertisement

Select Voice

Select Speed

1.00x